Morgan Stanley has revised its outlook on Joby Aviation (JOBY, Financial), lowering the rating from Overweight to Equal Weight. The financial institution has also adjusted its price target for the company, moving it down from $10 to $7. This change reflects the firm's increased caution regarding Joby's future performance amid ongoing industry challenges.

The decision comes as concerns grow about potential tariff impacts, which could exacerbate existing supply chain vulnerabilities. These vulnerabilities have been compounded by Boeing's operational difficulties and the lingering effects of the COVID-19 pandemic. Morgan Stanley’s analyst indicates that these factors contribute to the uncertainty surrounding Joby Aviation’s market position.

In the current economic climate, the firm expresses a preference for more stable, high-quality investments. The analyst suggests that Joby Aviation may struggle to achieve significant growth in a slower economic environment characterized by reduced risk appetites.

Investors are advised to consider these factors when evaluating Joby Aviation in the current market landscape, as the company’s stock is not expected to outperform under these conditions.

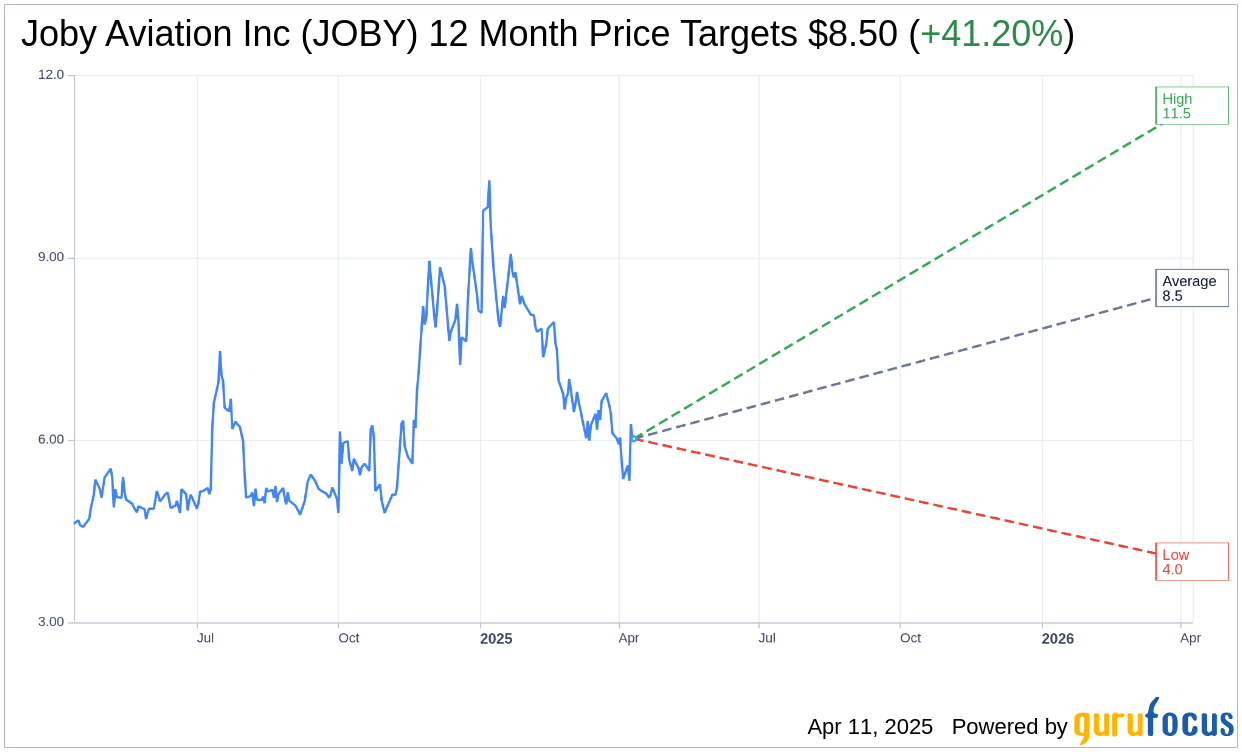

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Joby Aviation Inc (JOBY, Financial) is $8.50 with a high estimate of $11.50 and a low estimate of $4.00. The average target implies an upside of 41.20% from the current price of $6.02. More detailed estimate data can be found on the Joby Aviation Inc (JOBY) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Joby Aviation Inc's (JOBY, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.