- CarMax (KMX, Financial) demonstrates strong financial performance, with a notable 81% increase in diluted earnings per share.

- Analysts forecast significant upside potential with an average target price suggesting a 32.68% increase.

- GuruFocus estimates indicate a promising 17.62% upside based on GF Value metrics.

CarMax Inc. (KMX) recently delivered impressive results for its fourth quarter, underscored by an outstanding 81% surge in diluted earnings per share, reaching $0.58. This financial uptick was driven by a 14% rise in total gross profit, amounting to $668 million, primarily attributed to enhanced retail margins and process efficiency improvements. Additionally, the company reported a solid increase in retail unit sales, growing by 6.2%.

Wall Street Analysts Forecast

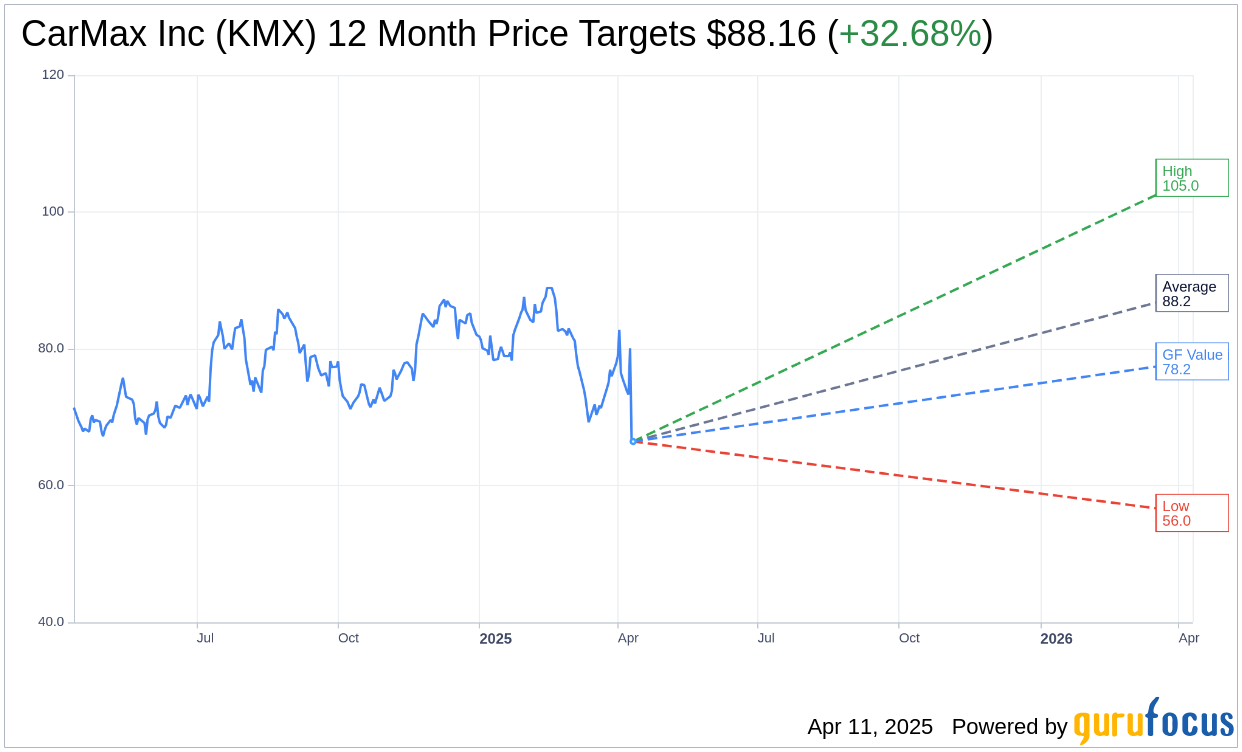

The market outlook for CarMax Inc. reveals a promising scenario, as depicted by the one-year price targets from 14 analysts. They project an average target price of $88.16, with estimates ranging from a high of $105.00 to a low of $56.00. This suggests a potential upside of 32.68% from its current price of $66.45. For more comprehensive estimate data, visit the CarMax Inc (KMX, Financial) Forecast page.

Moreover, based on the consensus from 19 brokerage firms, CarMax Inc. holds an average brokerage recommendation of 2.2, indicating an "Outperform" status. The recommendation scale spans from 1, representing a Strong Buy, to 5, which denotes a Sell.

GuruFocus GF Value Analysis

According to GuruFocus estimates, CarMax Inc.'s GF Value for the upcoming year is projected at $78.16, implying a potential upside of 17.62% from its current price of $66.45. The GF Value reflects GuruFocus' estimate of the fair value at which the stock is expected to trade. This valuation is calculated using historical multiples, past business growth, and future performance estimates. For further detailed insights, explore the CarMax Inc (KMX, Financial) Summary page.