Key Highlights:

- Nvidia's stock surged 14% following a delay in U.S. export restrictions to China.

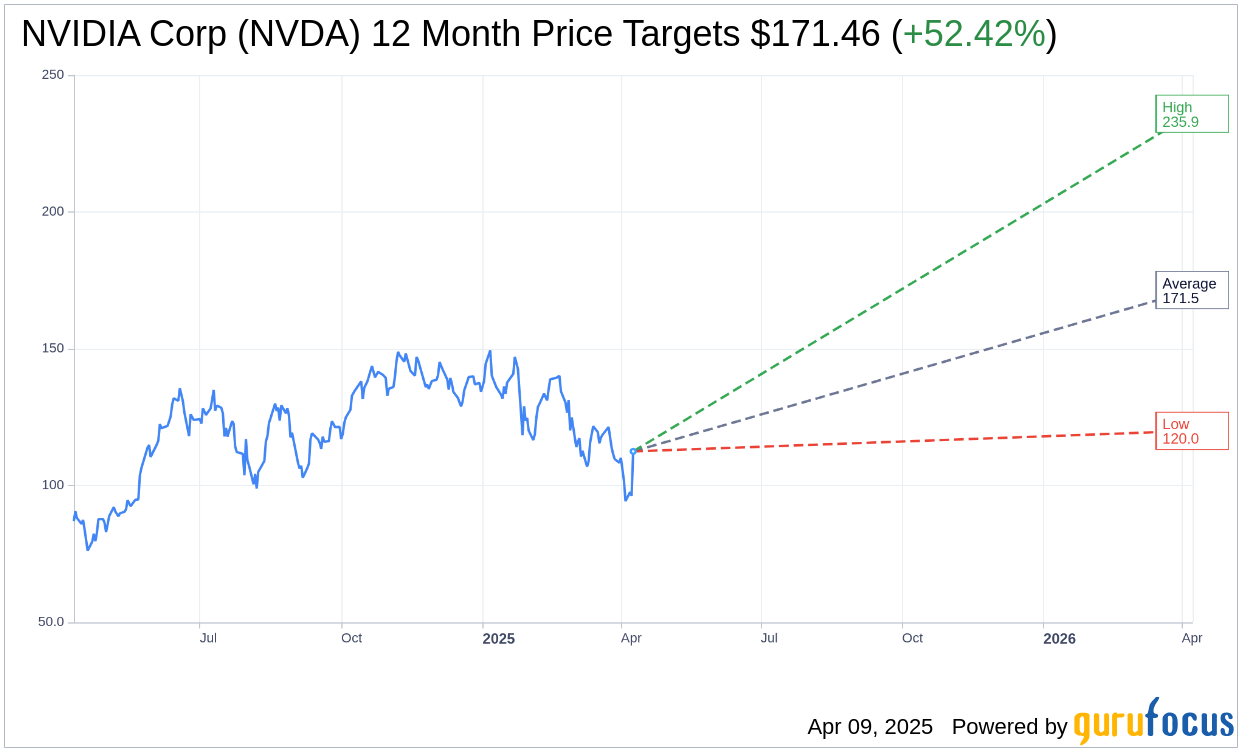

- Analyst price targets suggest a potential 52.42% upside from current levels.

- GuruFocus projects a significant 136.15% increase in the stock's fair value over the next year.

Nvidia's Strategic Maneuver Amid U.S.-China Trade Dynamics

Nvidia (NVDA, Financial) experienced a remarkable 14% increase in its stock price after the U.S. government opted to delay the enforcement of an export ban on its H20 graphics processing units to China. This decision comes as a relief to major Chinese companies, which had already placed considerable orders in anticipation of possible restrictions. In response, Nvidia has committed to boosting its investments in U.S.-based AI data centers, signaling a strategic focus on innovation and resilience.

Market Insights: Wall Street's Optimism for Nvidia

Wall Street analysts remain bullish on NVIDIA Corp (NVDA, Financial), with price targets reflecting a promising future. Among the 51 analysts providing one-year targets, the average projection stands at $171.46, with highs reaching $235.92 and lows at $120.00. This average target suggests a notable upside potential of 52.42% from the current price of $112.49. Investors seeking more in-depth data can refer to the NVIDIA Corp (NVDA) Forecast page for further insights.

Consensus Ratings: Confidence in Nvidia's Performance

According to the consensus from 63 brokerage firms, NVIDIA Corp's (NVDA, Financial) stock holds an average brokerage recommendation of 1.7, signifying an "Outperform" status. This rating, on a scale where 1 represents a Strong Buy and 5 indicates a Sell, reflects a strong market confidence in Nvidia's potential to sustain its growth trajectory.

GuruFocus Valuation: A Promising Future for Nvidia

The GF Value estimate provided by GuruFocus for NVIDIA Corp (NVDA, Financial) over the next year is $265.65, projecting a substantial upside of 136.15% from the current trading price of $112.49. This valuation takes into account the historical trading multiples, past business growth, and future performance projections. Investors looking for more comprehensive data can visit the NVIDIA Corp (NVDA) Summary page for detailed analysis.