Truist Securities has revised its price target for Integer Holdings Corporation (ITGR, Financial), reducing it from $163 to $140, while maintaining a Buy rating for the stock. This adjustment comes as part of a comprehensive analysis of the Medical Technology sector in anticipation of first-quarter outcomes.

The firm indicates that, despite potential tariff-related disruptions, Integer's revenue and earnings are expected to remain more stable compared to many other sub-sectors, which is likely to sustain investor interest. However, Truist is also preparing for cautious projections for the year 2025 as companies adjust for broader economic uncertainties.

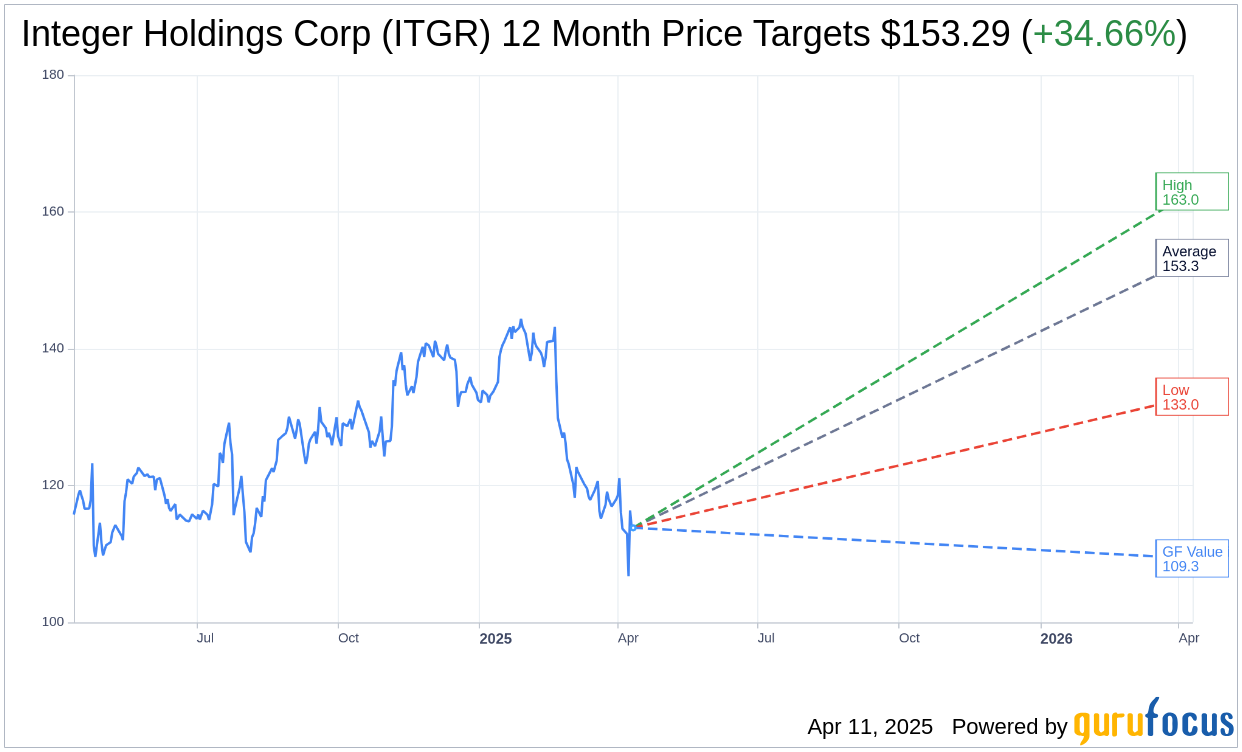

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Integer Holdings Corp (ITGR, Financial) is $153.29 with a high estimate of $163.00 and a low estimate of $133.00. The average target implies an upside of 34.66% from the current price of $113.83. More detailed estimate data can be found on the Integer Holdings Corp (ITGR) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Integer Holdings Corp's (ITGR, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Integer Holdings Corp (ITGR, Financial) in one year is $109.35, suggesting a downside of 3.94% from the current price of $113.83. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Integer Holdings Corp (ITGR) Summary page.