Key Highlights for DexCom Inc. Investors:

- DexCom anticipates sustained growth driven by its innovative product lineup and broader market access.

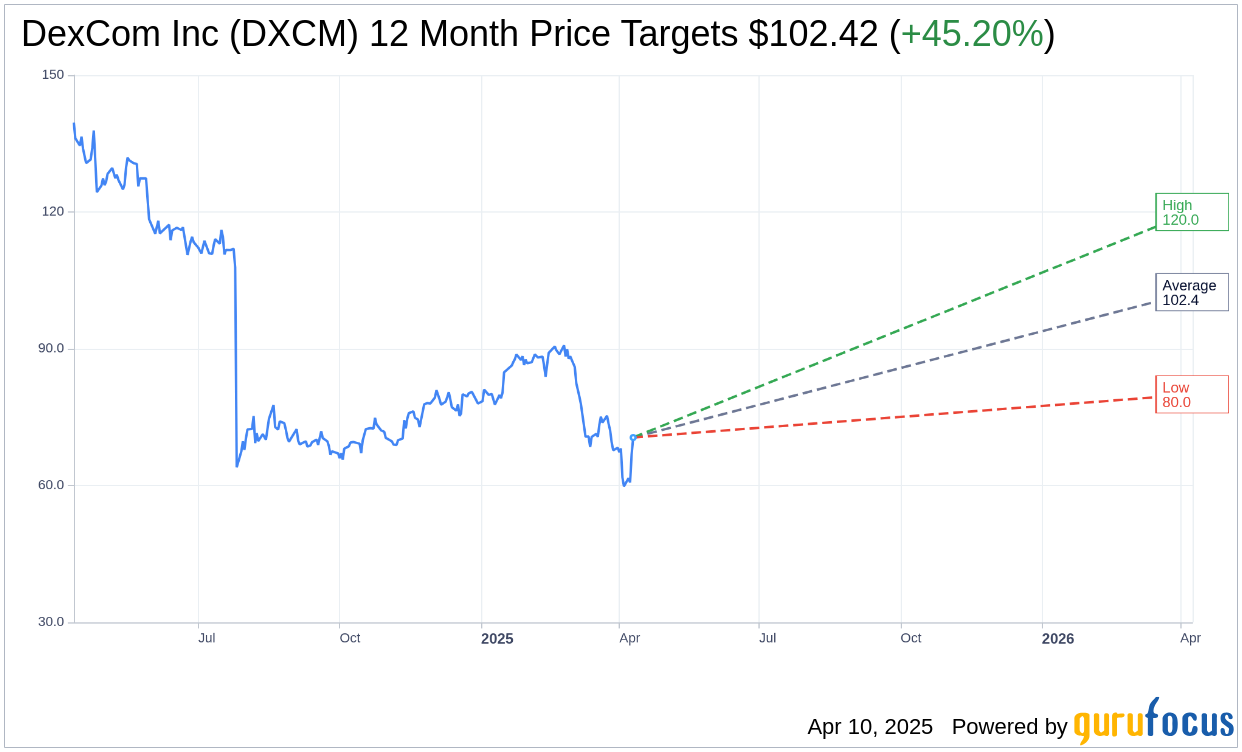

- The average analyst target price suggests a potential upside of over 45%.

- GuruFocus estimates a significant 146.94% upside based on GF Value calculations.

Growth Prospects for DexCom, Inc.

DexCom, Inc. (DXCM, Financial) projects ongoing growth, bolstered by an impressive suite of continuous glucose monitoring systems and expanding insurance coverage. Despite the challenges posed by intense competition and pressures from rebates, DexCom remains bullish about its future. The company is counting on its continuous product innovations to secure further market penetration and success.

Analyst Price Targets and Recommendations

According to 24 financial analysts, the one-year price target for DexCom Inc. (DXCM, Financial) averages at $102.42, with projections ranging between $80.00 and $120.00. This average target suggests a remarkable upside potential of 45.20% from the current trading price of $70.54. For further insights, visit the DexCom Inc. (DXCM) Forecast page.

Furthermore, the consensus from 26 brokerage firms positions DexCom Inc. (DXCM, Financial) with an average recommendation of 1.7, placing it within the "Outperform" category. This recommendation scale ranges from 1 (Strong Buy) to 5 (Sell), reflecting strong analyst confidence in DexCom's market performance.

Proprietary GuruFocus Metrics: GF Value

GuruFocus projections indicate a one-year GF Value for DexCom Inc. (DXCM, Financial) at $174.19, indicating an impressive upside of 146.94% from the current stock price of $70.54. The GF Value is a proprietary metric that combines historical trading multiples with past business growth and prospects to estimate a fair trading value for the stock. For a comprehensive analysis, visit the DexCom Inc. (DXCM) Summary page.