U.S. chipmakers outsourcing their manufacturing processes will not be subjected to China's retaliatory tariffs on American imports. According to the China Semiconductor Industry Association, the point of origin for custom procedures will be determined by the location of the wafer fabrication plant, which for many U.S. companies is in Taiwan.

This development significantly impacts major U.S. chip design firms such as Qualcomm (QCOM) and AMD (AMD, Financial), which rely on Taiwan Semiconductor Manufacturing Company (TSMC) for their production needs. Chinese customs will categorize these chips as originating from Taiwan, exempting them from the new tariffs aimed at U.S. goods.

This exemption provides a strategic advantage to these companies in the face of escalating trade tensions. Other prominent players in the semiconductor industry that may benefit indirectly include Intel (INTC), Marvell Technology (MRVL), Microchip Technology (MCHP), Micron Technology (MU), Nvidia (NVDA), and Texas Instruments (TXN).

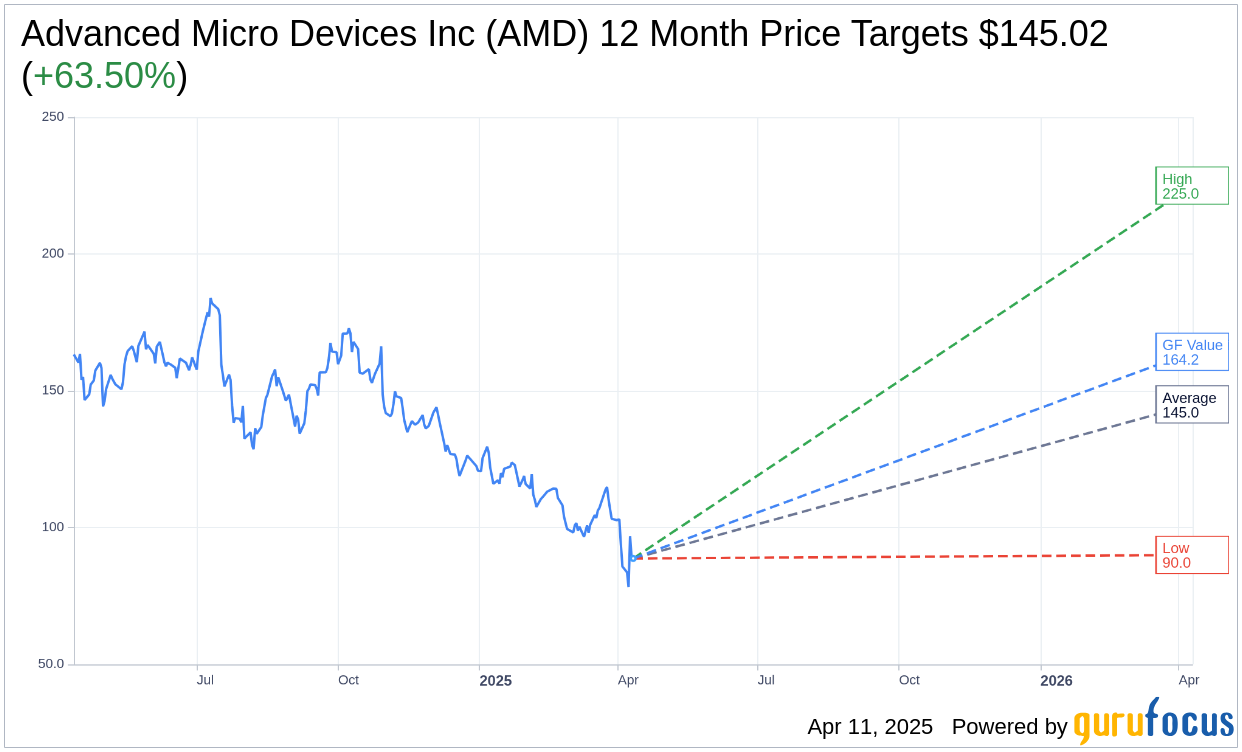

Wall Street Analysts Forecast

Based on the one-year price targets offered by 40 analysts, the average target price for Advanced Micro Devices Inc (AMD, Financial) is $145.02 with a high estimate of $225.00 and a low estimate of $90.00. The average target implies an upside of 63.50% from the current price of $88.70. More detailed estimate data can be found on the Advanced Micro Devices Inc (AMD) Forecast page.

Based on the consensus recommendation from 50 brokerage firms, Advanced Micro Devices Inc's (AMD, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Advanced Micro Devices Inc (AMD, Financial) in one year is $164.24, suggesting a upside of 85.16% from the current price of $88.7. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Advanced Micro Devices Inc (AMD) Summary page.