Summary:

- Core Natural Resources (CNR, Financial) is set to report its Q4 2024 earnings on February 20, 2025, accompanied by an investor call.

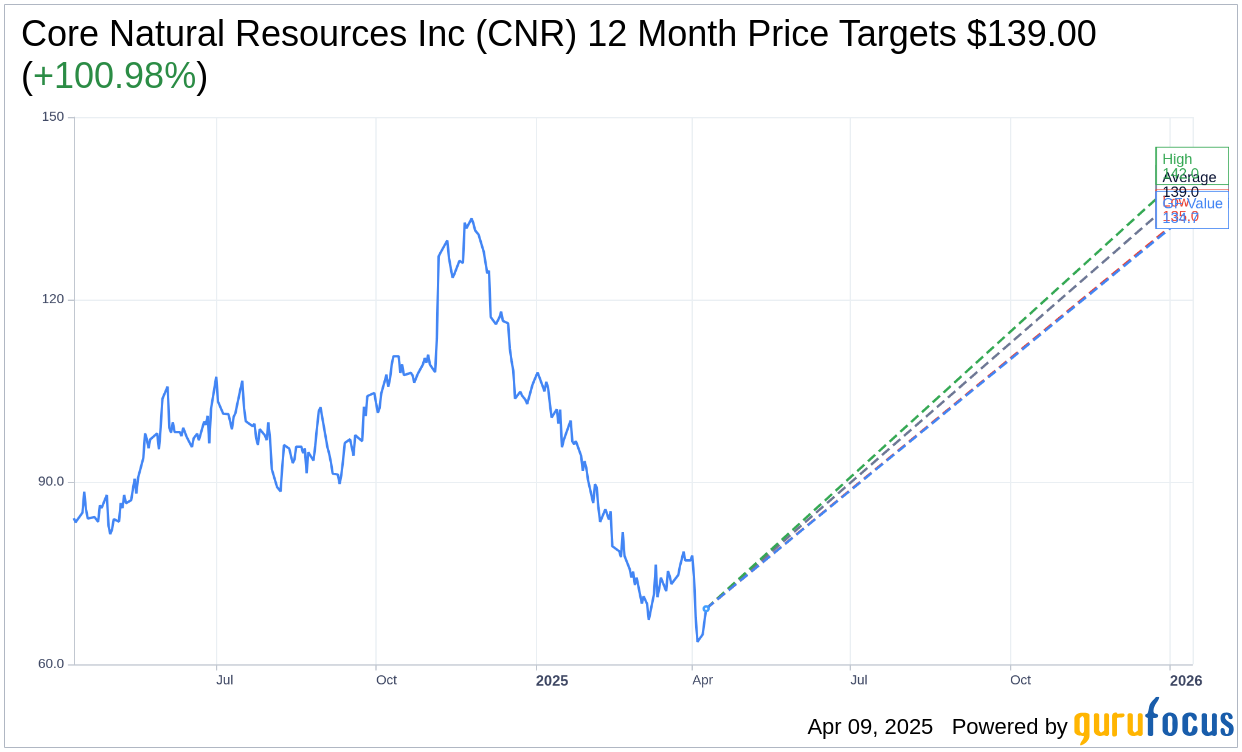

- Analysts' average price target suggests a potential upside of 100.98% from the current price.

- Consensus ratings reflect an "Outperform" status for the stock.

Core Natural Resources (CNR) has scheduled the release of its financial results for the fourth quarter of 2024 on February 20, 2025. The announcement will be followed by an investor conference call at 10:00 a.m. Eastern Time, accessible via phone or a webcast. The financial results will be made public before the market opens.

Wall Street Analysts Forecast

According to projections from three analysts, Core Natural Resources Inc (CNR, Financial) is expected to reach an average price target of $139.00 over the next year. This estimate includes a high target of $142.00 and a low of $135.00. If achieved, the average target price implies a significant upside of 100.98% from the current stock price of $69.16. Further insights can be accessed on the Core Natural Resources Inc (CNR) Forecast page.

In terms of broker ratings, Core Natural Resources Inc (CNR, Financial) has been assigned an average recommendation of 2.0 by three brokerage firms, categorizing the stock as "Outperform." The rating scale ranges from 1 to 5, with 1 indicating a Strong Buy and 5 suggesting a Sell.

From GuruFocus's perspective, the estimated GF Value for Core Natural Resources Inc (CNR, Financial) stands at $134.74 for the upcoming year. This projection hints at a potential upside of 94.82% from the current stock price of $69.16. The GF Value represents GuruFocus' estimate of the stock's fair trading value, derived from historical trading multiples, past business growth, and anticipated future performance metrics. For more in-depth data, visit the Core Natural Resources Inc (CNR) Summary page.