- Fastenal reports robust revenue growth, exceeding expectations despite challenges.

- Analyst consensus recommends holding Fastenal stock, with varied price targets.

- GuruFocus estimates indicate a potential downside in Fastenal's current valuation.

Fastenal Co. (NASDAQ: FAST) delivered impressive first-quarter 2025 results, reporting a revenue of $1.96 billion. This marks a 3.7% increase from the same period last year, outpacing market expectations by $10 million. Even with one fewer selling day, the company achieved a 5% increase in net daily sales year-over-year, maintaining earnings per share (EPS) at $0.52.

Wall Street Analysts Forecast

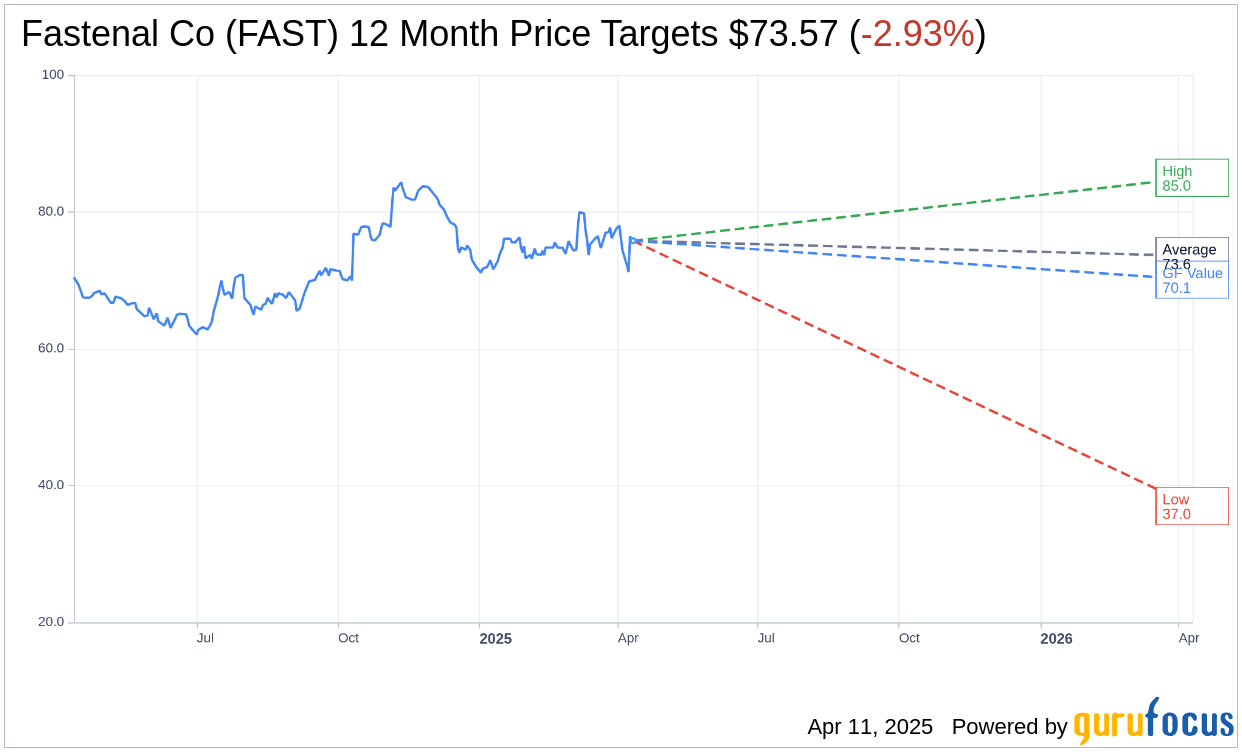

According to the insights from 11 analysts, Fastenal Co. is positioned with an average target price of $73.57 for the next year. This includes a high estimate of $85.00 and a low estimate of $37.00. The current stock price stands at $75.79, suggesting a potential downside of 2.93% based on the average target. For more detailed forecasting information, please visit the Fastenal Co (FAST, Financial) Forecast page.

The consensus recommendation from 16 brokerage firms places Fastenal's stock at a 2.8 rating, indicating a "Hold" status on their scale. This scale ranges from 1 to 5, where 1 equates to a Strong Buy and 5 to a Sell.

Using GuruFocus metrics, the estimated GF Value for Fastenal in one year is projected at $70.11. This suggests a downside of 7.49% from the current price of $75.79. The GF Value represents GuruFocus' assessment of the fair trading value of the stock, derived from historical trading multiples, past business growth, and future performance estimates. Additional detailed data are accessible on the Fastenal Co (FAST, Financial) Summary page.