Key Takeaways:

- Taiwan Semiconductor Manufacturing Co. (TSM, Financial) faces a potential $1 billion fine in a U.S. investigation related to Huawei's Ascend 910B processor.

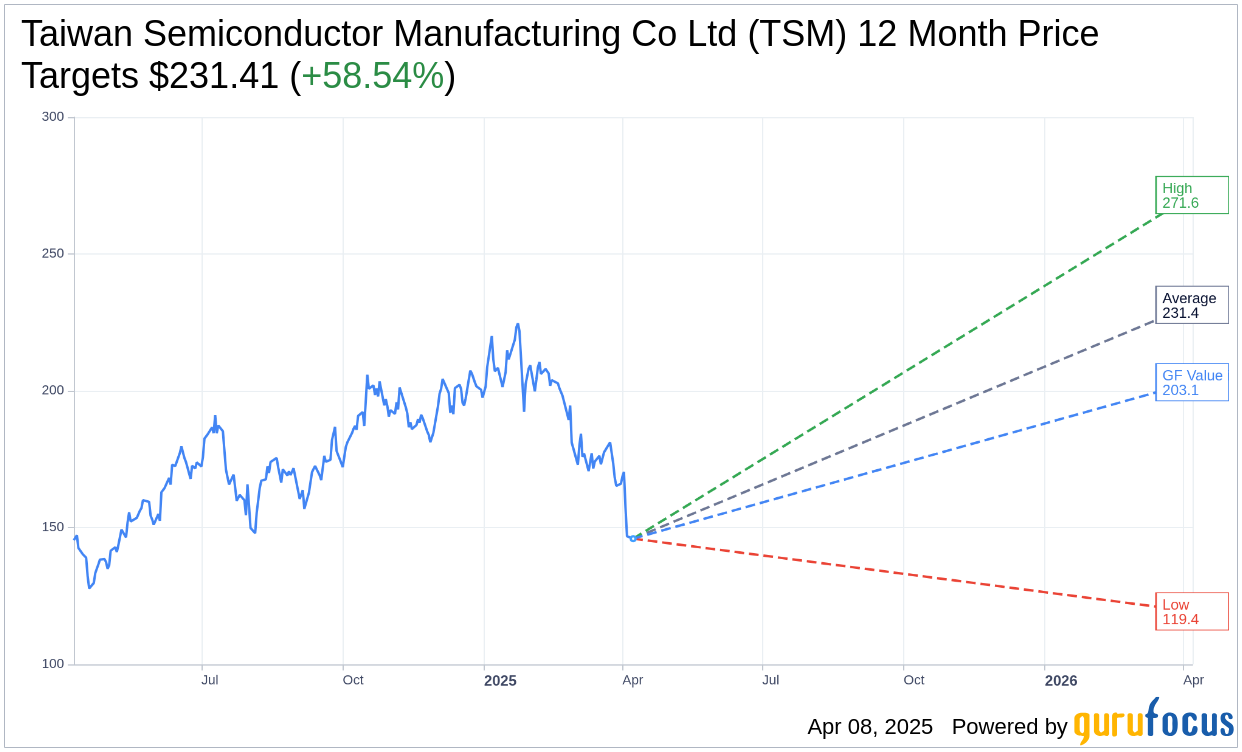

- Analysts predict a substantial upside potential for TSM, with a one-year target price suggesting a 58.54% increase from the current price.

- TSM holds an "Outperform" status with an average brokerage recommendation of 1.6 on a 1-5 scale, where 1 is a strong buy.

Taiwan Semiconductor Manufacturing Co. (TSM) is under scrutiny as a U.S. investigation could lead to a hefty fine exceeding $1 billion. This investigation centers around a chip used in Huawei's Ascend 910B processor, with exports to the Chinese firm Sophgo—the subject of prior U.S. sanctions. TSM maintains its operations are in compliance with U.S. laws, having discontinued its dealings with Huawei mid-2020.

Wall Street Analysts Forecast

Analysts covering Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) have set an average one-year price target of $231.41. Projections span from a high of $271.55 to a low of $119.37, implying a potential upside of 58.54% from the current $145.96 market price. For an in-depth analysis, visit the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Forecast page.

According to 18 brokerage firms, TSM's average recommendation is 1.6, indicating a favorable "Outperform" rating. The recommendation scale ranges from 1 (Strong Buy) to 5 (Sell), suggesting confidence among analysts regarding TSM's future performance.

The GF Value for TSM is estimated at $203.14 for the coming year, predicting a 39.18% rise from its current price of $145.96. This valuation is derived from historical trading multiples and projected business performance. For more detailed insights, explore the Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) Summary page.