KeyBanc Capital Markets has initiated coverage of Murphy USA (MUSA, Financial) with an "Overweight" rating and a target price of $550. According to the firm's analysis, the convenience store sector is characterized by its fragmentation, which presents significant opportunities for consolidation over the next five to ten years.

KeyBanc highlights that the industry is largely shielded from tariff-related impacts and exhibits resilience against economic downturns. Murphy USA stands out in the market due to its commitment to consistently offering low prices, a strategic focus that the firm believes sets it apart from its competitors.

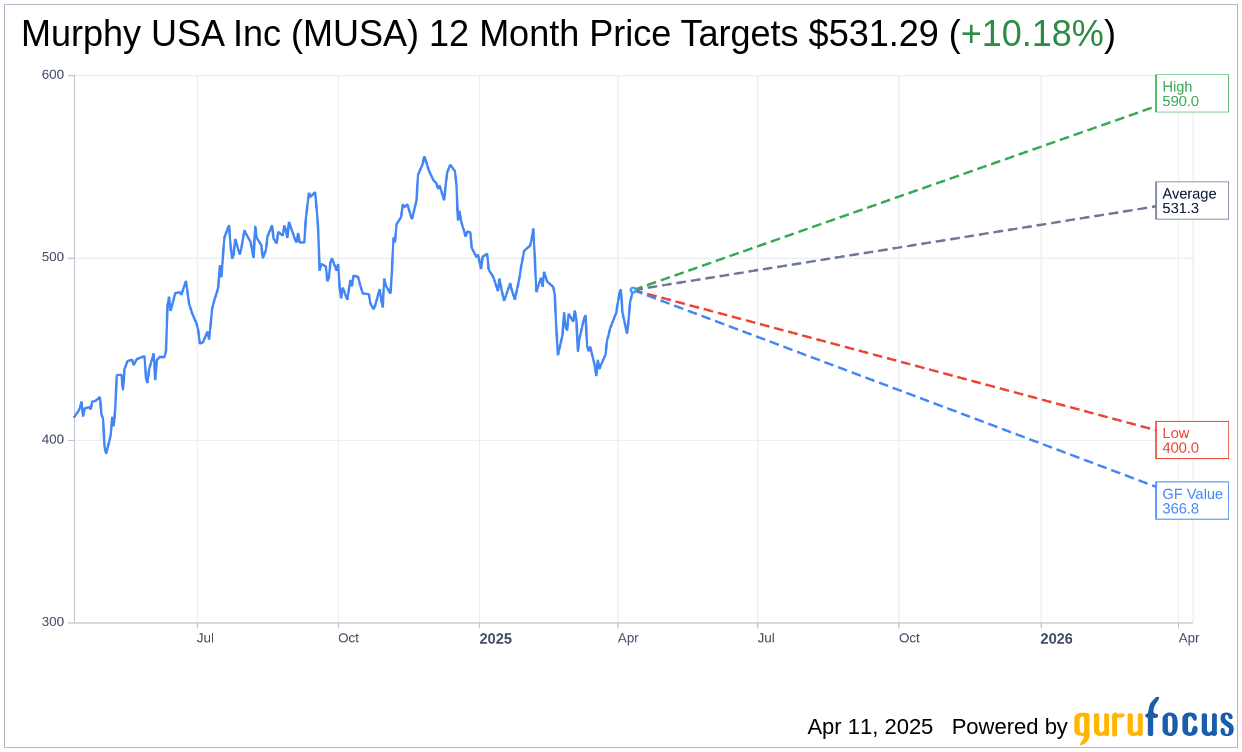

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Murphy USA Inc (MUSA, Financial) is $531.29 with a high estimate of $590.00 and a low estimate of $400.00. The average target implies an upside of 10.18% from the current price of $482.18. More detailed estimate data can be found on the Murphy USA Inc (MUSA) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Murphy USA Inc's (MUSA, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Murphy USA Inc (MUSA, Financial) in one year is $366.80, suggesting a downside of 23.93% from the current price of $482.18. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Murphy USA Inc (MUSA) Summary page.