Citi analyst Christopher Danely has revised the price target for Texas Instruments (TXN, Financial), trimming it from $235 to $210 while maintaining a Buy rating on the shares. The revision reflects a cautious stance as the firm anticipates a recession, driven by the enduring impact of tariffs, particularly those affecting China. This economic context suggests a challenging environment for semiconductor companies.

Despite the reduced target, Citi points out that Texas Instruments (TXN, Financial) and Analog Devices (ADI) have historically demonstrated resilience during economic downturns. The firm's analysis indicates that the valuations of U.S. semiconductor stocks are currently around the midpoint of historical averages, based on previous economic slowdowns and their impact on earnings per share (EPS).

As part of its overall assessment, Citi is adjusting its earnings estimates for semiconductor companies, including Texas Instruments, with an average reduction of 20% across the sector. However, the firm's historical data suggests that Texas Instruments could once again prove to be a strong performer, even amid potential economic headwinds.

Wall Street Analysts Forecast

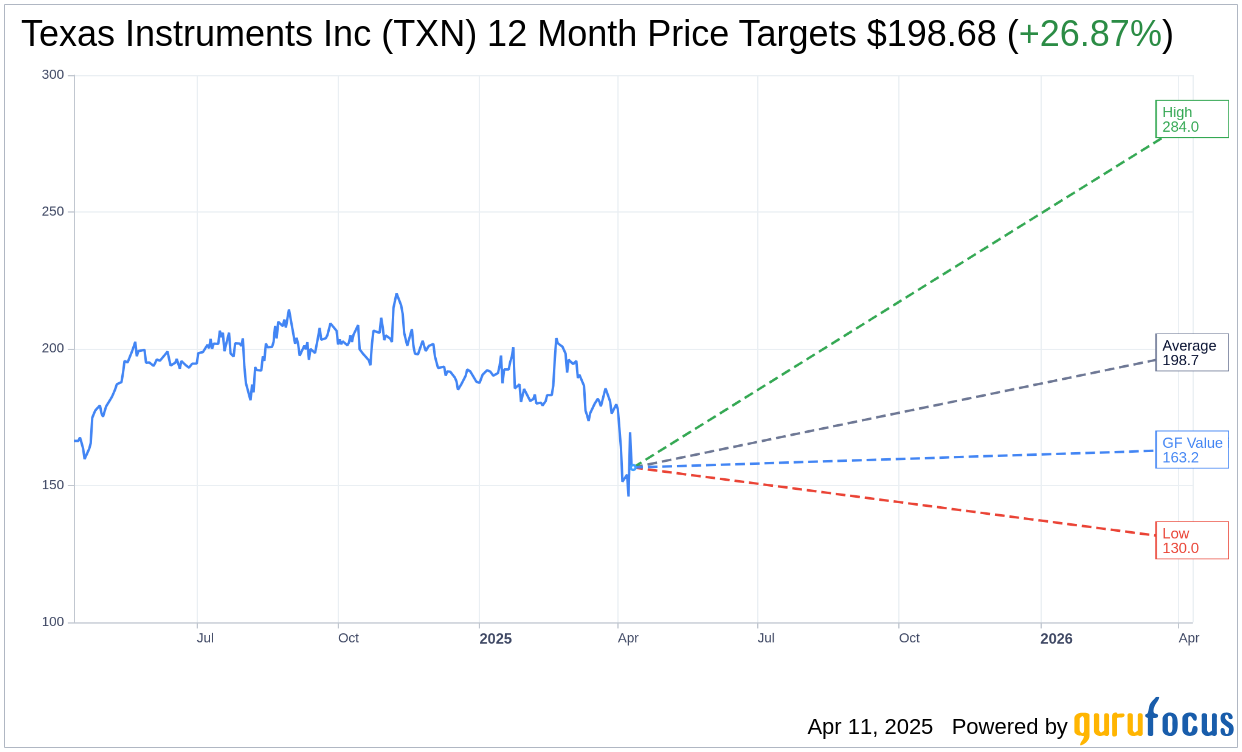

Based on the one-year price targets offered by 27 analysts, the average target price for Texas Instruments Inc (TXN, Financial) is $198.68 with a high estimate of $284.00 and a low estimate of $130.00. The average target implies an upside of 26.87% from the current price of $156.60. More detailed estimate data can be found on the Texas Instruments Inc (TXN) Forecast page.

Based on the consensus recommendation from 36 brokerage firms, Texas Instruments Inc's (TXN, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Texas Instruments Inc (TXN, Financial) in one year is $163.16, suggesting a upside of 4.19% from the current price of $156.6. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Texas Instruments Inc (TXN) Summary page.