Summary:

- LVMH (MC.PA) grapples with U.S. tariff challenges, impacting luxury goods pricing and demand.

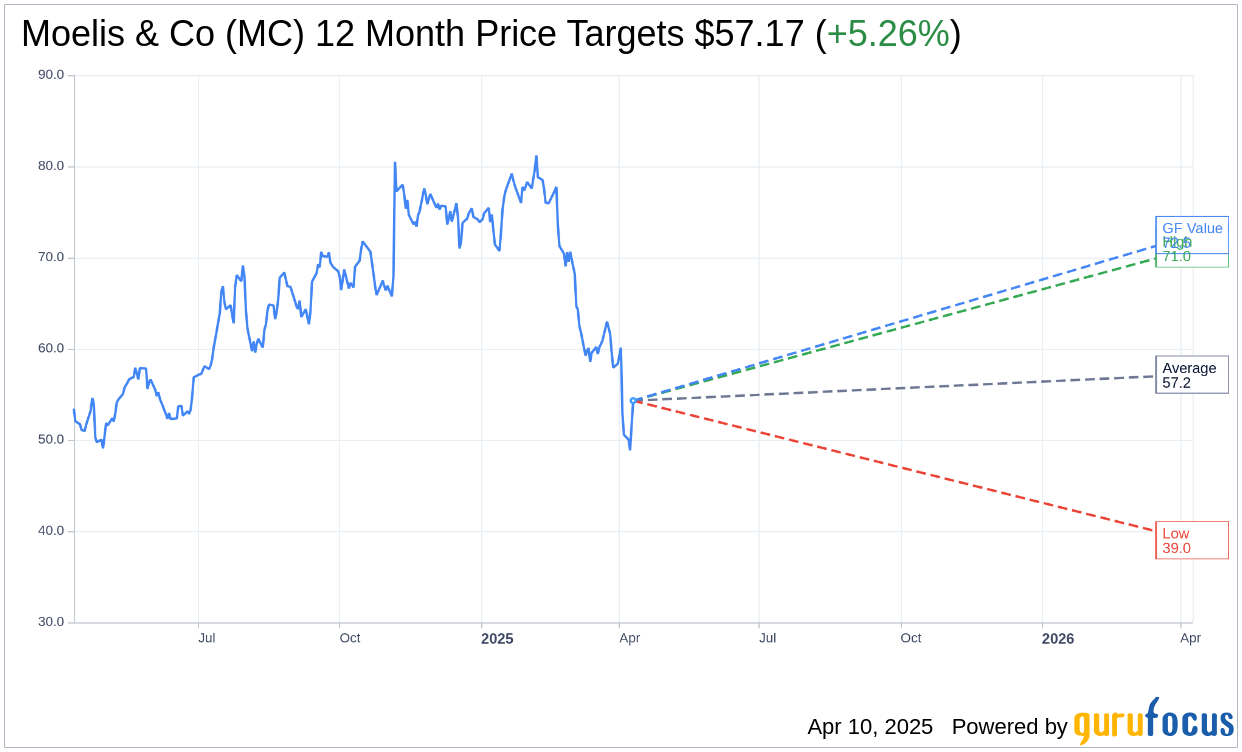

- Moelis & Co (MC, Financial) analysts predict a modest price increase with a one-year target implying potential gains.

- GuruFocus sees substantial upside based on GF Value estimates, indicating the stock may be undervalued.

LVMH (MC.PA), a major player in the luxury goods industry, is confronting significant hurdles as the new U.S. tariffs take hold. These tariffs are expected to increase the cost of goods sold, compelling companies to raise prices in anticipation of potential demand declines spurred by wider economic uncertainties.

Wall Street Analysts' Forecast

According to projections from six analysts, Moelis & Co (MC, Financial) has an average one-year target price of $57.17. Predictions range from a high of $71.00 to a low of $39.00, suggesting a potential upside of 5.26% from the current stock price of $54.31. For more in-depth estimate data, please visit the Moelis & Co (MC) Forecast page.

The consensus recommendation from nine brokerage firms places Moelis & Co (MC, Financial) at a 3.3 on the average brokerage recommendation scale, translating to a "Hold" position. This rating scale ranges from 1, indicating a Strong Buy, to 5, which signifies Sell.

GuruFocus Valuation Insights

GuruFocus estimates suggest that the GF Value for Moelis & Co (MC, Financial) in one year is $72.47, indicating a potential upside of 33.44% from the current price of $54.31. The GF Value reflects GuruFocus' assessment of the stock's fair value, calculated using historical trading multiples, past business growth, and projected future performance. For further detailed data, check out the Moelis & Co (MC) Summary page.