- Wells Fargo (WFC, Financial) exceeded earnings expectations with an EPS of $1.27, though its revenue fell short.

- Analyst forecasts suggest a potential upside of nearly 27% for WFC stock from its current price.

- Despite some mixed results, the bank holds an "Outperform" status, according to brokerage recommendations.

Wells Fargo (WFC) recently reported an earnings per share (EPS) of $1.27, which beat market expectations by $0.05. However, the bank's revenue totaled $20.15 billion, falling short of projections by $610 million. These mixed financial results shed light on the uneven performance of its various financial activities during the first quarter.

Wall Street Analysts Forecast

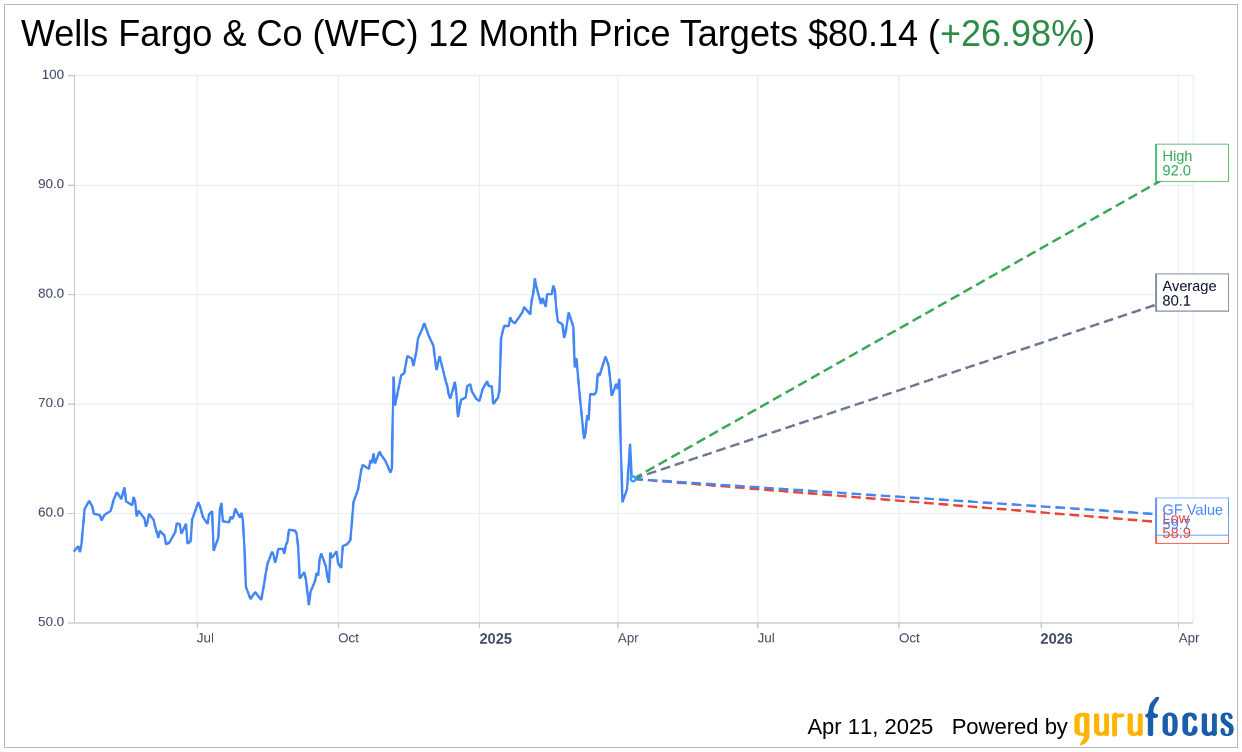

When it comes to future price movements, 21 analysts have pegged the average one-year target price for Wells Fargo & Co (WFC, Financial) at $80.14. This includes a high estimate of $92.00 and a low estimate of $58.92. The average price target suggests a promising upside of 26.98% from Wells Fargo's current trading price of $63.11. For more in-depth estimate data, visit the Wells Fargo & Co (WFC) Forecast page.

Furthermore, based on the consensus from 23 brokerage firms, Wells Fargo & Co has an average brokerage recommendation of 2.1, placing it in the "Outperform" category. This rating is derived from a scale of 1 to 5, where 1 signifies a Strong Buy and 5 represents a Sell.

According to GuruFocus' proprietary metrics, the estimated GF Value for Wells Fargo & Co (WFC, Financial) in one year is projected to be $59.67. This indicates a potential downside of 5.45% from the current price of $63.11. The GF Value is calculated considering historical trading multiples, past business growth, and future performance estimates. For further detailed data, refer to the Wells Fargo & Co (WFC) Summary page.