- A federal judge has dismissed the class action suit against Bristol Myers Squibb regarding antitrust practices.

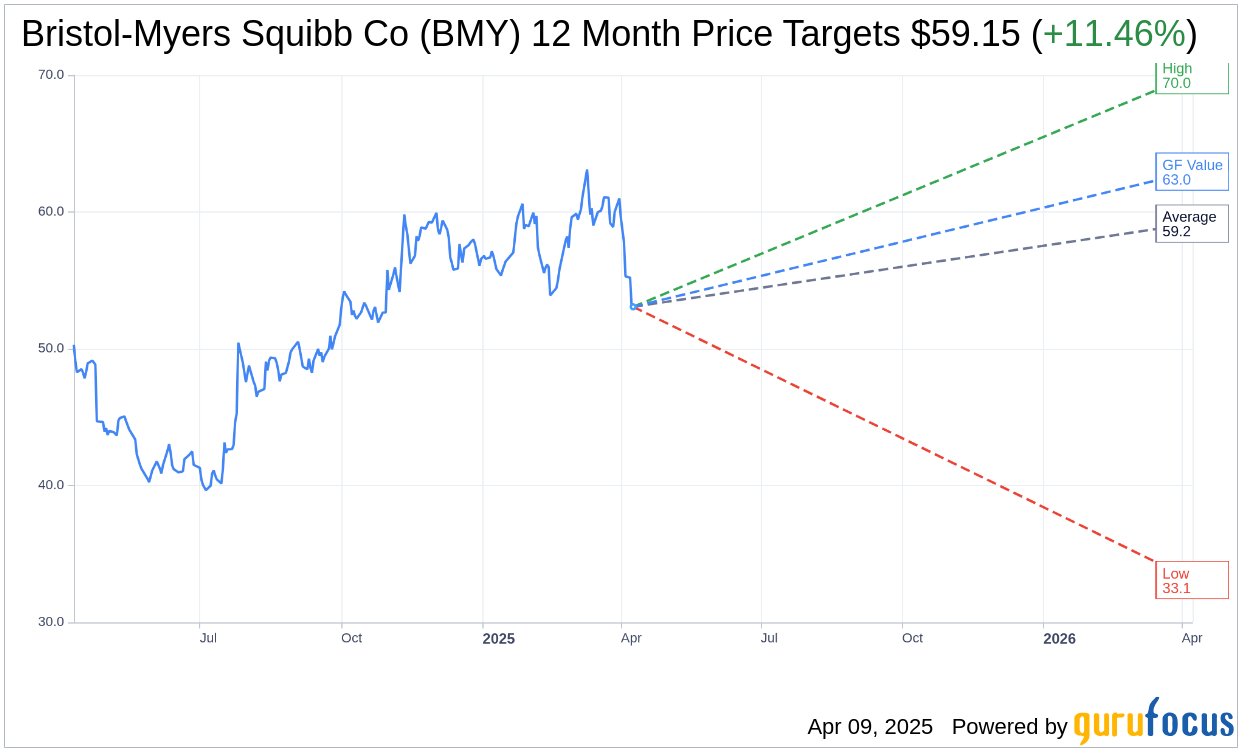

- Analyst forecasts suggest potential upside for Bristol-Myers Squibb Co. (BMY, Financial) stock, with an average target price of $59.15.

- The GF Value estimate indicates a potential 18.62% upside from current prices.

A recent ruling has seen a federal judge dismiss the class action lawsuit filed by Blue Cross Blue Shield of Louisiana against Bristol Myers Squibb (BMY). The suit alleged monopolistic practices concerning its Pomalyst drug. However, the court found insufficient evidence of fraudulent patent acquisition or groundless legal tactics, resulting in no violation of antitrust laws.

Wall Street Analyst Projections

As investors look ahead, insights from 21 analysts have shaped a one-year price target landscape for Bristol-Myers Squibb Co (BMY, Financial). The average target price stands at $59.15, with projections ranging from a high of $70.00 to a low of $33.10. This average target hints at a potential upside of 11.46% based on the current price of $53.07. For those seeking more detailed insights, further data is available on the Bristol-Myers Squibb Co (BMY) Forecast page.

The consensus recommendation across 27 brokerage firms positions Bristol-Myers Squibb Co (BMY, Financial) with an average recommendation score of 2.7, indicating a "Hold" status. This rating system employs a scale from 1 to 5, where 1 equates to a Strong Buy and 5 signifies a Sell.

GuruFocus GF Value Estimation

According to GuruFocus estimates, the projected GF Value for Bristol-Myers Squibb Co (BMY, Financial) over the next year is $62.95. This suggests an enticing upside of 18.62% from the current price of $53.07. The GF Value represents GuruFocus' proprietary estimate of a stock's fair value, derived from historical trading multiples, past business growth, and anticipated future business performance. Investors can explore more comprehensive information on the Bristol-Myers Squibb Co (BMY) Summary page.