Welcome to our comprehensive analysis of Aehr Test Systems (AEHR, Financial). Delve into the latest developments and expert forecasts that make this stock a compelling consideration for investors.

- Aehr Test Systems is transitioning its focus to AI processor testing, now comprising 35% of its operations.

- Despite tariff-related uncertainties, analysts maintain a positive outlook, predicting significant potential upside.

- Current valuations suggest a promising growth trajectory, supported by GuruFocus proprietary metrics.

Company Overview: Shifting Gears

Aehr Test Systems (AEHR, Financial) has recently chosen to pause its fiscal 2025 guidance due to uncertainties related to new tariff measures. The company is strategically pivoting from silicon carbide to AI processor testing, which now accounts for over 35% of its business activities. This strategic shift reflects Aehr's commitment to staying ahead in an evolving market. Despite the tariff challenges, Aehr remains optimistic about its growth prospects across multiple sectors.

Wall Street Analysts Forecast

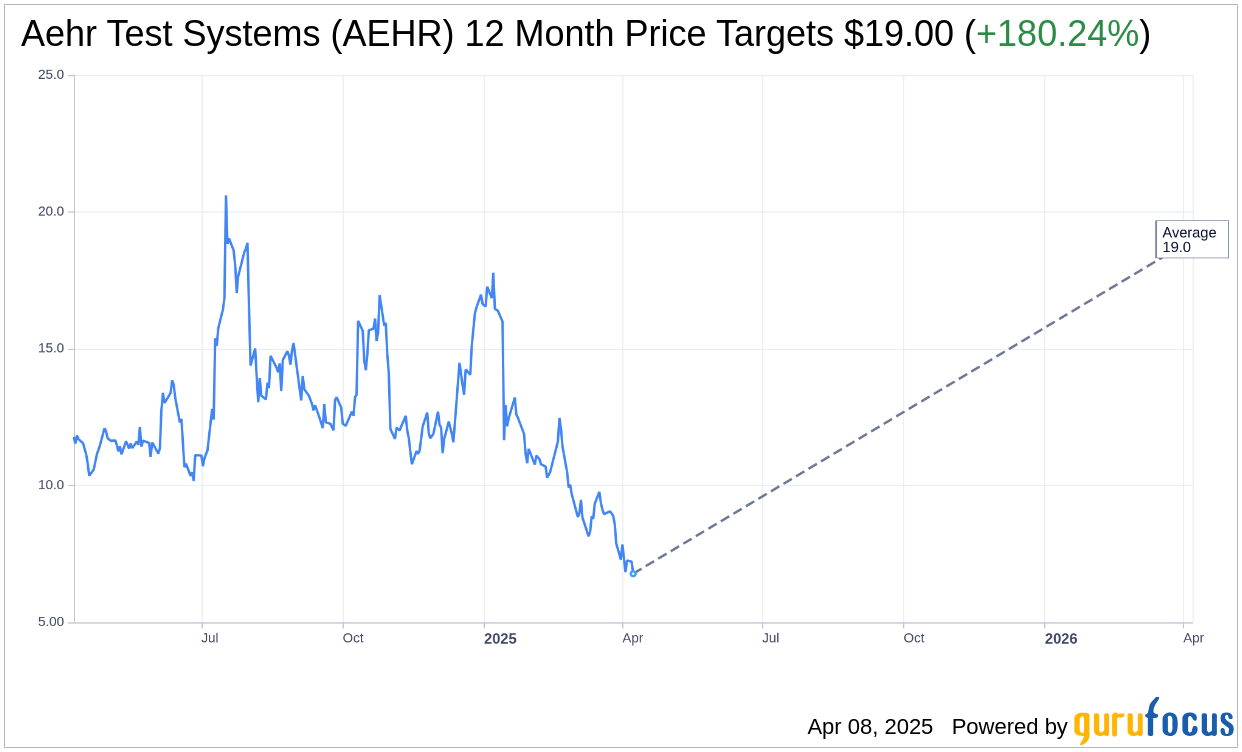

According to predictions from a single analyst, the average one-year price target for Aehr Test Systems (AEHR, Financial) is $19.00, with both high and low estimates aligning at $19.00. This average target suggests a potential upside of 180.24% from the current trading price of $6.78. Investors seeking more detailed projection data can access it on the Aehr Test Systems (AEHR) Forecast page.

Despite external challenges, Aehr Test Systems holds an "Outperform" status, based on a consensus recommendation from two brokerage firms. With a brokerage recommendation averaging 2.5, it places the stock favorably on the scale from 1, signifying Strong Buy, to 5, indicating Sell.

Long-Term Valuation and Potential

GuruFocus estimates that the GF Value of Aehr Test Systems (AEHR, Financial) in a year's time is projected at $25.01. This suggests an impressive upside of 268.88% from the current price of $6.78. The GF Value is a meticulously calculated estimate of the stock's fair trading value. It considers the historical trading multiples, past business growth trajectories, and anticipated future performance metrics. Investors can explore more comprehensive data by visiting the Aehr Test Systems (AEHR) Summary page.

Stay informed with GuruFocus to make well-rounded investment decisions based on data-driven insights.