Key Highlights:

- Jefferies adjusts SAP's price target to EUR 280, retaining a Buy rating.

- Analysts predict SAP SE's stock could see a 21.53% upside from current prices.

- GuruFocus estimates suggest potential downside based on GF Value calculations.

Jefferies has adjusted its price target for SAP SE (SAP, Financial) from EUR 295 to EUR 280 but has upheld its Buy rating. The firm foresees that SAP's performance in the first quarter will improve, driven by substantial order gains and strategic restructuring efforts planned for fiscal year 2024.

Wall Street Analysts' Forecast

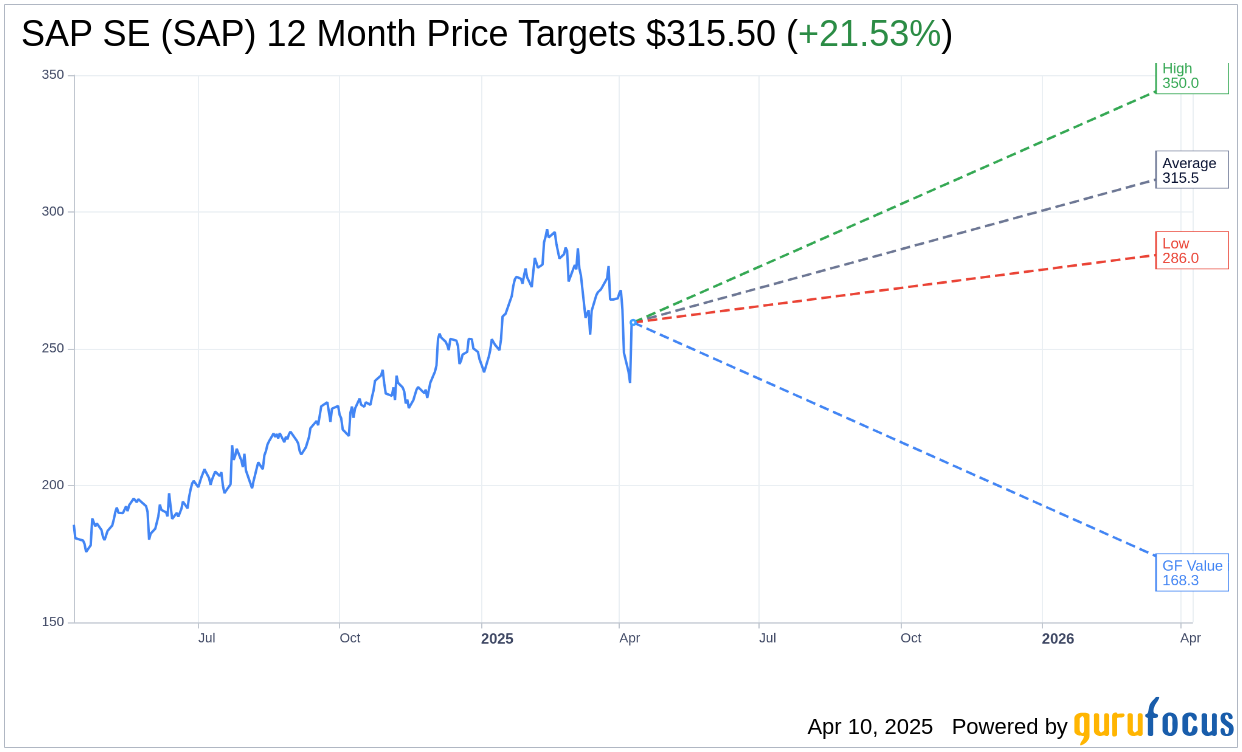

According to projections from 10 analysts, the average price target for SAP SE (SAP, Financial) stands at $315.50. This comes with a high estimate of $350.00 and a low estimate of $286.00. If these estimates hold true, they imply a significant upside of 21.53% from the current trading price of $259.61. For more in-depth data, visit the SAP SE (SAP) Forecast page.

Brokerage Recommendation

The consensus from 30 brokerage firms rates SAP SE (SAP, Financial) with an average recommendation of 2.1, which aligns with an "Outperform" status on the rating scale that goes from 1 (Strong Buy) to 5 (Sell).

GuruFocus's GF Value Estimate

Based on GuruFocus estimates, SAP SE (SAP, Financial) is projected to have a GF Value of $168.26 in a year, suggesting a potential downside of 35.19% from the current price of $259.61. The GF Value is GuruFocus' calculated fair value for the stock, considering historical trading multiples, historical business growth, and future business performance forecasts. For additional detailed data, please refer to the SAP SE (SAP) Summary page.