Summary:

- Microsoft's Azure cloud platform continues to drive significant revenue growth.

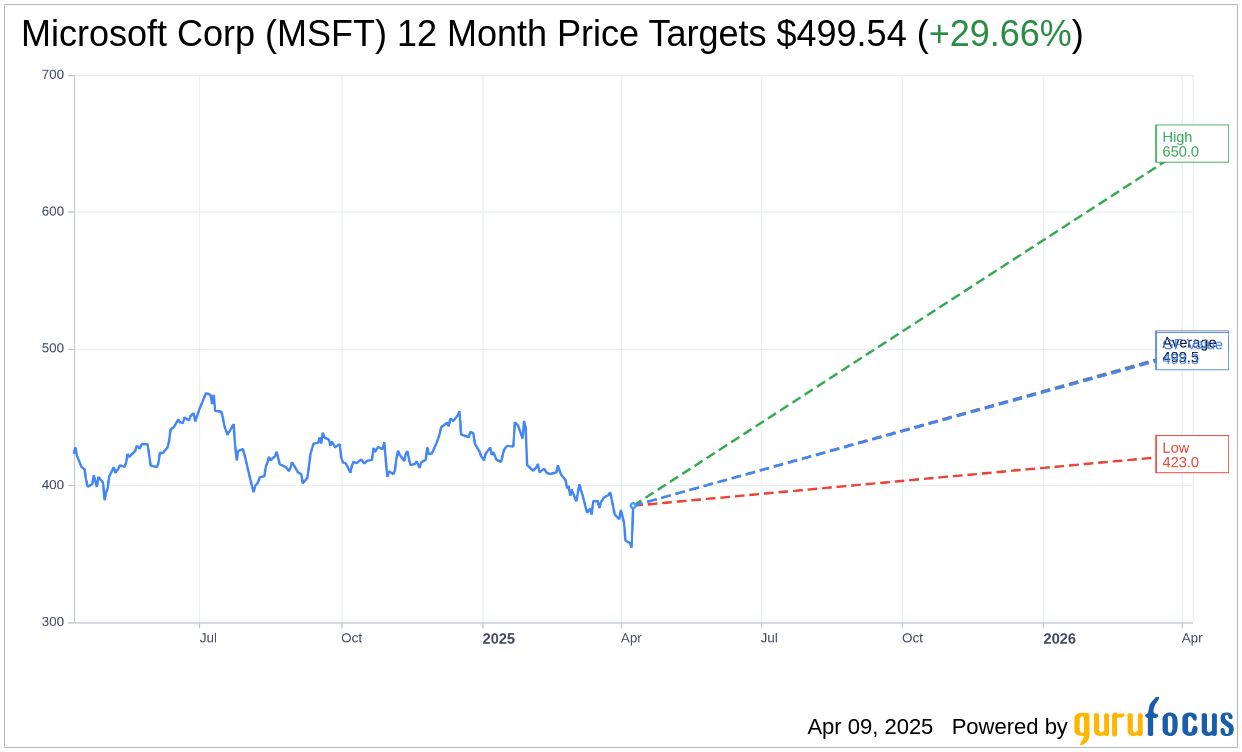

- Analysts predict a potential upside for MSFT, with a favorable average price target.

- GuruFocus estimates show a promising future value for Microsoft's stock.

Microsoft Corporation (NASDAQ: MSFT) maintains its influential position in the evolving big data landscape, particularly through its widely adopted Azure cloud platform. In the second quarter of fiscal 2025, Azure reported a remarkable 21% revenue surge to $40.9 billion, substantially contributing to Microsoft's overall revenue increase of 12% year-over-year, reaching $69.6 billion.

Wall Street Analysts Forecast

Wall Street analysts have provided one-year price targets for Microsoft Corp (MSFT, Financial), offering a compelling perspective on its future performance. Among the 49 analysts polled, the average price target stands at $499.54, with estimates ranging from a high of $650.00 to a low of $423.00. This average target suggests a potential upside of 29.66% from the current price of $385.28. Investors can access more detailed estimate data on the Microsoft Corp (MSFT) Forecast page.

Consensus from 60 brokerage firms places Microsoft's average recommendation at 1.8, indicating an "Outperform" status. On the rating scale, where 1 represents a Strong Buy and 5 indicates a Sell, this suggests a favorable outlook for the company's stock.

GuruFocus GF Value Estimation

According to GuruFocus estimations, Microsoft's GF Value in one year is calculated to be $498.30, portending a potential upside of 29.33% from its current market price of $385.28. The GF Value represents GuruFocus's assessment of the fair trading value of the stock, derived from historical trading multiples, past business growth, and future performance forecasts. For additional detailed data, visit the Microsoft Corp (MSFT, Financial) Summary page.