Argenx (ARGX, Financial) has received approval from the U.S. Food and Drug Administration for a new self-injection method of administering VYVGART Hytrulo. This development offers patients diagnosed with generalized myasthenia gravis, who are anti-acetylcholine receptor antibody positive, and those with chronic inflammatory demyelinating polyneuropathy, a greater degree of independence in managing their treatment.

The newly approved prefilled syringe allows patients to inject themselves with VYVGART Hytrulo, providing the flexibility to administer the treatment at their convenience, whether at a healthcare facility, at home, or while on the move. This innovation represents a significant step forward for patients seeking to maintain control over their treatment regimen, accommodating various lifestyle needs.

According to Argenx's Chief Medical Officer, this self-injection option underscores the company's commitment to addressing the diverse experiences of patients living with MG and CIDP. The prefilled syringe is designed to enhance autonomy while maintaining the therapy’s safety and effectiveness.

This self-injection option aims to empower patients by reducing their dependency on regular clinical visits for treatment administration, fostering greater adherence to treatment plans and potentially improving health outcomes.

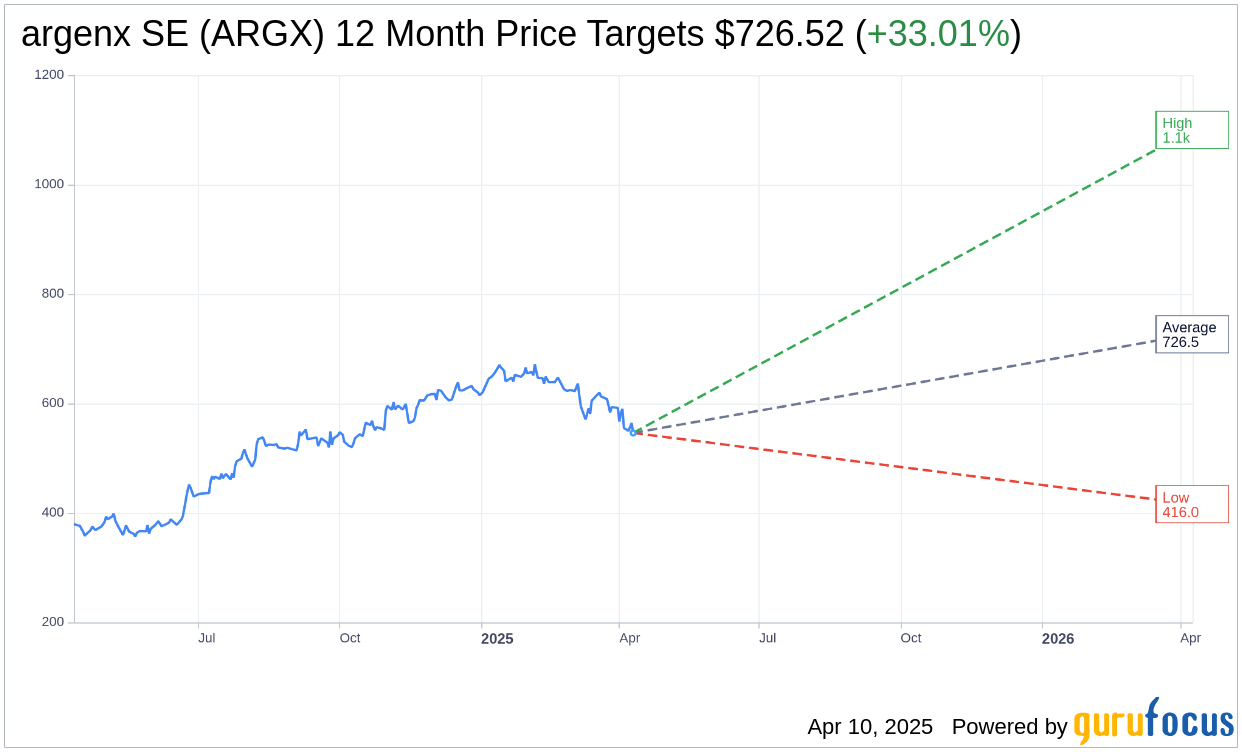

Wall Street Analysts Forecast

Based on the one-year price targets offered by 24 analysts, the average target price for argenx SE (ARGX, Financial) is $726.52 with a high estimate of $1,100.00 and a low estimate of $416.00. The average target implies an upside of 33.01% from the current price of $546.22. More detailed estimate data can be found on the argenx SE (ARGX) Forecast page.

Based on the consensus recommendation from 25 brokerage firms, argenx SE's (ARGX, Financial) average brokerage recommendation is currently 1.6, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for argenx SE (ARGX, Financial) in one year is $2054.21, suggesting a upside of 276.08% from the current price of $546.22. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the argenx SE (ARGX) Summary page.