- Dave & Buster's reported significant year-over-year declines in both revenue and comparable store sales for the fourth quarter.

- Despite a challenging quarter, the company engaged in aggressive share buybacks totaling $172 million.

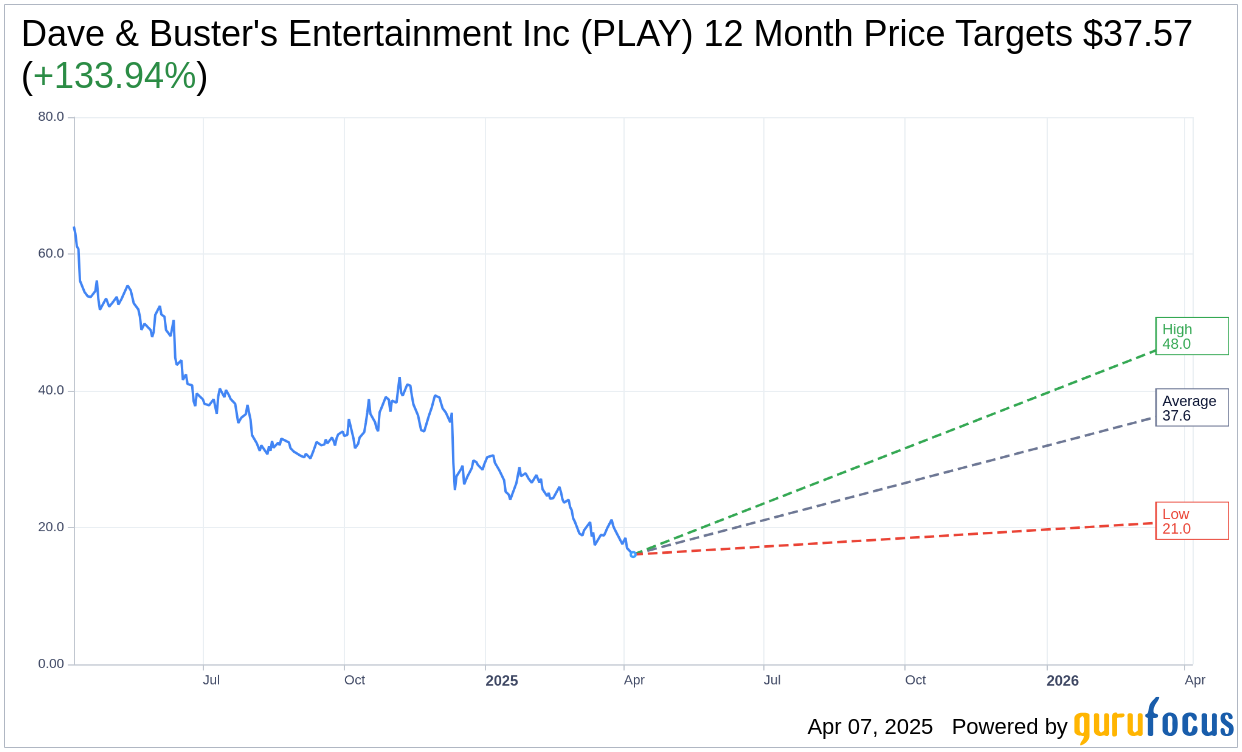

- Analysts offer a mixed outlook, with price targets suggesting substantial potential gains from current levels.

Dave & Buster's Entertainment Inc. (NASDAQ: PLAY) recently announced its fourth-quarter earnings, highlighting a revenue dip to $534.5 million—a 10.8% decrease compared to the previous year. This figure fell short of analysts' expectations by $11.33 million. The decline in performance was further reflected in a 9.4% drop in comparable store sales and a 16.2% decrease in adjusted EBITDA, down to $127.2 million. Despite these setbacks, Dave & Buster's demonstrated confidence in its future by repurchasing approximately 5 million shares at a cost of $172 million.

Wall Street Analysts Forecast

In light of these results, analysts have provided various one-year price targets for Dave & Buster's, with an average target of $37.57. The range of forecasts includes a high of $48.00 and a low of $21.00, indicating a potential upside of 132.07% from the current stock price of $16.19. Investors can access more detailed estimates on the Dave & Buster's Entertainment Inc (PLAY, Financial) Forecast page.

The consensus among 10 brokerage firms currently categorizes Dave & Buster's with a "Hold" status, reflected in an average brokerage recommendation of 2.6 on a scale of 1 to 5, where 1 represents a Strong Buy and 5 denotes a Sell.

GuruFocus Valuation Insight

Additionally, GuruFocus provides an insightful GF Value estimate for Dave & Buster's, projecting a one-year fair value of $61.15. This suggests a compelling potential upside of 277.7% from the current trading price of $16.19. The GF Value is derived from historical multiples, past business growth, and future business performance projections. For a comprehensive look at these calculations, investors can refer to the Dave & Buster's Entertainment Inc (PLAY, Financial) Summary page.