Goldman Sachs has elevated its outlook on Huntington Ingalls Industries (HII, Financial), upgrading the stock from 'Sell' to 'Buy' while significantly raising its price target from $145 to $234. This adjustment reflects a positive outlook for the company based on several factors, particularly its position in Navy shipbuilding, which is expected to remain a key priority within the defense budget over the medium term.

The upgrade aligns with a recent executive order focusing on strengthening domestic maritime labor, enhancing supply chains, and boosting production capacities. These strategic priorities could provide Huntington Ingalls with a favorable environment for growth.

Furthermore, the potential implementation of new policies around Shipyard Accountability and Workforce Support could bolster HII’s margins, according to the analysis. This development suggests that the company is well-positioned to capitalize on expected increases in demand and support from government initiatives.

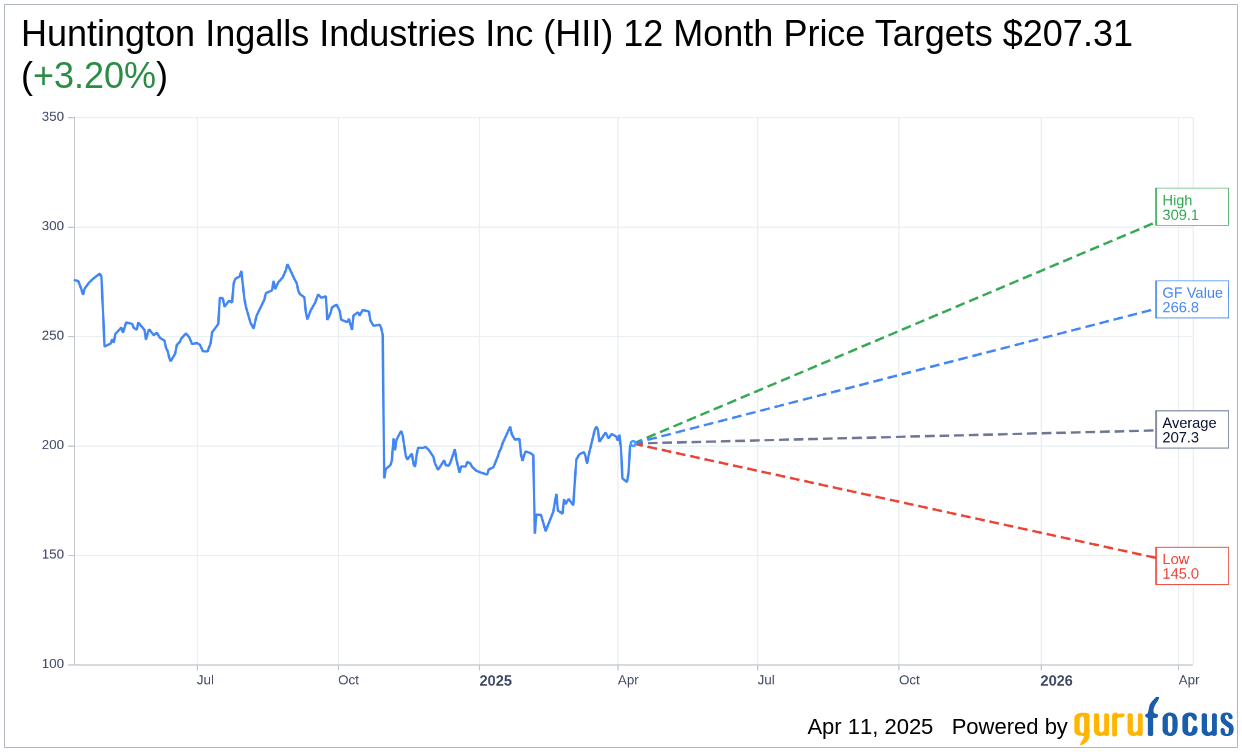

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Huntington Ingalls Industries Inc (HII, Financial) is $207.31 with a high estimate of $309.11 and a low estimate of $145.00. The average target implies an upside of 3.20% from the current price of $200.89. More detailed estimate data can be found on the Huntington Ingalls Industries Inc (HII) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Huntington Ingalls Industries Inc's (HII, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Huntington Ingalls Industries Inc (HII, Financial) in one year is $266.75, suggesting a upside of 32.78% from the current price of $200.89. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Huntington Ingalls Industries Inc (HII) Summary page.