Key Takeaways:

- Jefferies cuts PepsiCo's price target due to a slump in Frito-Lay sales, but strong profit margins remain.

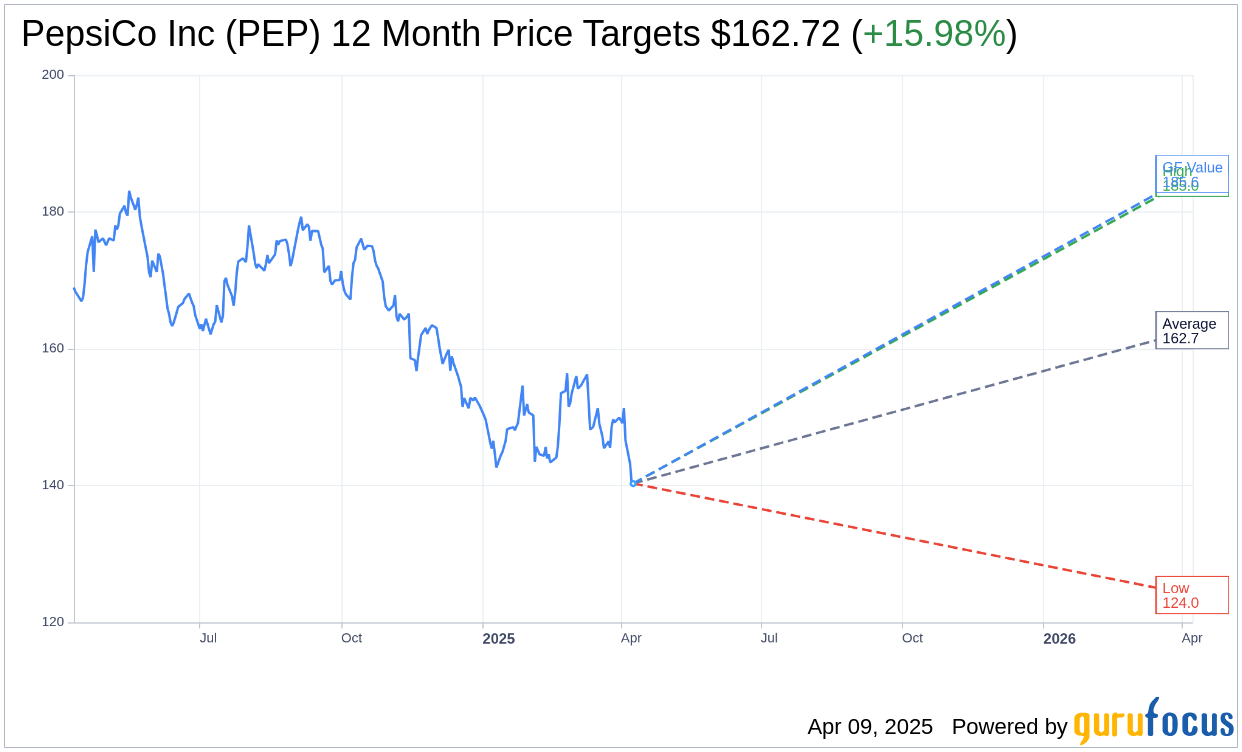

- Analysts' consensus presents an average 15.98% upside potential.

- Projected GF Value posits a significant 32.26% upside.

PepsiCo (PEP, Financial) is under the spotlight as Jefferies analyst Kaumil Gajrawala recently lowered the company's price target from $170 to $165, albeit maintaining a "Hold" rating. This revision follows a noticeable 5% decline in its Frito-Lay segment, yet PepsiCo continues to boast robust profit margins. The company is also on track to introduce a new productivity strategy by year-end, which anticipates increasing projected expenses from $3.7 billion to $6.2 billion by 2030.

Wall Street Analysts Forecast

With insights from 21 analysts, the average target price for PepsiCo Inc (PEP, Financial) is set at $162.72. This presents a high forecast of $185.00 and a low of $124.00. The average target suggests a notable upside of 15.98% from the current market price of $140.30. For further detailed estimates, refer to the PepsiCo Inc (PEP) Forecast page.

Evaluating the consensus from 24 brokerage firms, PepsiCo Inc's (PEP, Financial) average brokerage recommendation is at 2.7, indicating a "Hold" status. This rating scale spans from 1 (Strong Buy) to 5 (Sell), providing a clear insight into the stock's current standing.

According to GuruFocus estimates, the projected GF Value for PepsiCo Inc (PEP, Financial) over the next year is $185.56, which indicates a potential upside of 32.26% from the present price of $140.3. The GF Value is GuruFocus' forecast of the fair market value, derived from historical trading multiples, past business growth, and future performance projections. More comprehensive data is available on the PepsiCo Inc (PEP) Summary page.