Summary Highlights:

- Certara, Inc. (CERT, Financial) introduces an enhanced Simcyp Simulator to bolster PBPK modeling in drug development.

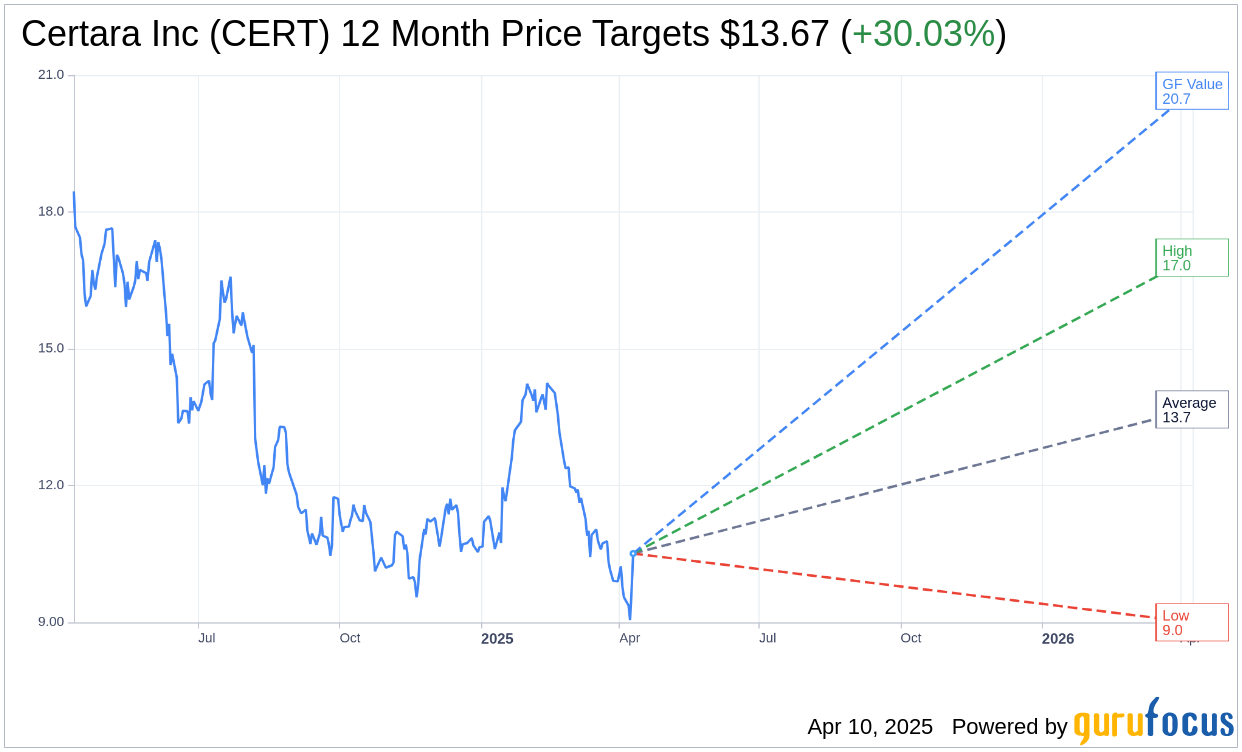

- Wall Street analysts predict a potential 30.03% upside with a target price of $13.67 for Certara, Inc.

- GuruFocus estimates a significant upside of 96.57% with a GF Value of $20.66 for CERT.

Certara, Inc. (CERT) has released an updated version of its Simcyp Simulator, designed to enhance physiologically-based pharmacokinetic (PBPK) modeling in drug development. This latest version incorporates feedback from more than 30 pharmaceutical companies, aiming to streamline regulatory decision-making and broaden PBPK applications in clinical development.

Wall Street Analysts' Predictions

According to price targets from nine analysts, the average target price for Certara Inc (CERT, Financial) stands at $13.67, with a high estimate of $17.00 and a low of $9.00. This average target suggests a potential upside of 30.03% from the current price of $10.51. For more detailed estimate data, visit the Certara Inc (CERT) Forecast page.

Brokerage Firms' Recommendations

The consensus recommendation from 11 brokerage firms gives Certara Inc's (CERT, Financial) an average brokerage rating of 2.5, classifying it under the "Outperform" category. This rating scale ranges from 1 to 5, where 1 signifies a Strong Buy and 5 denotes a Sell.

GuruFocus's GF Value Estimation

GuruFocus estimates a one-year GF Value for Certara Inc (CERT, Financial) at $20.66, indicating a potential upside of 96.57% from the current price of $10.51. GF Value represents GuruFocus' estimation of the fair trading value of the stock, calculated based on historical trading multiples, previous business growth, and projected future business performance. For a deeper data dive, head to the Certara Inc (CERT) Summary page.