Jefferies analyst Andrew Andersen has elevated the price target for Palomar Holdings (PLMR, Financial) to $168, up from the previous target of $145, while maintaining a Buy rating on the stock. Andersen emphasizes that tariffs represent a controllable earnings risk for the robust property and casualty insurance sector.

The analyst notes that auto insurers possess the ability to adjust prices swiftly, and concerns over loss cost inflation are already a priority for the commercial sector. Any potential tariff impacts are expected to encourage further caution within the industry. Despite these challenges, the firm anticipates no significant effects on Palomar's performance in the first quarter and remains optimistic about personal insurance lines.

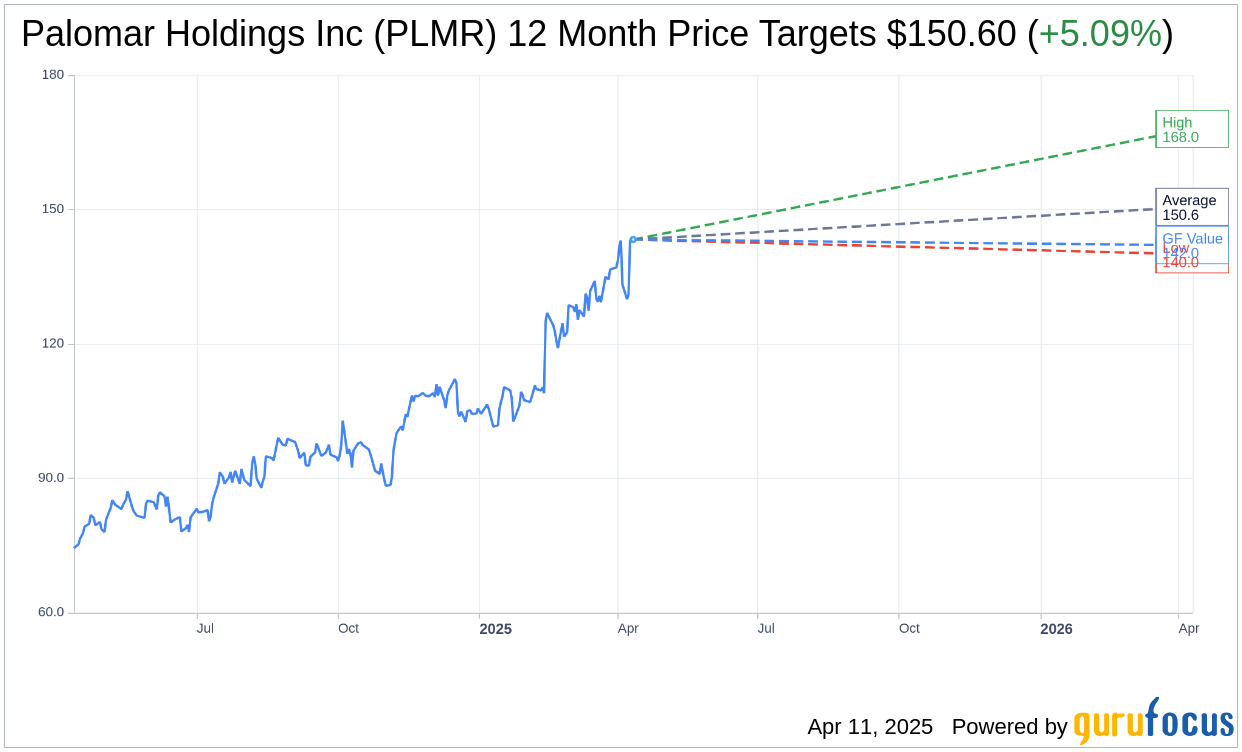

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Palomar Holdings Inc (PLMR, Financial) is $150.60 with a high estimate of $168.00 and a low estimate of $140.00. The average target implies an upside of 5.09% from the current price of $143.30. More detailed estimate data can be found on the Palomar Holdings Inc (PLMR) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Palomar Holdings Inc's (PLMR, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Palomar Holdings Inc (PLMR, Financial) in one year is $142.03, suggesting a downside of 0.89% from the current price of $143.3. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Palomar Holdings Inc (PLMR) Summary page.