- Axsome Therapeutics (AXSM, Financial) shares dipped by 6% due to mixed outcomes from phase 3 trial results.

- Despite unmet primary goals, significant potential was observed in alleviating severe daytime sleepiness.

- Analysts maintain a positive outlook with price targets suggesting substantial gains.

Axsome Therapeutics (AXSM) recently experienced a 6% drop in its stock following the release of findings from its phase 3 trial for solriamfetol, aimed at treating major depressive disorder. While the trial fell short of its primary objective, it revealed promising outcomes for patients suffering from severe daytime sleepiness, leading to plans for a subsequent trial set for 2025.

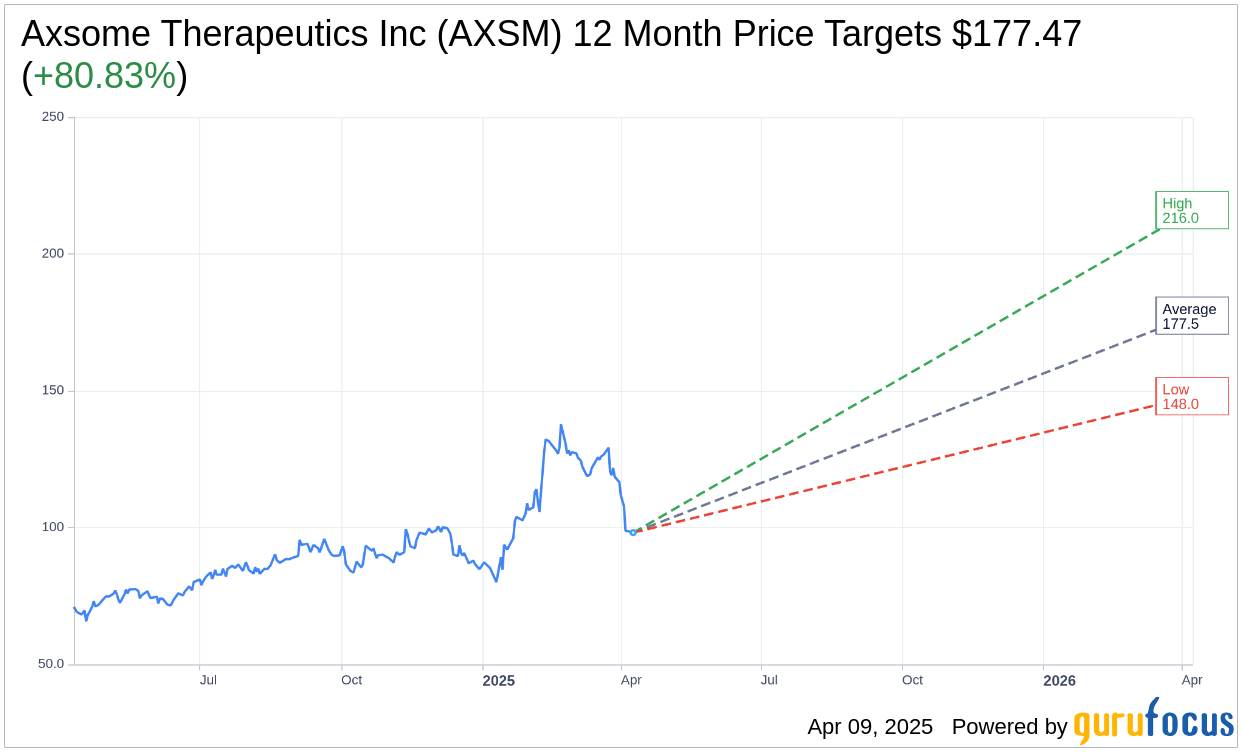

Wall Street Analysts Forecast

Seventeen analysts have weighed in with one-year price targets for Axsome Therapeutics Inc (AXSM, Financial), presenting an average target price of $177.47. The range of estimates spans from a high of $216.00 to a low of $148.00. This average target suggests a remarkable upside of 80.83% from the current stock price of $98.14. For more in-depth estimate data, visit the Axsome Therapeutics Inc (AXSM) Forecast page.

Moreover, the consensus recommendation from 18 brokerage firms positions Axsome (AXSM, Financial) at an average rating of 1.7, categorizing the stock as "Outperform." This rating scale runs from 1, indicating a Strong Buy, to 5, representing a Sell.

According to GuruFocus estimates, the projected GF Value for Axsome Therapeutics Inc (AXSM, Financial) stands at $252.05 in the coming year. This suggests a potential upside of 156.83% from the current price of $98.14. The GF Value is GuruFocus’ calculated fair value at which the stock ought to be traded. It leverages historical stock multiples, past business growth, and prospective business performance estimates. Explore further details on the Axsome Therapeutics Inc (AXSM) Summary page.