Key Highlights:

- Banco Santander is considering selling its 62% stake in Santander Bank Polska, potentially valued at $8 billion.

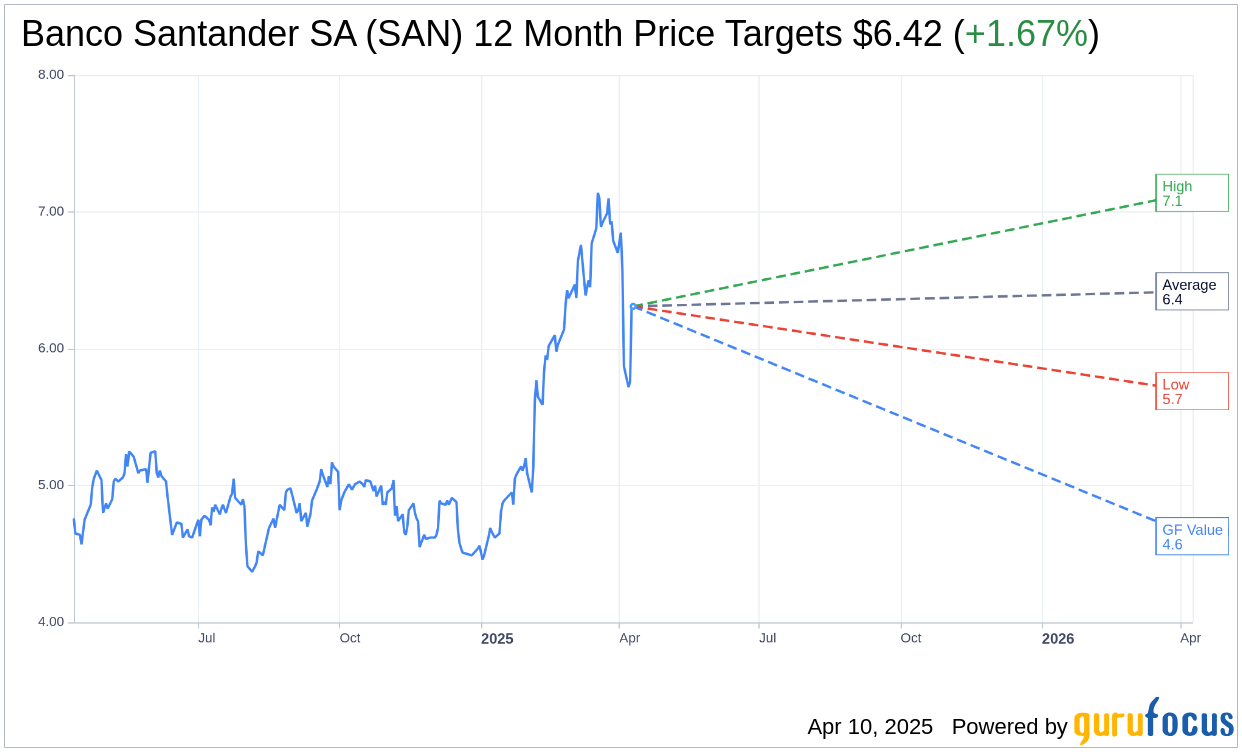

- Analysts set a one-year average price target for Banco Santander at $6.42, just above the current price of $6.31.

- GuruFocus estimates suggest a potential downside for the stock's value over the next year.

Banco Santander (SAN, Financial) is contemplating the sale of its 62% interest in Santander Bank Polska, which could fetch around $8 billion. This strategic move aligns with the bank's focus on bolstering growth across the Americas. Although initial discussions with prospective investors are underway, Banco Santander has not ruled out the possibility of retaining or partially selling its stake in the Polish bank.

Analysts' Forecast for Banco Santander

According to forecasts from two seasoned analysts, the average target price for Banco Santander SA (SAN, Financial) over the coming year is $6.42. The forecasts suggest a high of $7.14 and a low of $5.69, indicating a projected upside of 1.67% from the current trading price of $6.31. For a comprehensive dive into these projections, visit the Banco Santander SA (SAN) Forecast page.

Brokerage Recommendations

The consensus recommendation from two brokerage firms categorizes Banco Santander SA (SAN, Financial) with an average rating of 3.0, which equates to a "Hold" recommendation. On this scale, a rating of 1 represents a "Strong Buy," while a 5 indicates a "Sell."

Insights from GuruFocus: GF Value Estimate

According to GuruFocus metrics, the estimated GF Value for Banco Santander SA (SAN, Financial) in the next year is projected at $4.63. This valuation implies a potential downside of 26.62% from its current stock price of $6.31. The GF Value is a proprietary GuruFocus calculation that assesses fair trade value based on historical stock multiples, past business growth, and anticipated future performance. For a more detailed analysis, investors can explore the Banco Santander SA (SAN) Summary page.