- ReShape Lifesciences (RSLS, Financial) has announced a 41.9% reduction in operating expenses for 2024.

- The company is pursuing strategic growth through a merger with Vyome Therapeutics and an asset acquisition from Biorad Medisys.

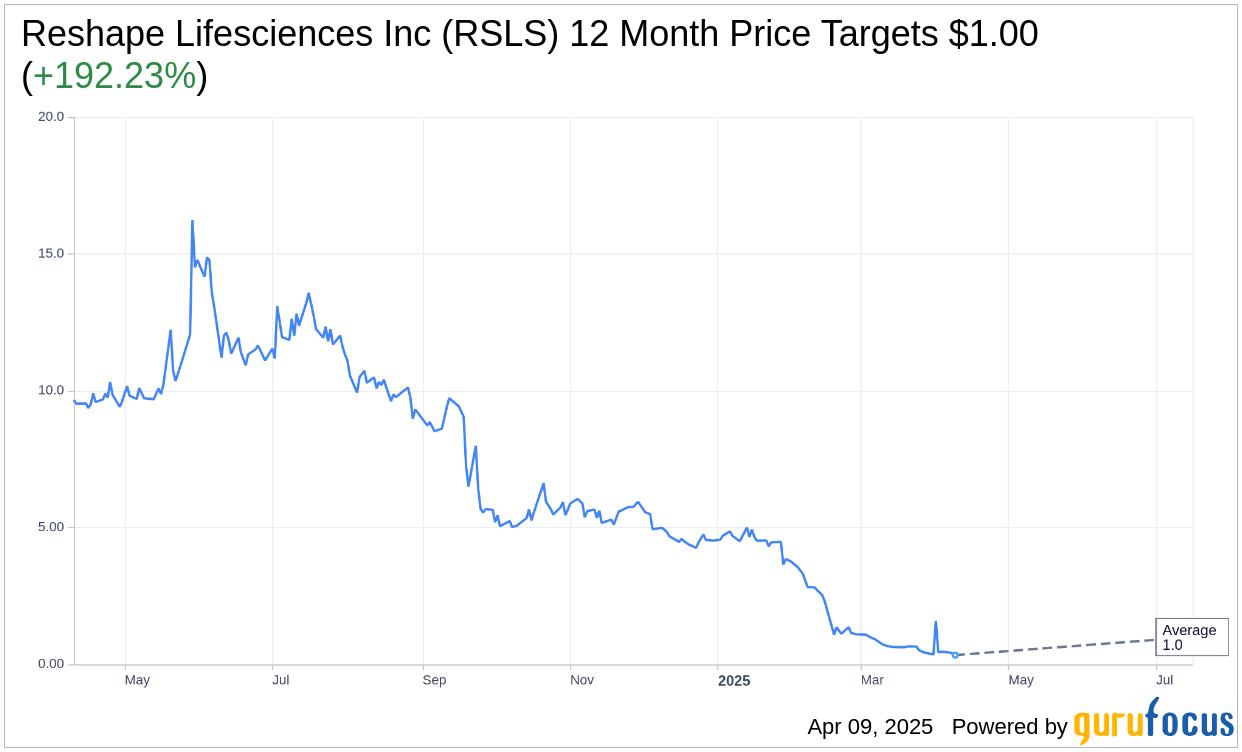

- Despite a 7.7% drop in revenue, analysts see potential upside, with an average price target suggesting a 192.23% increase.

ReShape Lifesciences' Financial Performance and Strategic Moves

In a significant cost-saving maneuver, ReShape Lifesciences (RSLS) has reported a notable 41.9% reduction in operating expenses for 2024. This move is part of a broader strategy to streamline operations amidst challenging market conditions.

Complementing these financial adjustments, ReShape Lifesciences has embarked on key business ventures, including a strategic merger agreement with Vyome Therapeutics, known for its innovative dermatology solutions, and an asset purchase deal with Biorad Medisys, enhancing its portfolio. However, the company's earnings faced headwinds, with a 7.7% decline in revenue, driven by stiff competition in the pharmaceuticals sector.

Wall Street Analysts' Forecast for ReShape Lifesciences

According to comprehensive analyses from one seasoned analyst, the average price target for ReShape Lifesciences (RSLS, Financial) stands firm at $1.00, offering both high and low estimates at this level. This suggests a substantial upside potential of 192.23% from its present trading price of $0.34. Investors can delve deeper into these projections on the Reshape Lifesciences Inc (RSLS) Forecast page.

Brokerage Recommendations

The consensus from a single brokerage firm assigns ReShape Lifesciences (RSLS, Financial) an average recommendation of 3.0, which translates to a "Hold" status on the investment spectrum. This scale ranges from 1, indicating a "Strong Buy", to 5, signaling "Sell". Investors should consider this recommendation in light of the company's strategic initiatives and current market dynamics.

Investors monitoring ReShape Lifesciences should interpret these insights with a critical eye on upcoming business developments and market shifts, which could impact these forecasts and recommendations.