Key Takeaways:

- AGNC Investment Corp's stock recently closed at $9.34, trailing the broader market performance.

- Expected earnings report reveals a significant EPS drop but a substantial revenue increase.

- Analysts project a potential 29.07% upside from the current price with a recommendation of "Outperform."

Overview of AGNC Investment Corp's Recent Performance

AGNC Investment Corp (AGNC, Financial) has recently caught the attention of investors as its stock closed at $9.34, slightly underperforming the broader market. As anticipation builds for its forthcoming earnings report, market participants are preparing for mixed results. The company is expected to report a 31.03% earnings per share (EPS) decline to $0.40. However, revenue is projected to increase dramatically by 618.05%, reaching $155.42 million. These figures suggest significant volatility but also potential opportunities for discerning investors. Additionally, AGNC's Forward P/E ratio of 5.88 positions it favorably when compared to its industry's average of 8.09, indicating a potential undervaluation.

Wall Street Analysts' Forecast

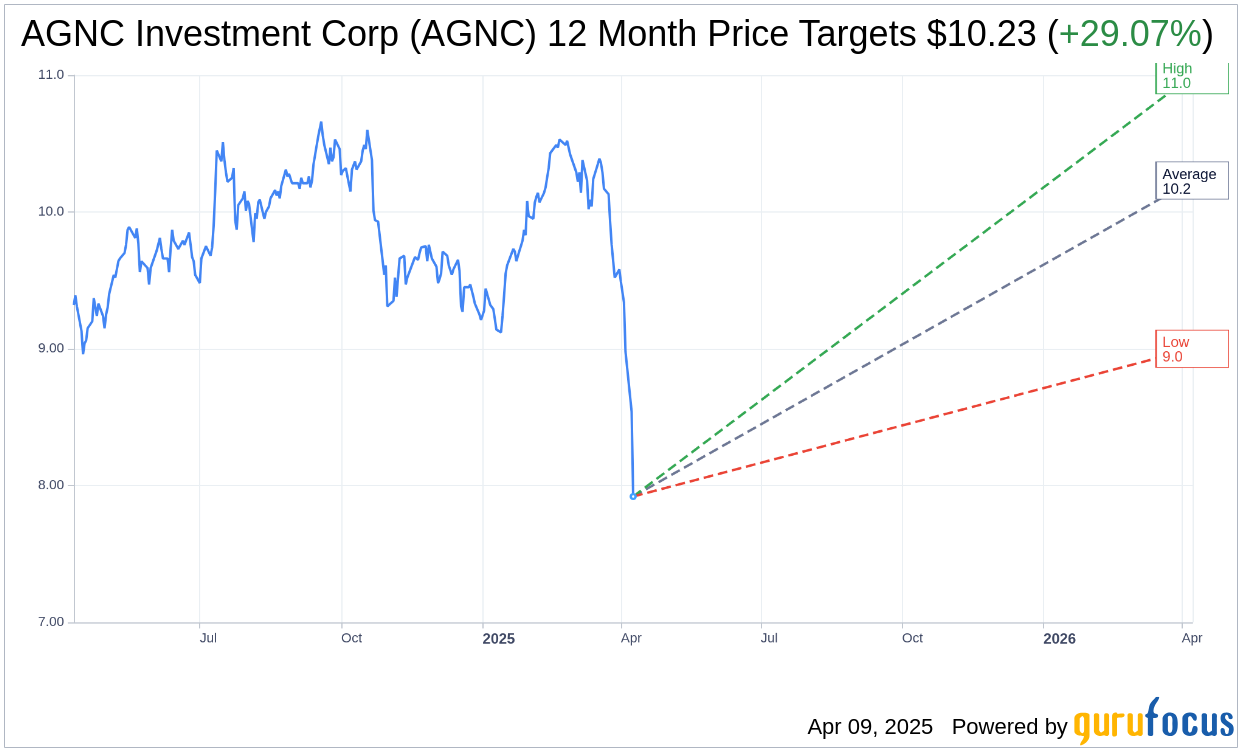

Market analysts have provided their insights with 12 issuing one-year price targets for AGNC Investment Corp. The average target price is set at $10.23, with estimates ranging from a high of $11.00 to a low of $9.00. This data suggests an upside potential of 29.07% from the current stock price of $7.93, signaling a promising opportunity for growth-oriented investors. For a more comprehensive analysis, additional estimates are available on the AGNC Investment Corp (AGNC, Financial) Forecast page.

Brokerage Firms' Recommendations

Further reinforcing investor interest, AGNC Investment Corp has garnered a favorable consensus rating from 15 brokerage firms. The average recommendation stands at 2.2, categorized as "Outperform." The rating system spans from 1 (Strong Buy) to 5 (Sell), underlining the stock's appealing investment profile. This endorsement by analysts suggests confidence in AGNC's ability to navigate market challenges and capitalize on opportunities.

As AGNC Investment Corp approaches its earnings announcement, investor focus remains on how the company will deliver against these projections and how the broader economic environment will influence its trajectory. Keeping a close watch on updated analyst forecasts and earnings results will be crucial for making informed investment decisions.