Key Highlights:

- Taiwan Semiconductor Manufacturing Co. achieves a stunning 42% revenue growth in Q1, driven by high AI and smartphone demand.

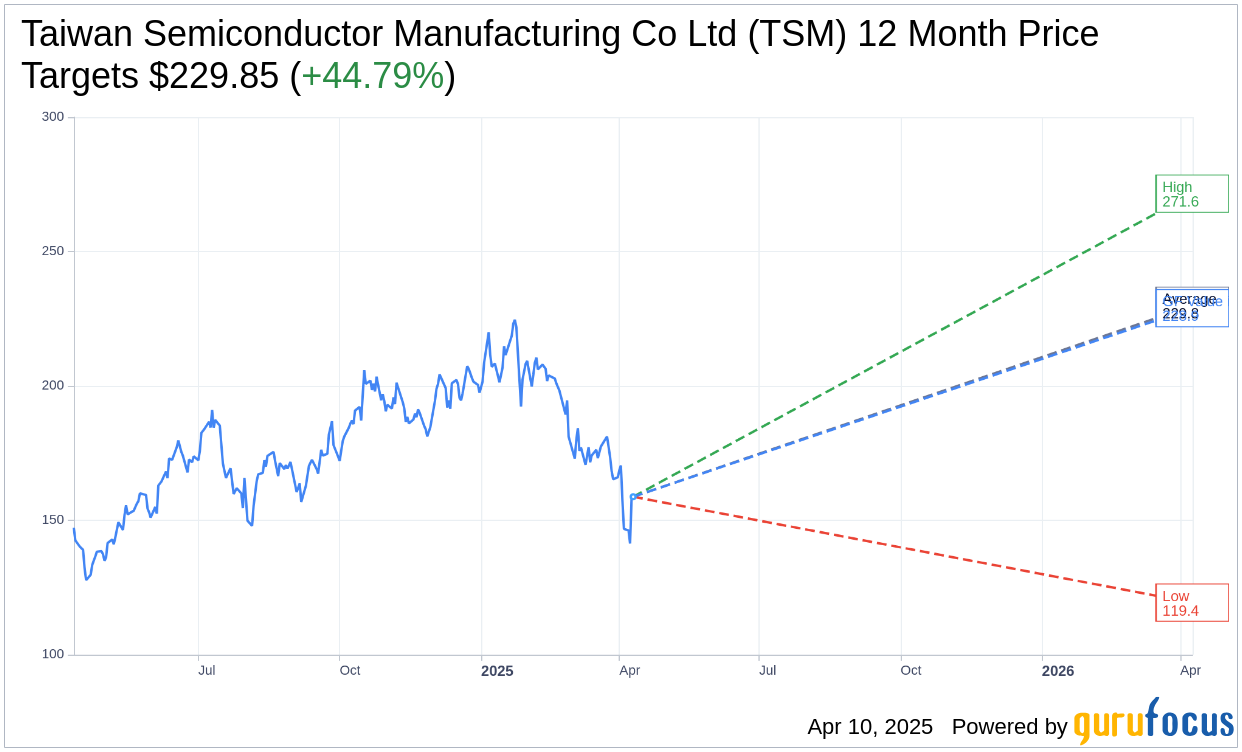

- Analysts project a significant upside potential of nearly 45% for TSM stock.

- Brokerages maintain an "Outperform" recommendation for TSM, indicating strong confidence in future performance.

Taiwan Semiconductor Manufacturing Co. (TSM, Financial) has reported an impressive 42% rise in Q1 revenue, totaling NT$839.25 billion ($25.6 billion). This growth is largely fueled by escalating demand for AI servers and smartphones despite potential U.S. tariffs. These results have exceeded analysts' expectations, setting a promising stage for the full earnings disclosure scheduled for April 17.

Analyst Expectations and Stock Forecast

According to the latest analysis from 16 financial experts, the average one-year price target for Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) is $229.85. Projections range from a high of $271.55 to a low of $119.37. This average target price indicates a potential upside of 44.79% from the current stock price of $158.75. Investors interested in more nuanced details should visit the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Forecast page.

Brokerage Recommendations

Analyzing the consensus from 18 brokerage firms, Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) currently holds an average brokerage recommendation of 1.6, which suggests an "Outperform" rating. This rating system uses a scale where 1 denotes a Strong Buy, and 5 indicates a Sell, reflecting strong confidence in TSM's future prospects.

GF Value Estimation

According to GuruFocus estimates, the projected GF Value for Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) in one year's time is anticipated to be $228.92. This represents a 44.2% increase from the current stock price of $158.75, aligning with the broader positive outlook for the company. GF Value is a metric created by GuruFocus to estimate a stock's fair trading value, factoring historical multiples, past growth, and future business performance forecasts. Investors can explore further details on the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Summary page.