Barclays has begun its coverage of Churchill Downs (CHDN, Financial) with an "Overweight" rating and a price target of $125. The financial firm describes Churchill Downs as a leading growth entity within the U.S. land-based gaming industry, highlighting its extensive and exclusive development pipeline. This makes it an appealing option for long-term investors, according to the firm's analysis.

The current valuation of Churchill Downs' shares is seen as attractive despite recent challenges. Barclays attributes recent market sentiment shifts to the timing of the new Dumfries property's opening and broader economic concerns in the D.C. area. However, these factors are viewed as temporary setbacks, suggesting that the current dip in share sentiment may be an overreaction.

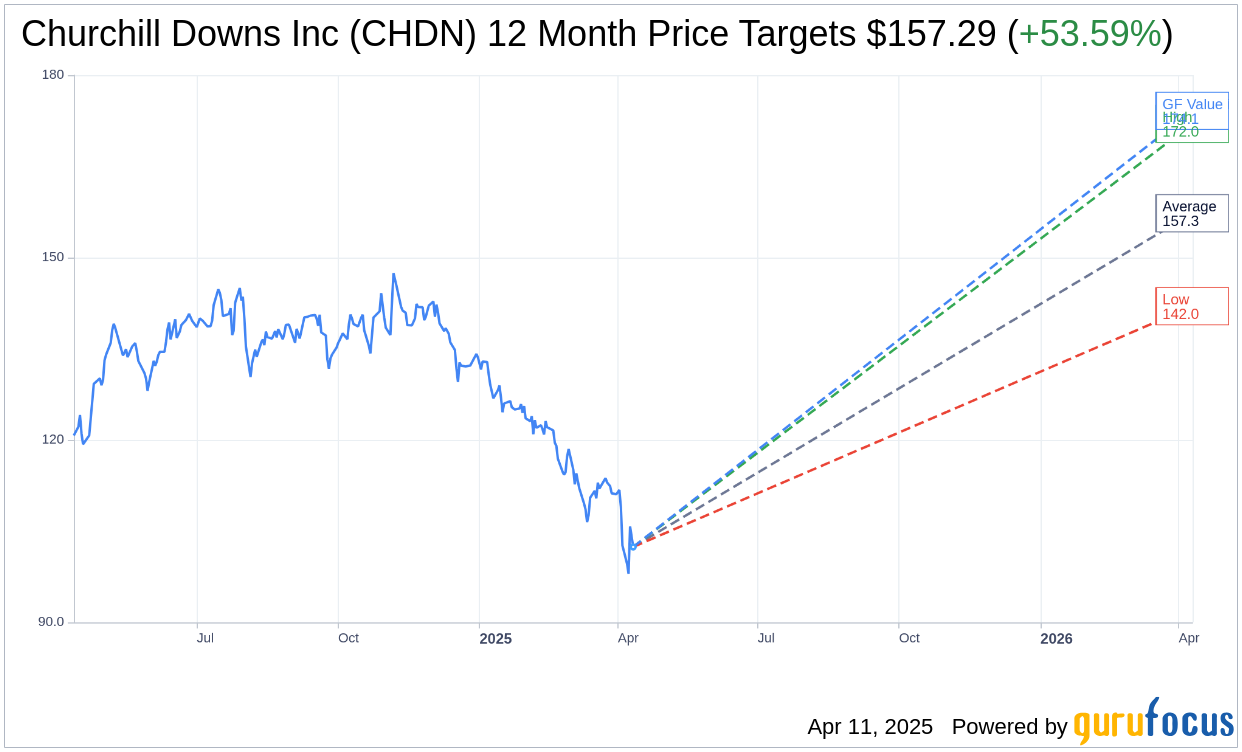

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for Churchill Downs Inc (CHDN, Financial) is $157.29 with a high estimate of $172.00 and a low estimate of $142.00. The average target implies an upside of 53.59% from the current price of $102.41. More detailed estimate data can be found on the Churchill Downs Inc (CHDN) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Churchill Downs Inc's (CHDN, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Churchill Downs Inc (CHDN, Financial) in one year is $174.13, suggesting a upside of 70.03% from the current price of $102.41. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Churchill Downs Inc (CHDN) Summary page.