Summary:

- Cboe Global Markets (CBOE, Financial) to introduce new Bitcoin Index futures on April 28, pending approval.

- Analyst consensus suggests a "Hold" rating with a 5.52% upside potential.

- GuruFocus estimates a 58.32% downside based on GF Value calculations.

Cboe Global Markets (CBOE) is gearing up for a significant expansion with the forthcoming launch of their Cboe FTSE Bitcoin Index futures, set for an April 28 debut, contingent on regulatory clearance. The introduction of these XBTF futures is aimed at diversifying Cboe's current suite of offerings, particularly enhancing their existing options on the Cboe Bitcoin U.S. ETF Index.

Analyst Price Predictions and Recommendations

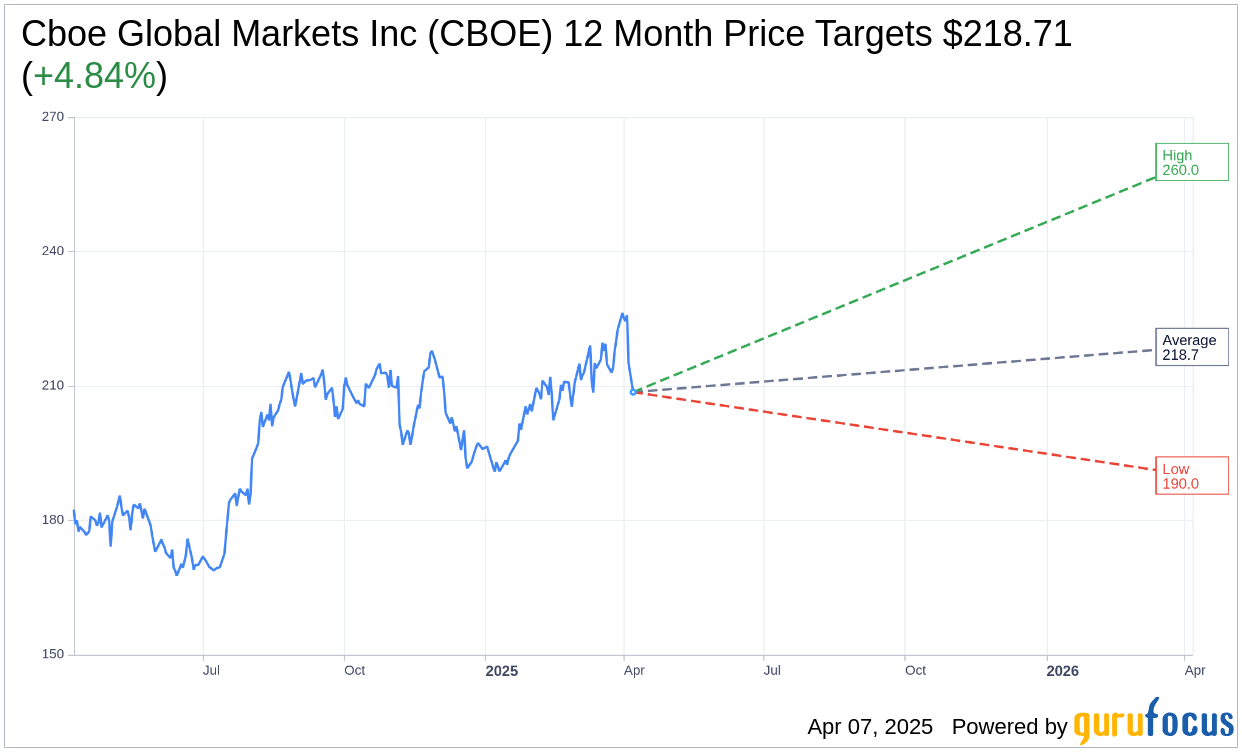

The expert analysis provided by 14 financial analysts forecasts an average price target for Cboe Global Markets Inc (CBOE, Financial) at $218.71. Their projections span a high of $260.00 and a low of $190.00, suggesting a potential upside of 5.52% from the current price of $207.27. For a comprehensive look at these forecasts, visit the Cboe Global Markets Inc (CBOE) Forecast page.

From the viewpoint of 19 brokerage firms, Cboe Global Markets Inc earns an average recommendation of 2.7, which translates into a "Hold" status. This rating system operates on a scale of 1 to 5, with 1 indicating a Strong Buy and 5 indicating a Sell.

Valuation Insights from GuruFocus

According to GuruFocus's calculations, the estimated GF Value for Cboe Global Markets Inc (CBOE, Financial) in one year stands at $86.38. This projection suggests a significant downside of 58.32% from the current price of $207.27. The GF Value metric reflects the fair value at which the stock is expected to trade, factoring in historical multiples, past business growth, and future performance estimates. For an in-depth analysis, refer to the Cboe Global Markets Inc (CBOE) Summary page.