Jefferies has raised its rating for Nektar Therapeutics (NKTR, Financial) from Hold to Buy, while also increasing the stock's price target from $1 to $2. This upgrade is driven by expectations surrounding Nektar's investigational drug, rezpegaldesleukin, which is set to reveal topline results from its Phase 2b study in atopic dermatitis during the second quarter.

The firm anticipates that rezpegaldesleukin will demonstrate a promising efficacy and safety profile. It highlights that the drug employs a unique mechanism of action, providing a potential edge over both existing treatments and other pipeline candidates for atopic dermatitis.

Furthermore, Jefferies views the current valuation of Nektar, which has a negative enterprise value, as offering a favorable risk-reward balance. This perspective is based on the potential positive data outcomes from the upcoming study readout, which could significantly bolster investor confidence in Nektar's prospects.

Wall Street Analysts Forecast

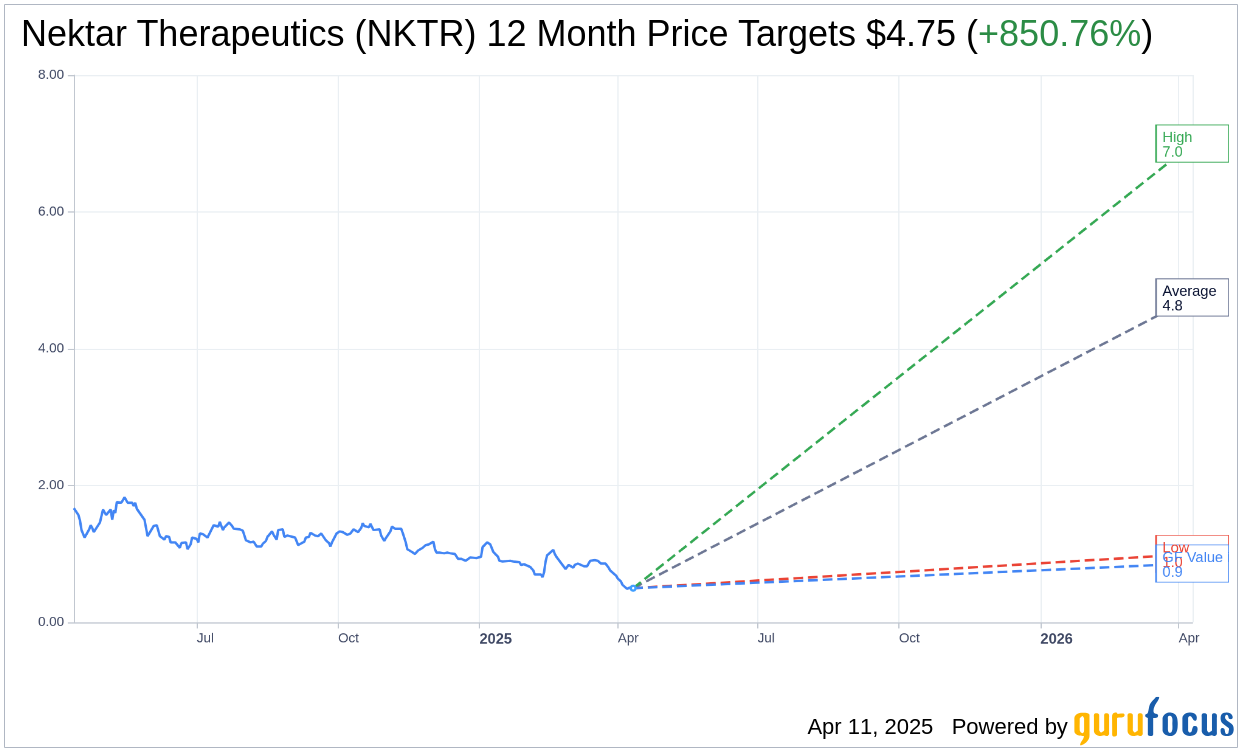

Based on the one-year price targets offered by 6 analysts, the average target price for Nektar Therapeutics (NKTR, Financial) is $4.75 with a high estimate of $7.00 and a low estimate of $1.00. The average target implies an upside of 850.76% from the current price of $0.50. More detailed estimate data can be found on the Nektar Therapeutics (NKTR) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Nektar Therapeutics's (NKTR, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Nektar Therapeutics (NKTR, Financial) in one year is $0.86, suggesting a upside of 72.14% from the current price of $0.4996. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Nektar Therapeutics (NKTR) Summary page.