Key Highlights:

- Magic Software Enterprises Ltd. (MGIC, Financial) announces a robust 4.2% semi-annual dividend yield.

- Potential delisting due to merger with Matrix I.T Ltd. underscores the need for investor vigilance.

- Analysts project a 27.29% upside, suggesting a promising investment opportunity.

Magic Software Enterprises Ltd. (MGIC) has recently announced a semi-annual dividend that offers a generous yield of 4.2%. This announcement comes amidst a backdrop of past stock volatility. Notably, the company may face potential delisting as it progresses with a merger with Matrix I.T Ltd. However, the strong cash flow backing its dividend payouts positions MGIC as a compelling value pick.

Wall Street Analysts' Projections

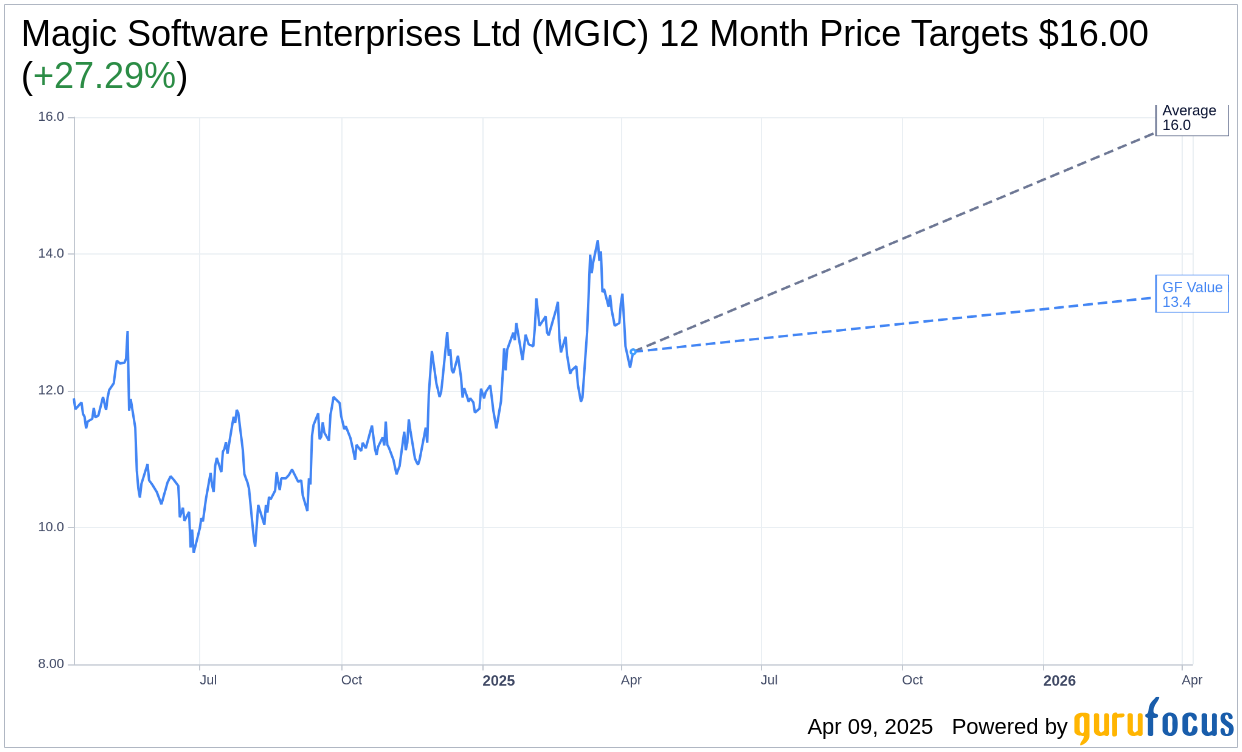

According to one analyst covering Magic Software Enterprises Ltd. (MGIC, Financial), the average 12-month price target is set at $16.00. This target aligns with both the high and low price estimates, indicating a uniform outlook. With the current stock price at $12.57, this forecast signals a potential upside of 27.29%. For more thorough estimate insights, visit the Magic Software Enterprises Ltd. (MGIC) Forecast page.

Analyst Recommendations

Drawing from recommendations by two brokerage firms, Magic Software Enterprises Ltd. (MGIC, Financial) holds an average brokerage recommendation of 2.5. This rating suggests an "Outperform" status on a scale where 1 denotes a Strong Buy and 5 indicates a Sell. Investors should consider this favorable outlook when evaluating MGIC's potential.

Valuation Insights from GuruFocus

Using GuruFocus estimates, the projected GF Value for Magic Software Enterprises Ltd. (MGIC, Financial) in a year's time is $13.42. This estimated value implies a modest upside of 6.76% from its current trading price of $12.57. The GF Value represents GuruFocus' fair value assessment, calculated through historical trading multiples, previous business growth, and future performance projections. For a deeper dive into these figures, the Magic Software Enterprises Ltd. (MGIC) Summary page offers extensive details.

Also check out: (Free Trial)