On April 9, 2025, Delta Air Lines Inc (DAL, Financial) released its 8-K filing detailing its financial performance for the March quarter. The Atlanta-based airline, one of the world's largest, operates a vast network of over 300 destinations across more than 50 countries. Delta's hub-and-spoke model facilitates global passenger distribution through major hubs such as Atlanta, New York, Salt Lake City, Detroit, Seattle, and Minneapolis-St. Paul.

Performance Overview and Challenges

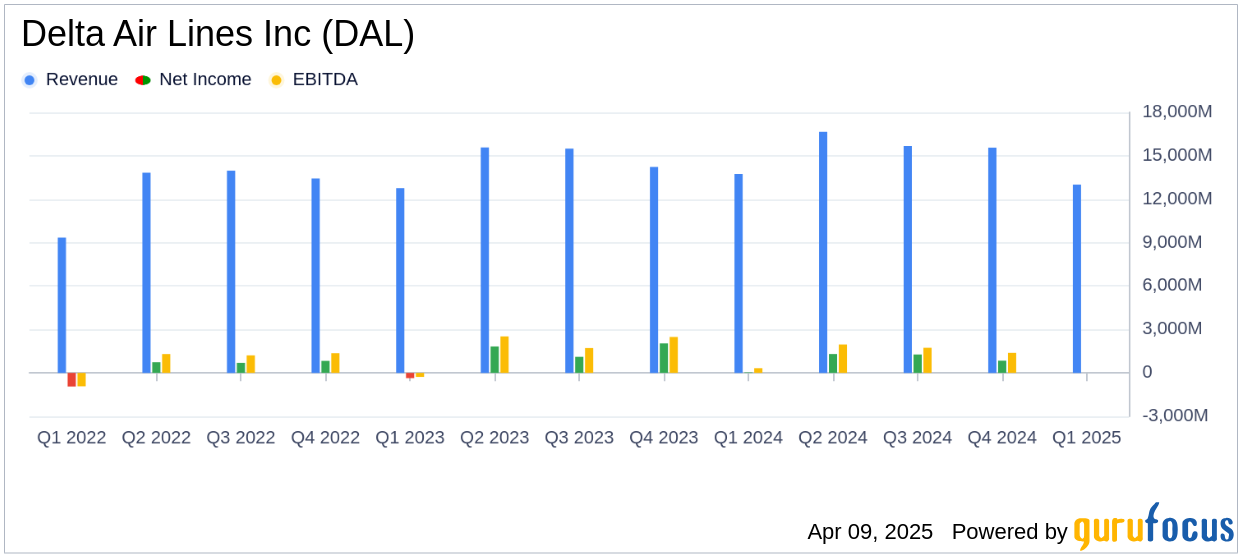

Delta Air Lines Inc (DAL, Financial) reported a solid revenue performance for the March quarter, with operating revenue reaching $14.0 billion, surpassing the analyst estimate of $13.022 billion. However, the company's earnings per share (EPS) of $0.37 fell short of the estimated $0.38. The airline's profitability remained flat compared to the previous year, amidst a backdrop of broad economic uncertainty and stalled global trade growth.

Delta's CEO, Ed Bastian, acknowledged the challenges, stating,

While the first quarter unfolded differently than initially expected, we delivered solid profitability that was flat to prior year and is expected to lead the industry."The company is focusing on protecting margins and cash flow by aligning capacity growth with demand and actively managing costs.

Financial Achievements and Industry Context

Delta's financial achievements are noteworthy in the transportation industry, where managing costs and maintaining profitability amidst fluctuating demand and economic conditions is crucial. The airline's operating income stood at $569 million, with an operating margin of 4.0%. Pre-tax income was reported at $320 million, with a pre-tax margin of 2.3%.

Key Financial Metrics

Delta's financial statements reveal important metrics that highlight its operational efficiency and financial health:

| Metric | GAAP | Non-GAAP |

|---|---|---|

| Operating Revenue | $14.0 billion | $13.0 billion |

| Operating Income | $569 million | $591 million |

| Pre-tax Income | $320 million | $382 million |

| Earnings Per Share | $0.37 | $0.46 |

| Operating Cash Flow | $2.4 billion | |

Analysis and Outlook

Delta's performance in the March quarter reflects its ability to adapt to changing market conditions. The airline's diverse revenue streams, including premium and loyalty programs, contributed significantly to its revenue growth. Premium revenue grew by 7% year-over-year, while American Express remuneration reached a record $2.0 billion, up 13% from the previous year.

Looking ahead, Delta is guiding for a June quarter operating margin of 11% to 14% and EPS of $1.70 to $2.30. The company plans to reduce capacity growth in the second half of the year to align supply with demand, ensuring continued profitability and cash flow protection.

Delta's strategic focus on cost management and capacity alignment positions it well to navigate the current economic uncertainties. The airline's commitment to maintaining a strong balance sheet and reducing debt further enhances its financial durability in the competitive airline industry.

Explore the complete 8-K earnings release (here) from Delta Air Lines Inc for further details.