- CVS Health (CVS, Financial) is set to distribute a $0.665 per share dividend on May 1, yielding 4.2%.

- Recent stock price surge by 39% and 71.4% EPS growth forecast highlight potential dividend sustainability.

- Analysts project a 37.51% upside according to GuruFocus estimates.

Solid Dividend Amidst Rising Stock

CVS Health (CVS) is gearing up to distribute a dividend of $0.665 per share on May 1, boasting an attractive yield of 4.2%. This payout comes on the heels of a notable 39% increase in the company's stock price over the past three months. Coupled with an anticipated earnings per share (EPS) growth of 71.4%, CVS Health appears well-positioned to sustain its dividend moving forward. Investors might find this combination of growth and yield particularly enticing.

Wall Street Analysts Forecast

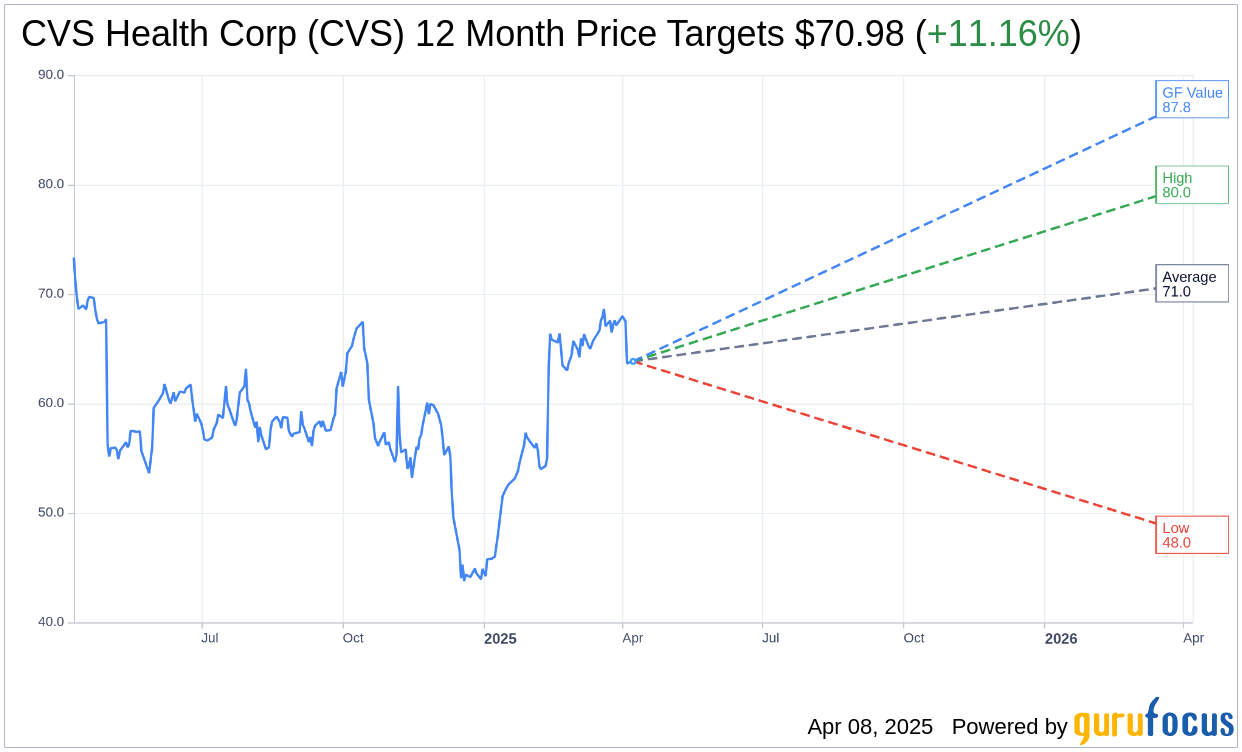

According to the one-year price targets proposed by 24 analysts, CVS Health Corp (CVS, Financial) is expected to reach an average target price of $70.98. Estimates range from a high of $80.00 to a low of $48.01, suggesting an upside potential of 11.16% from the current price of $63.85. For a deeper dive into these estimates, visit the CVS Health Corp (CVS) Forecast page.

Brokerage Recommendations

The consensus from 29 brokerage firms rates CVS Health Corp (CVS, Financial) at an average recommendation of 2.2, indicating an "Outperform" status. This rating is derived from a scale where 1 represents a Strong Buy and 5 represents a Sell.

Estimating Intrinsic Value with GF Value

GuruFocus estimates suggest a GF Value of $87.80 for CVS Health Corp (CVS, Financial) in one year, implying a substantial upside of 37.51% from the current price of $63.85. The GF Value is calculated by considering historical trading multiples, past business growth, and projected future performance. For further insights, visit the CVS Health Corp (CVS) Summary page.

Also check out: (Free Trial)