On April 8, 2025, Techprecision Corp (TPCS, Financial) released its 8-K filing detailing the financial results for the third quarter ended December 31, 2024. Techprecision Corp, a manufacturer of precision metal components, serves industries such as defense, aerospace, and nuclear through its subsidiaries Ranor and Stadco. The company operates exclusively in the United States, providing a comprehensive range of services from raw material transformation to precision finished products.

Performance Overview and Challenges

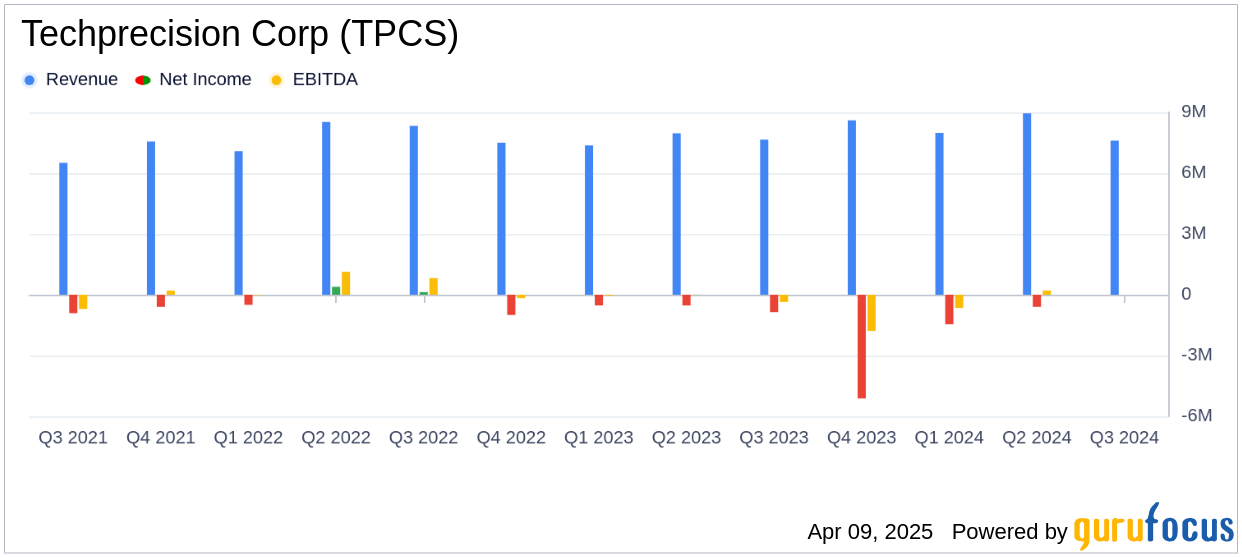

Techprecision Corp reported a slight decrease in revenue for the third quarter of FY 2025, with $7.6 million compared to $7.7 million in the same period last year. This marginal decline is attributed to seasonal factors affecting overhead absorption. The Ranor segment maintained profitability due to a favorable project mix, while the Stadco segment faced challenges with legacy pricing issues and unfavorable project mixes, impacting its performance.

The company's backlog stood at $45.5 million as of December 31, 2024, indicating strong customer confidence. This backlog is expected to be delivered over the next one to three fiscal years, potentially leading to gross margin expansion.

Financial Achievements and Industry Importance

Despite the challenges, Techprecision Corp achieved several financial milestones. The company's operating loss for the quarter was reduced to $0.7 million from $1.0 million in the previous year, showcasing improved operational efficiency. However, the net loss was $0.8 million, influenced by maintaining a full valuation on deferred tax assets.

For the nine months ended December 31, 2024, revenue increased by 7% to $24.6 million, driven by a favorable project mix at both Ranor and Stadco. This growth is significant for the industrial products sector, highlighting the company's ability to adapt and thrive in a competitive market.

Key Financial Metrics

Important metrics from the financial statements include a gross profit of $1.0 million for the quarter, a 15% decrease due to higher production costs at Stadco. Selling, General, and Administrative (SG&A) expenses decreased by 22% to $1.7 million, primarily due to the absence of acquisition-related due diligence costs.

| Metric | Three Months Ended Dec 31, 2024 | Nine Months Ended Dec 31, 2024 |

|---|---|---|

| Revenue | $7.6 million | $24.6 million |

| Cost of Revenue | $6.6 million | $22.3 million |

| Gross Profit | $1.0 million | $2.2 million |

| Net Loss | $0.8 million | $2.9 million |

Financial Position and Analysis

As of December 31, 2024, Techprecision Corp reported $165,000 in cash and cash equivalents, a slight increase from March 31, 2024. The company's working capital was negative $1.8 million, an improvement from negative $2.9 million at the end of the previous fiscal year. Total debt stood at $7.4 million, reflecting a decrease from $7.6 million.

“Customer confidence remains high as our backlog was $45.5 million on December 31, 2024. We expect to deliver our backlog over the course of the next one to three fiscal years with gross margin expansion,” stated Alexander Shen, Techprecision’s Chief Executive Officer.

Overall, Techprecision Corp's financial results for the third quarter of FY 2025 reflect a company navigating challenges while maintaining a strong position in the industrial products sector. The company's strategic focus on backlog delivery and operational efficiency could lead to improved financial performance in the coming years.

Explore the complete 8-K earnings release (here) from Techprecision Corp for further details.