Key Takeaways:

- Wells Fargo's (WFC, Financial) stock rose 1.2% in premarket trading following stronger-than-expected first-quarter earnings.

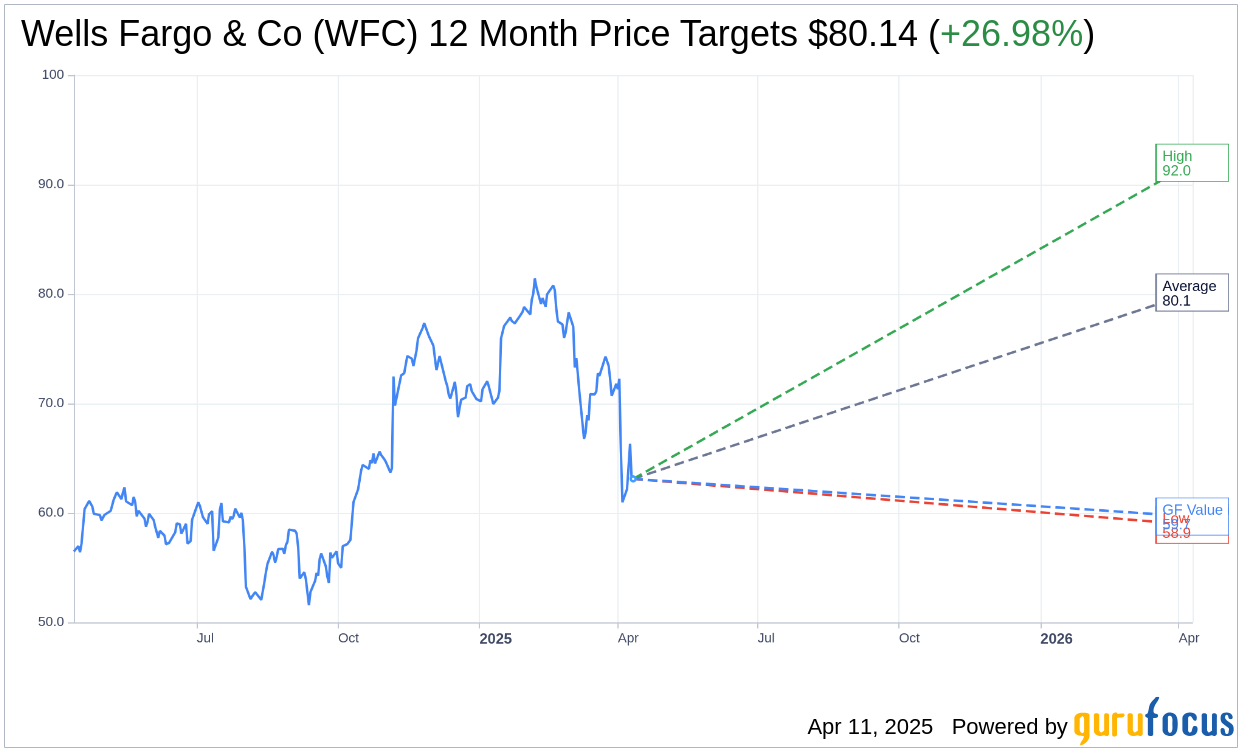

- Analysts project an average price target of $80.14, suggesting a potential upside of 26.98% from its current price.

- The consensus recommendation is "Outperform," while GuruFocus's GF Value indicates a potential downside of 5.45%.

Strong Earnings Propel Wells Fargo Stock

Wells Fargo (WFC) experienced a notable 1.2% rise in premarket trading, attributed to its impressive first-quarter earnings performance. The bank's success was largely driven by significant growth within its Corporate and Investment Banking and Wealth and Investment Management sectors. Adding confidence for investors, Wells Fargo maintained its net interest income guidance for 2025, projecting a steady 1%-3% increase.

Insights from Wall Street Analysts

According to a survey of 21 analysts, Wells Fargo & Co (WFC, Financial) boasts an average one-year price target of $80.14. With a high estimate of $92.00 and a low estimate of $58.92, the average target price highlights a potential upside of 26.98% from the current trading price of $63.11. For more comprehensive estimate data, be sure to visit the Wells Fargo & Co (WFC) Forecast page.

Meanwhile, the consensus from 23 brokerage firms places Wells Fargo & Co's (WFC, Financial) average brokerage recommendation at 2.1, denoting an "Outperform" status. This recommendation is based on a scale where 1 signifies a Strong Buy and 5 indicates a Sell.

Evaluating GF Value Projections

According to GuruFocus, the estimated GF Value for Wells Fargo & Co (WFC, Financial) in one year is $59.67. This estimation suggests a potential downside of 5.45% from its current price of $63.11. The GF Value is calculated using historical multiples and past business growth, as well as future business performance estimates. For more detailed data, visit the Wells Fargo & Co (WFC) Summary page.