Key Highlights:

- CarMax (KMX, Financial) achieves significant fourth-quarter EPS growth for fiscal year 2025, with sales reaching $6 billion.

- 14 analysts set a one-year average target price of $88.16, suggesting a 32.68% potential upside from current prices.

- CarMax maintains an "Outperform" status with an average brokerage recommendation of 2.2.

CarMax (NYSE: KMX) has delivered a robust performance in the fourth quarter of fiscal 2025, marking a notable year-over-year growth in earnings per share (EPS). With an impressive $6 billion in sales—a 7% increase attributed to elevated retail and wholesale unit volumes—the company's strategy continues to bear fruit. Despite hurdles like inclement weather, CarMax saw a 6.2% rise in retail unit sales, reinforcing its stronghold in the used car market through a customer-focused strategy and advanced digital platforms.

Wall Street Analysts Forecast

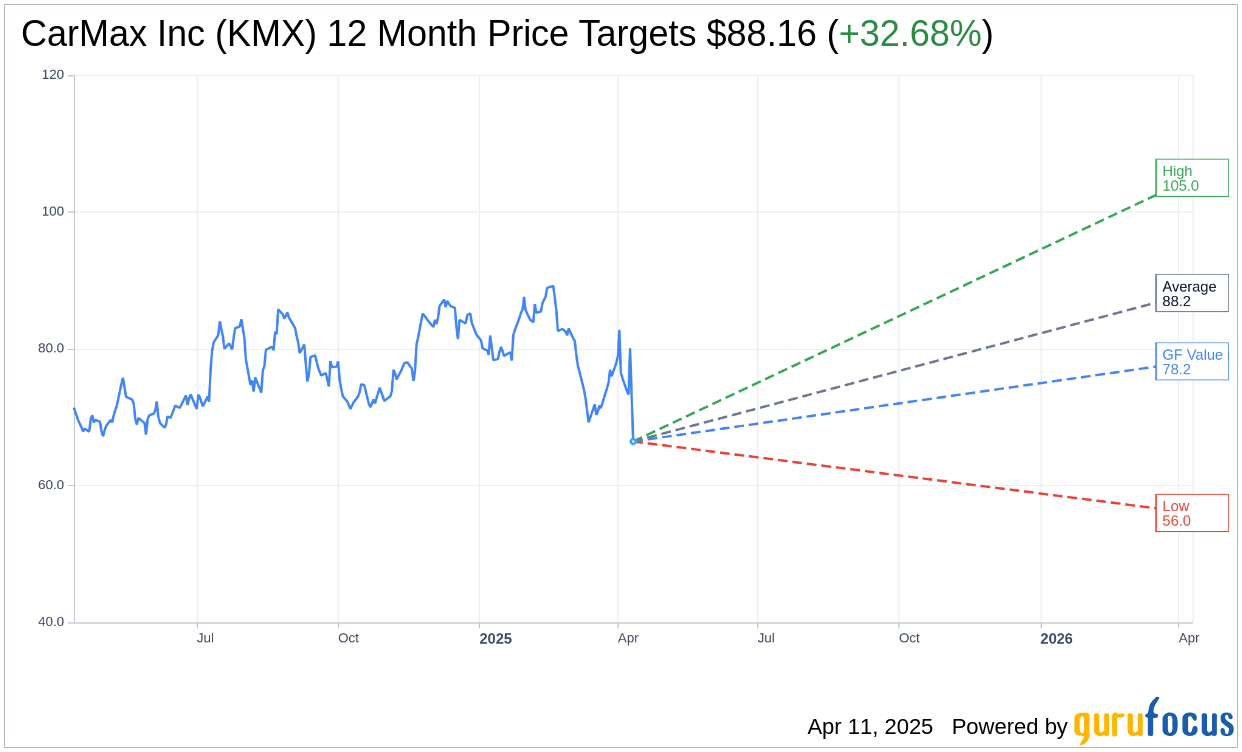

According to projections from 14 financial analysts, the average one-year price target for CarMax Inc (KMX, Financial) stands at $88.16. This forecast ranges from a high of $105.00 to a low of $56.00, implying a substantial upside of 32.68% compared to the current trading price of $66.45. For a more comprehensive analysis, visit the CarMax Inc (KMX) Forecast page.

Furthermore, insights from 19 brokerage firms position CarMax's current average brokerage recommendation at 2.2, signaling an "Outperform" status. This rating is based on a scale where 1 signifies a Strong Buy and 5 indicates a Sell.

GuruFocus also provides an estimation, noting that the GF Value for CarMax Inc (KMX, Financial) in the upcoming year is projected to be $78.16. This suggests an additional 17.62% upside from its present price of $66.45. The GF Value metric offers an estimate of the fair trading value, calculated from historical trading multiples, past business performance, and future business forecasts. For more details, explore the CarMax Inc (KMX) Summary page.