Key Highlights:

- XPeng (XPEV, Financial) marks expansion into Poland as it sees a significant stock price increase.

- Analyst targets suggest potential further growth for XPeng Inc.

- GuruFocus estimates indicate a promising upside for XPeng's future valuation.

XPeng (XPEV) continues to make strategic moves by expanding its footprint in Europe with a new launch in Poland. Even as the broader markets face challenges, XPeng's stock has impressively climbed 35% over the last quarter. Despite this upward trend, the company faces notable financial hurdles, partially due to sustained losses that accompany its strategic growth endeavors.

Wall Street Analysts Forecast

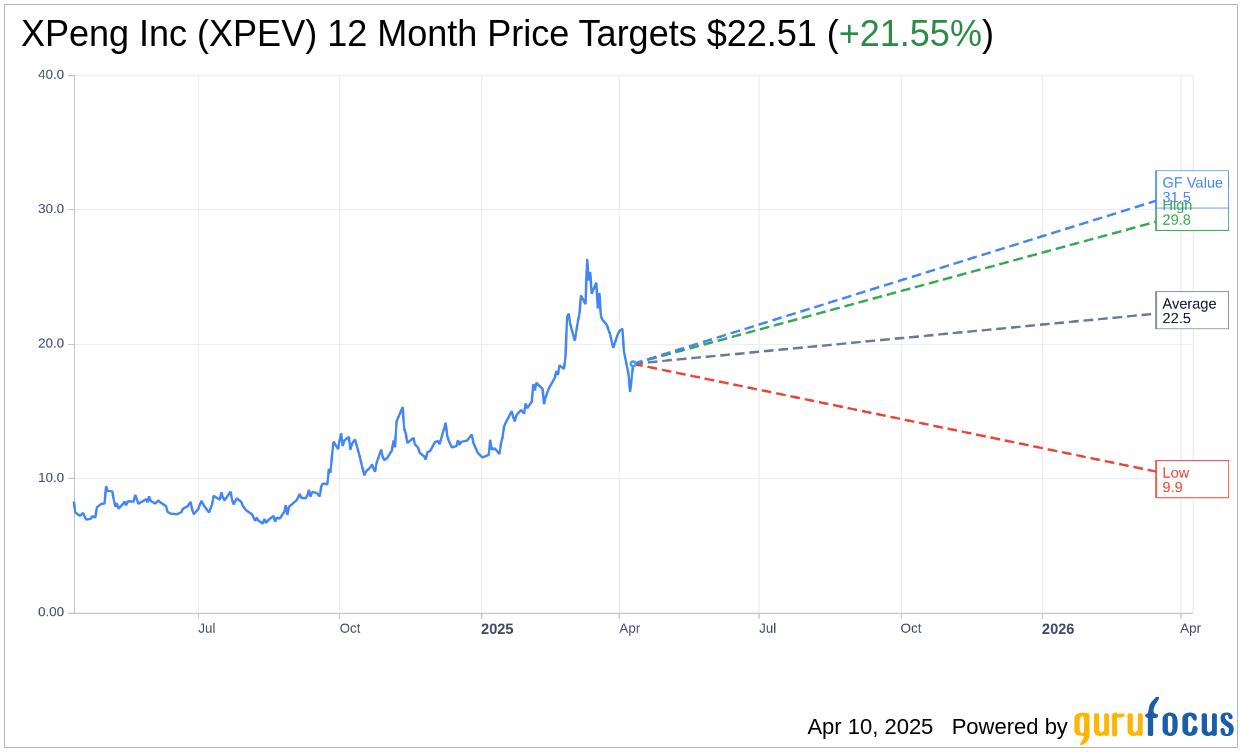

Wall Street analysts provide a varied outlook for XPeng Inc (XPEV, Financial) with 25 experts projecting a one-year average price target of $22.51. This forecast also includes a high estimate of $29.83 and a low of $9.94, offering investors a calculated potential upside of 21.55% from the current trading price of $18.52. Investors can delve deeper into these projections on the XPeng Inc (XPEV) Forecast page.

The consensus recommendation from 24 brokerage firms places XPeng Inc (XPEV, Financial) at an average rating of 2.3, indicating an "Outperform" classification. This rating scale ranges from 1 to 5, where 1 suggests a Strong Buy and 5 indicates a Sell. Therefore, the consensus implies positive sentiment towards XPeng's potential in the market.

According to GuruFocus estimates, the one-year GF Value for XPeng Inc (XPEV, Financial) is forecasted to be $31.50, suggesting a substantial upside of 70.09% from its current price of $18.52. The GF Value is a vital metric offered by GuruFocus, providing an estimate of the fair market value based on historical trading multiples, past business growth, and future performance estimates. Further insights can be accessed through the XPeng Inc (XPEV) Summary page.