Key Highlights:

- CVS Health Corp is experiencing a shift in its financial leadership as CFO Thomas Cowhey plans to step down.

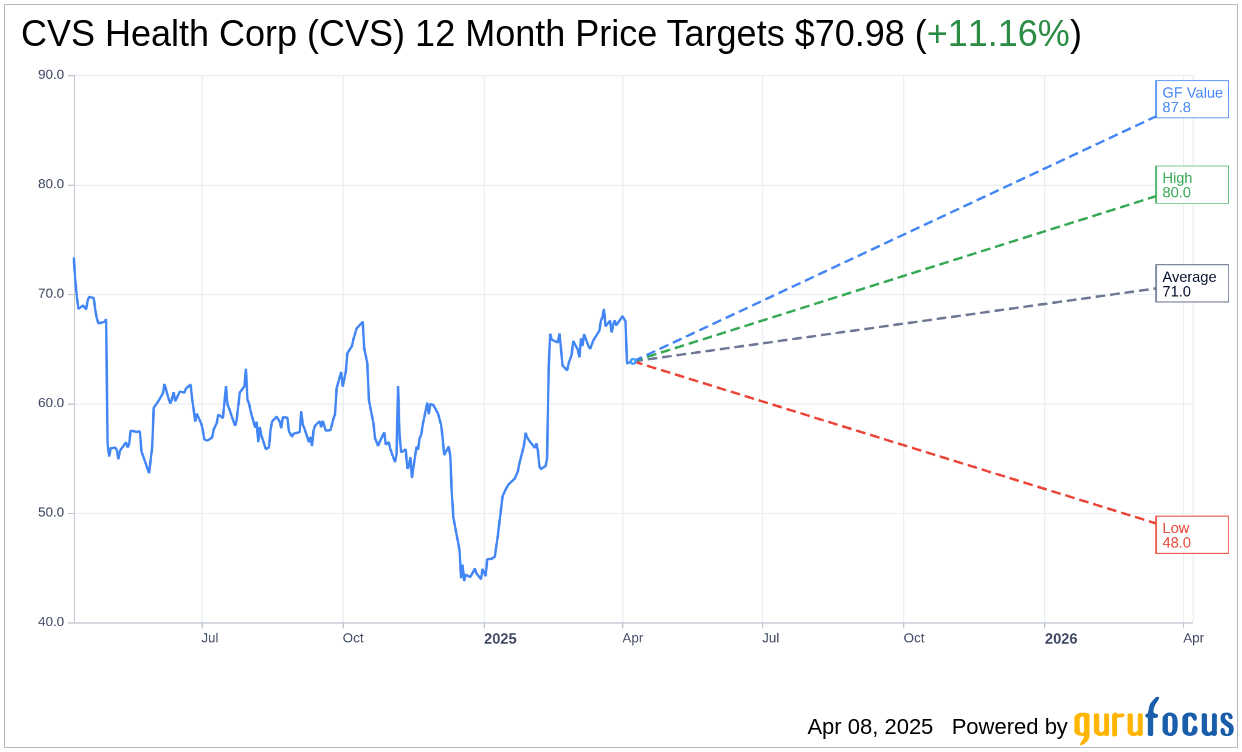

- Analysts provide a one-year average price target for CVS, indicating a potential 11.16% upside.

- GuruFocus estimates suggest an attractive 37.51% upside to the GF Value for CVS.

CVS Health Corp is poised for potential shifts as its Chief Financial Officer, Thomas Cowhey, reportedly plans to vacate his position, according to Bloomberg. This impending departure might herald significant changes in the company's financial leadership, raising interest and speculation among investors.

Wall Street Analysts Forecast

Wall Street remains optimistic about CVS Health Corp's trajectory, as 24 analysts have set a one-year average price target of $70.98. This projection ranges from a high of $80.00 to a low of $48.01, translating to a potential upside of 11.16% from the current trading price of $63.85. For further details regarding these estimates, please visit the CVS Health Corp (CVS, Financial) Forecast page.

The consensus from 29 brokerage firms further underscores confidence in CVS, with an average brokerage recommendation of 2.2, categorizing the stock as "Outperform." On the rating scale, 1 denotes a Strong Buy, and 5 corresponds to Sell, placing CVS favorably among its peers.

According to GuruFocus' sophisticated analysis, the projected GF Value for CVS Health Corp stands at $87.80 one year down the line. This suggests a compelling 37.51% upside from its current valuation of $63.85. The GF Value represents an estimate of the fair market value the stock should command, based on historical multiples, past growth, and future business forecasts. For a comprehensive overview, refer to the CVS Health Corp (CVS, Financial) Summary page.

- CEO Buys, CFO Buys: Stocks that are bought by their CEO/CFOs.

- Insider Cluster Buys: Stocks that multiple company officers and directors have bought.

- Double Buys: Companies that both Gurus and Insiders are buying

- Triple Buys: Companies that both Gurus and Insiders are buying, and Company is buying back.