TD Cowen analyst Charles Rhyee has maintained a Hold rating on Charles River Laboratories (CRL, Financial), setting the price target at $179 per share. This outlook follows the U.S. Food and Drug Administration's (FDA) announcement that it plans to gradually eliminate animal testing, replacing it with AI-driven computational models and organoid testing methods. This strategic shift is anticipated to significantly affect Charles River's Discovery & Safety Assessment segment.

While the transition towards these advanced testing methodologies is expected to unfold over several years, the decision introduces a potential risk affecting the stock's performance. As the FDA moves forward with its plans, market watchers forecast this shift could present a meaningful challenge for the company's shares in the long term.

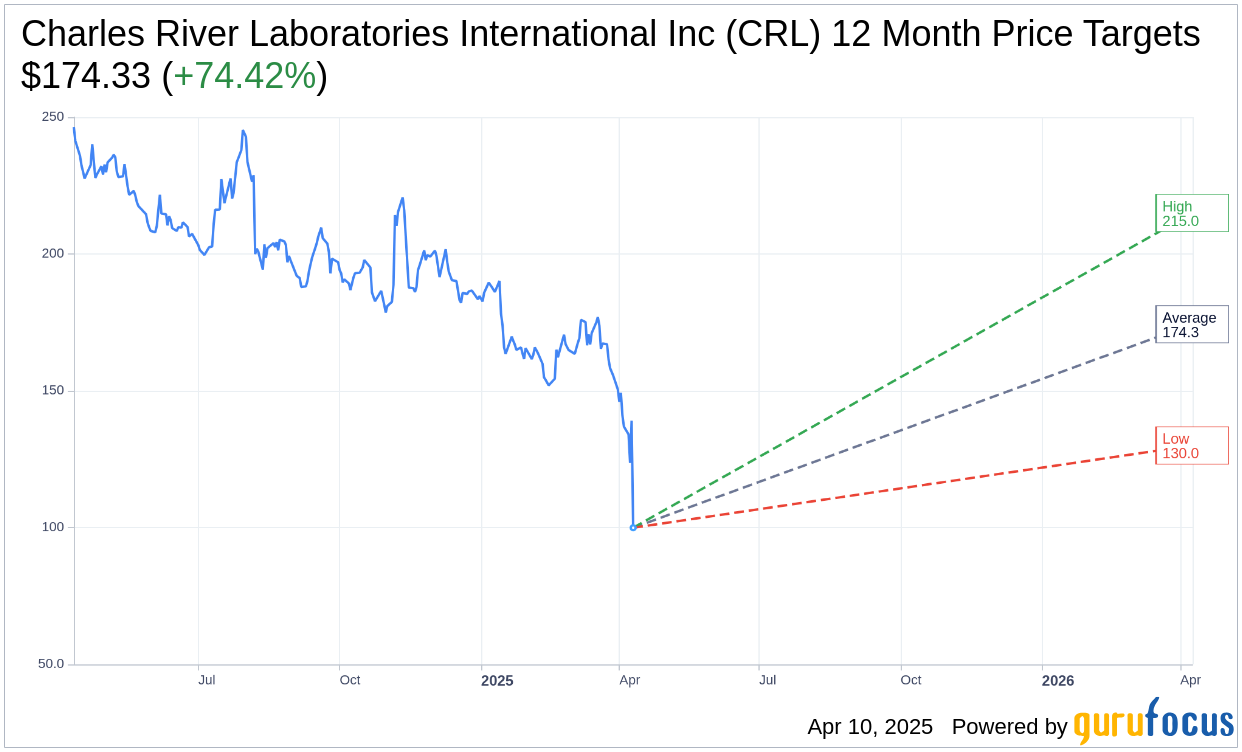

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for Charles River Laboratories International Inc (CRL, Financial) is $174.33 with a high estimate of $215.00 and a low estimate of $130.00. The average target implies an upside of 74.42% from the current price of $99.95. More detailed estimate data can be found on the Charles River Laboratories International Inc (CRL) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, Charles River Laboratories International Inc's (CRL, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Charles River Laboratories International Inc (CRL, Financial) in one year is $204.97, suggesting a upside of 105.07% from the current price of $99.95. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Charles River Laboratories International Inc (CRL) Summary page.