Summary:

- ASML shares dip as EU prepares for potential trade measures against U.S. tariffs.

- Analysts remain optimistic, projecting a significant upside potential for the stock.

- The GF Value estimate suggests ASML's fair value is considerably higher than its current trading price.

Shares of ASML (ASML, Financial), a leading Dutch company in the semiconductor equipment industry, experienced a premarket drop of roughly 3%. This decline coincided with the European Union's preparation for countermeasures against U.S. tariffs, which may impact products–including semiconductors–valued up to $28 billion.

Analyst Price Forecast for ASML

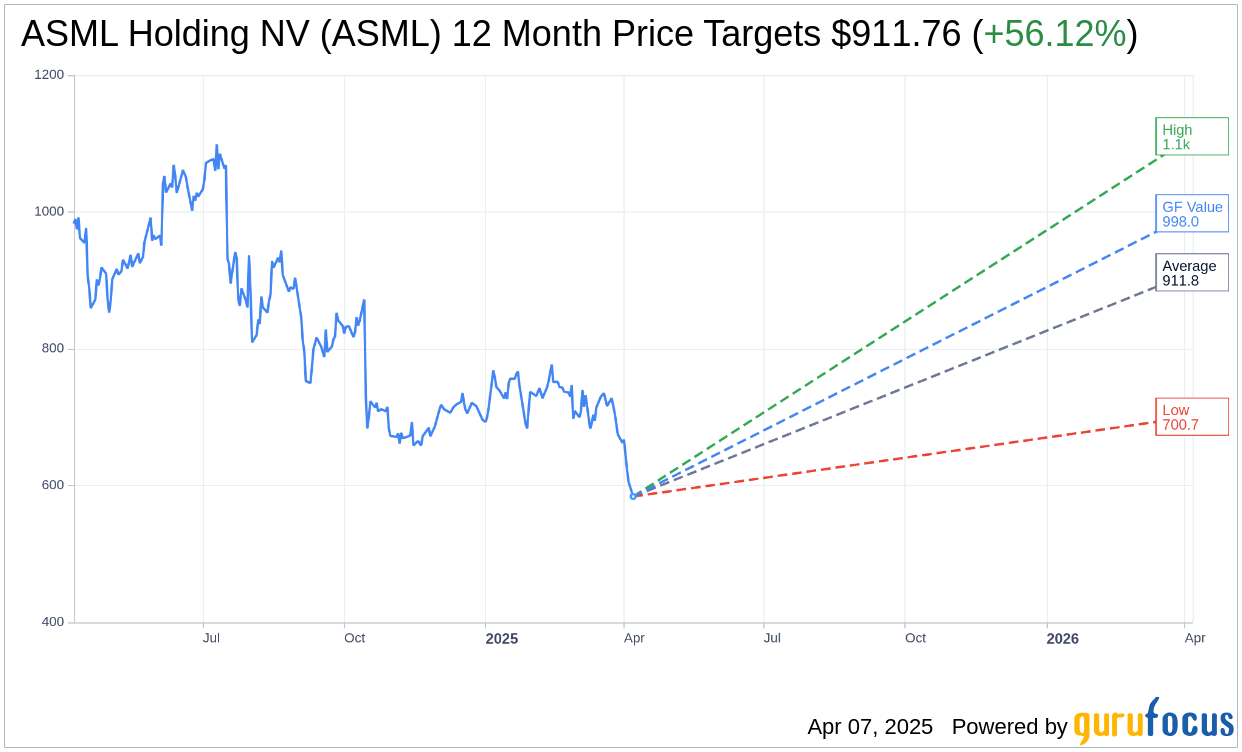

According to projections from 12 analysts, the average one-year price target for ASML Holding NV (ASML, Financial) stands at $911.76. This comprises a high estimate of $1,110.58 and a low estimate of $700.68. Such targets suggest a promising upside of 56.12% from ASML's current price of $584.01. Investors can explore more extensive data on the ASML Holding NV (ASML) Forecast page.

Brokerage Recommendations

The consensus recommendation from 15 brokerage firms positions ASML Holding NV's (ASML, Financial) average rating at 1.8, denoting an "Outperform" status. This scale ranges from 1 to 5, where 1 represents a Strong Buy and 5 a Sell.

GF Value and Potential Upside

GuruFocus estimates the GF Value for ASML Holding NV (ASML, Financial) to be $998.03 in one year. This implies an upside potential of 70.89% from the stock's current price of $584.01. The GF Value is an assessment of the stock's fair value based on historical trading multiples, past business growth, and future business performance estimates. For additional insights, visit the ASML Holding NV (ASML) Summary page.