Key Highlights:

- Infosys (INFY, Financial) expands collaboration with AIB to boost operational efficiency.

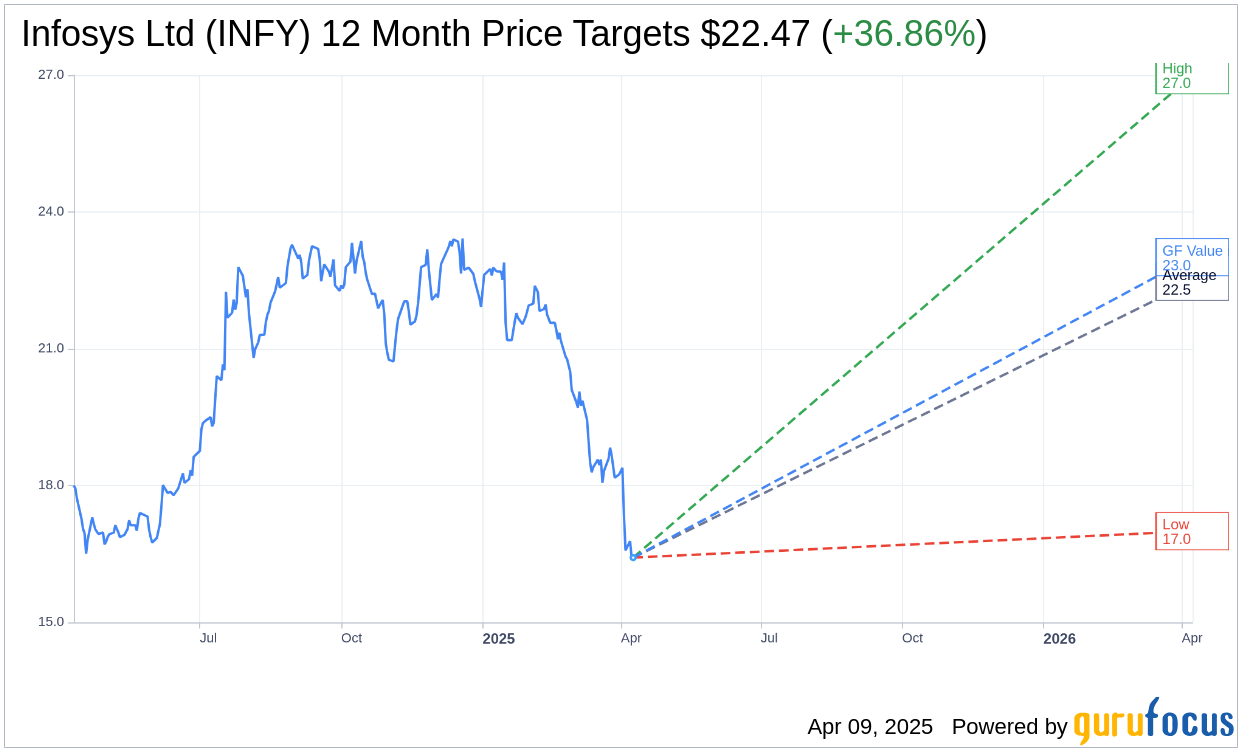

- Analysts project a potential 36.86% upside, with a target price of $22.47.

- GuruFocus estimates a potential value increase of 40.13% within a year.

Infosys Ltd. (INFY) has announced plans to deepen its partnership with AIB to spearhead a transformation in AIB's application landscape. This enhanced collaboration is poised to significantly elevate operational efficiencies through robust application development and maintenance services.

Wall Street Analysts' Projections

According to projections by ten financial analysts, Infosys Ltd (INFY, Financial) is expected to reach an average price target of $22.47 within a year. Estimates range from a high of $27.00 to a low of $17.00, indicating a potential upside of 36.86% from the current market price of $16.42. Investors seeking further insights can visit the Infosys Ltd (INFY) Forecast page for comprehensive data.

From 14 brokerage firms, the consensus average recommendation for Infosys Ltd stands at 2.4, suggesting an "Outperform" rating. This rating falls within a scale of 1 to 5, where 1 indicates a Strong Buy and 5 represents a Sell.

Utilizing GuruFocus' proprietary metrics, the estimated GF Value for Infosys Ltd (INFY, Financial) projects a significant upside of 40.13% from the current trading price of $16.42, bringing it to an estimated $23.01 in one year. The GF Value represents an estimate of the stock's fair trading value, calculated using historical trading multiples, past growth, and future performance forecasts. Investors can find additional detailed information on the Infosys Ltd (INFY) Summary page.