AGNC Investment Corp. (AGNC, Financial) reported a decrease in its tangible book value per share, marking $8.25 as of March 31 and projecting a range between $7.75 and $7.85 by April 9. This decline reflects fluctuations in market conditions impacting the company's financial standing.

The firm announced its net spread and dollar roll income, estimating earnings of 44 cents per common share for the first quarter. This figure is a critical indicator of AGNC's profitability from its core investment activities.

Throughout the first quarter, the company actively managed its capital structure by issuing 49.7 million shares of common stock, thereby raising $509 million in net proceeds. This move was likely aimed at bolstering AGNC’s financial position amidst challenging market dynamics.

The company's strategies, including stock issuance, are pivotal in navigating the current economic environment, providing liquidity and supporting future growth opportunities. Investors will be closely monitoring AGNC's performance as it implements these financial maneuvers.

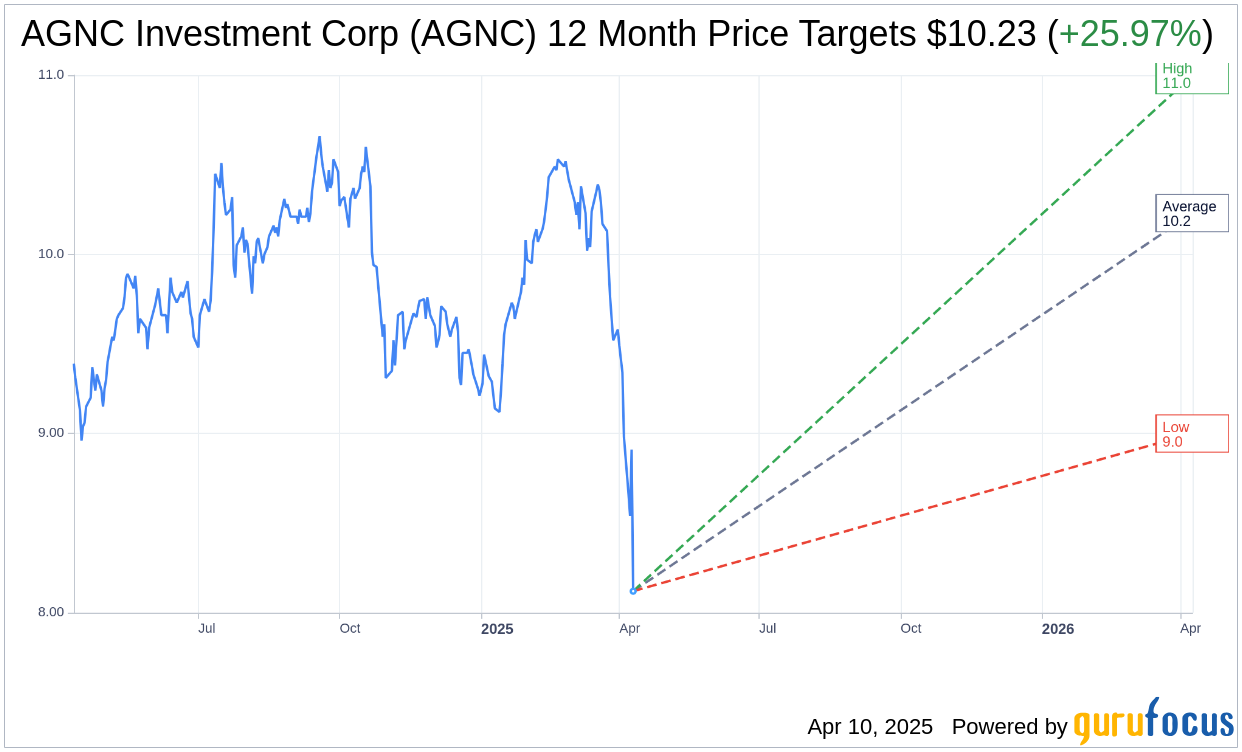

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for AGNC Investment Corp (AGNC, Financial) is $10.23 with a high estimate of $11.00 and a low estimate of $9.00. The average target implies an upside of 25.97% from the current price of $8.12. More detailed estimate data can be found on the AGNC Investment Corp (AGNC) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, AGNC Investment Corp's (AGNC, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.