Jefferies has adjusted its price target for RenaissanceRe Holdings Ltd. (RNR, Financial), reducing it slightly from $266 to $265 while maintaining a Hold rating on the stock. Analyst Andrew Andersen remarks that although the firm is well-capitalized and defensively positioned within the property and casualty sector, tariffs could present an earnings risk. Despite this, the company is viewed as capable of managing such challenges.

The analysis highlights that the auto insurance segment is in a position to swiftly adjust pricing in response to changing market conditions. Furthermore, concerns around loss cost inflation are prevalent among commercial insurers, potentially leading to increased pricing discipline if tariffs impact this area.

The report suggests that the tariff situation is unlikely to have a significant effect on first-quarter results. However, Jefferies expresses optimism particularly within the personal lines sector, which could indicate resilient performance despite the broader industry pressures. RenaissanceRe's strategic positioning appears to cushion the firm against immediate tariff-related concerns, according to the investment firm.

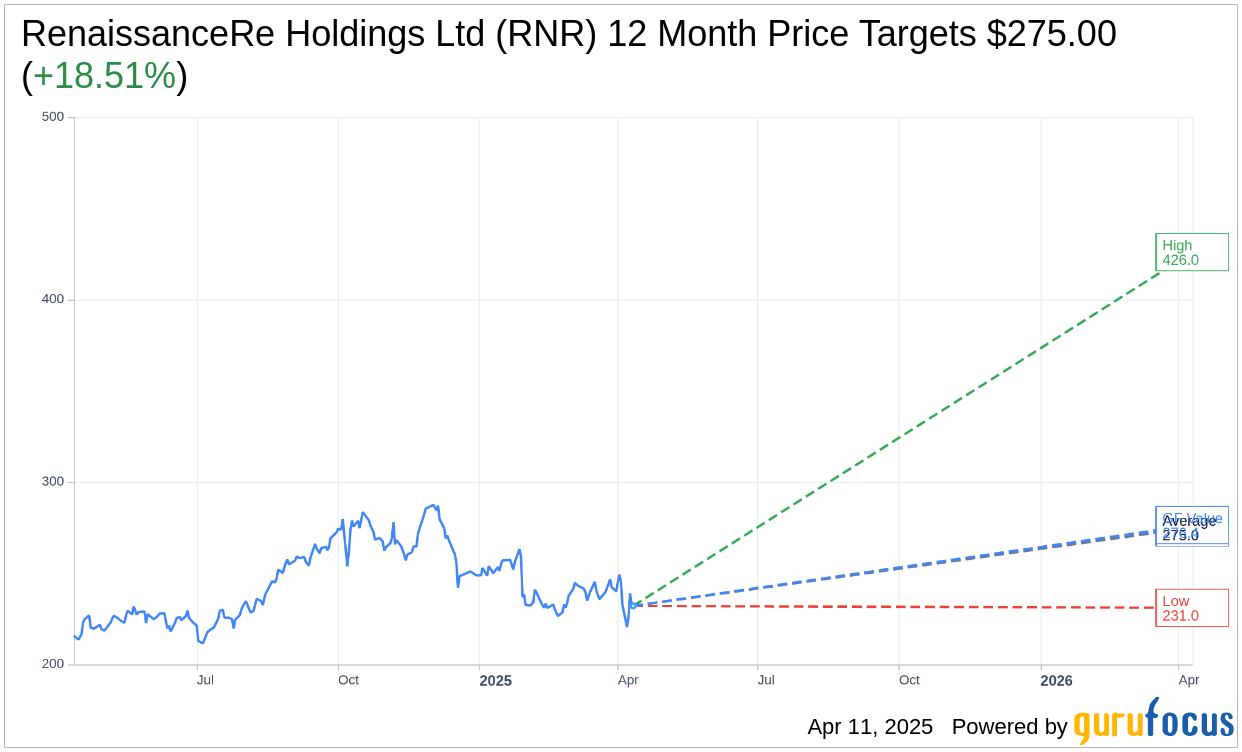

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for RenaissanceRe Holdings Ltd (RNR, Financial) is $275.00 with a high estimate of $426.00 and a low estimate of $231.00. The average target implies an upside of 18.51% from the current price of $232.05. More detailed estimate data can be found on the RenaissanceRe Holdings Ltd (RNR) Forecast page.

Based on the consensus recommendation from 14 brokerage firms, RenaissanceRe Holdings Ltd's (RNR, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for RenaissanceRe Holdings Ltd (RNR, Financial) in one year is $276.37, suggesting a upside of 19.1% from the current price of $232.05. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the RenaissanceRe Holdings Ltd (RNR) Summary page.