Jefferies has adjusted its price target for Marsh McLennan (MMC, Financial), increasing it from $237 to $244 while maintaining a Hold rating on the company's stock. This revision reflects the firm's assessment that tariffs pose a manageable risk to earnings for the robustly capitalized and defensive property and casualty sector.

The analyst notes that auto insurers, part of this sector, have the capability to adjust pricing swiftly, which can mitigate potential tariff-related impacts. Furthermore, the commercial insurance group is already vigilant regarding cost inflation, suggesting that any tariff repercussions would likely heighten their pricing discipline.

While there is no expected impact in the first quarter, Jefferies remains notably optimistic about the prospects for personal insurance lines. This update underscores the firm's confidence in Marsh McLennan's ability to navigate current market challenges.

Wall Street Analysts Forecast

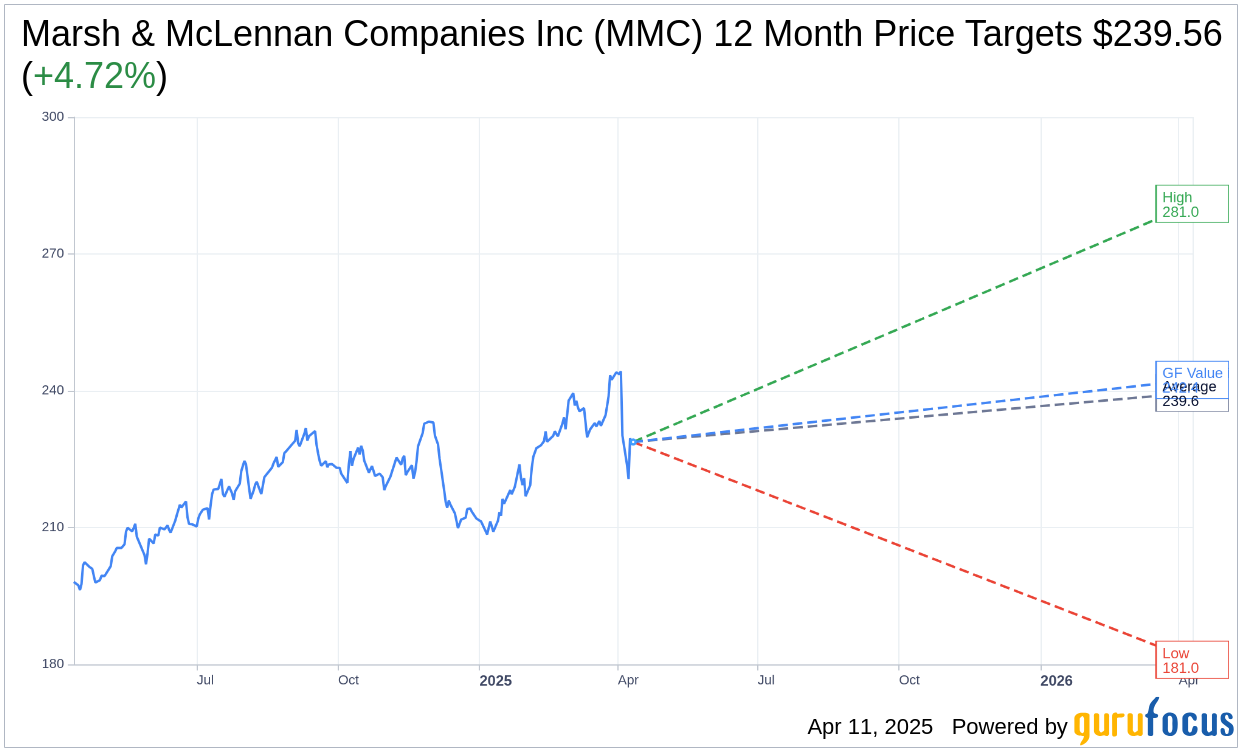

Based on the one-year price targets offered by 18 analysts, the average target price for Marsh & McLennan Companies Inc (MMC, Financial) is $239.56 with a high estimate of $281.00 and a low estimate of $181.02. The average target implies an upside of 4.72% from the current price of $228.77. More detailed estimate data can be found on the Marsh & McLennan Companies Inc (MMC) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Marsh & McLennan Companies Inc's (MMC, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Marsh & McLennan Companies Inc (MMC, Financial) in one year is $242.38, suggesting a upside of 5.95% from the current price of $228.77. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Marsh & McLennan Companies Inc (MMC) Summary page.