- Pfizer significantly reduces its debt load, showcasing strong financial management.

- Analysts project a potential upside of over 42% for Pfizer's stock price.

- Current brokerage rating suggests investors should "Hold" on to Pfizer shares.

Pfizer Inc. (NYSE: PFE) has demonstrated effective financial management by reducing its debt from $72.2 billion to $64.8 billion over the past year. With a robust cash reserve of $20.5 billion, Pfizer's net debt is approximately $44.3 billion. The pharmaceutical giant's Earnings Before Interest and Taxes (EBIT) growth of 30% and a debt to EBITDA ratio of 1.9 further highlight its adept handling of liabilities.

Wall Street Analysts' Insights

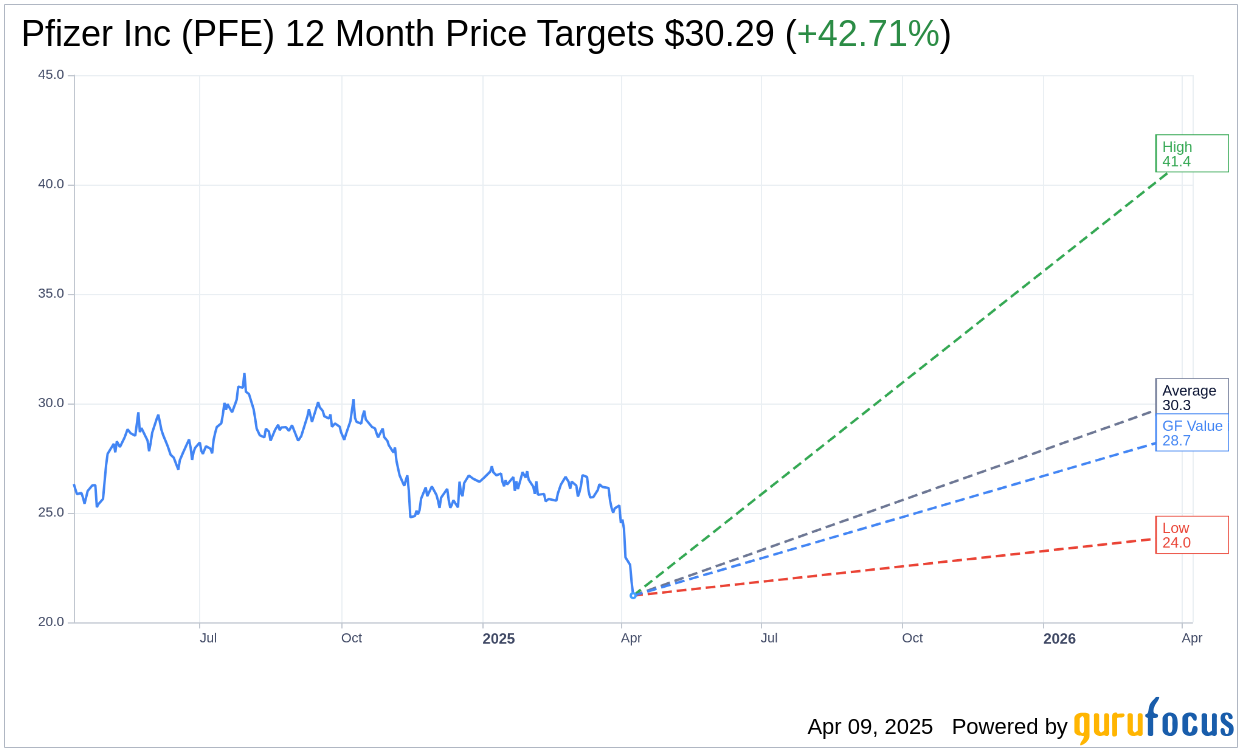

According to price targets set by 19 Wall Street analysts, the average target price for Pfizer Inc. (PFE, Financial) over the next year is $30.29. This estimate ranges from a high of $41.43 to a low of $24.00, suggesting a compelling upside potential of 42.71% from the current stock price of $21.22. For more detailed projections, visit the Pfizer Inc. (PFE) Forecast page.

The consensus among 23 brokerage firms currently assigns Pfizer Inc. (PFE, Financial) a 2.6 rating, which translates to a "Hold" recommendation. This rating is based on a scale of 1 to 5, where 1 indicates a Strong Buy and 5 suggests a Sell.

GF Value Estimation

GuruFocus estimates Pfizer Inc.'s one-year GF Value at $28.68, offering a potential upside of 35.14% from the present trading price of $21.2224. The GF Value represents the fair market value of the stock, formulated by analyzing historical trading multiples, previous business growth, and future performance forecasts. To delve deeper into these figures, visit the Pfizer Inc. (PFE, Financial) Summary page.