Quick Takeaways:

- Wells Fargo endorses Sarepta Therapeutics (SRPT, Financial) with an Overweight rating due to the potential of its Elevidys gene therapy.

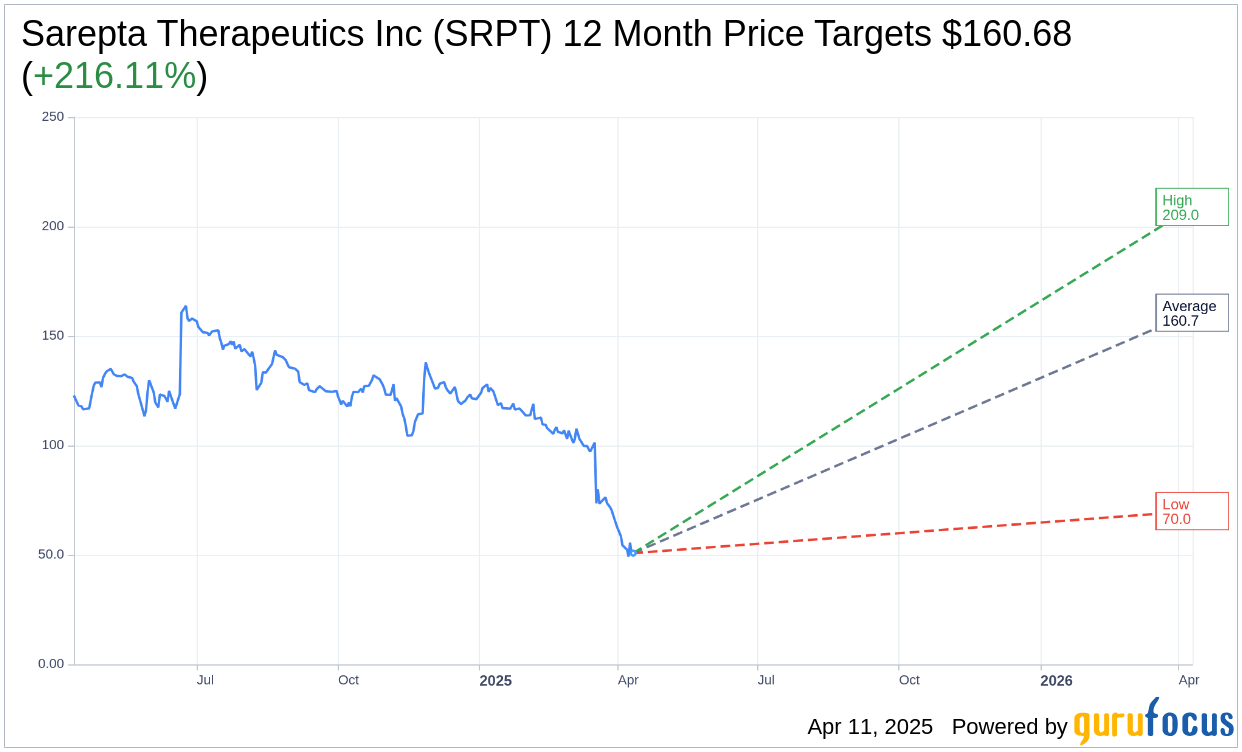

- Analysts set a one-year average price target of $160.68, suggesting substantial upside from the current price.

- GuruFocus predicts a GF Value for SRPT of $217.10, indicating impressive growth potential.

Wells Fargo's Positive Outlook on Sarepta Therapeutics

In a significant move, Wells Fargo has initiated coverage on Sarepta Therapeutics (SRPT) with an "Overweight" recommendation. This optimistic stance is primarily fueled by the promising prospects of Sarepta's innovative gene therapy, Elevidys, developed in collaboration with Roche to combat Duchenne muscular dystrophy. Despite encountering some recent safety concerns, Elevidys is still viewed as a leading choice in its field, and these concerns are anticipated to exert minimal influence on consumer adoption.

Wall Street Analysts' Forecasts

Exploring the sentiments of 22 Wall Street analysts, the average one-year price target for Sarepta Therapeutics Inc (SRPT, Financial) is projected at $160.68. This target includes a high estimate of $209.00 and a low of $70.00. The average target reflects a remarkable upside of 216.11% from the current market price of $50.83. To delve deeper into these projections, visit the Sarepta Therapeutics Inc (SRPT) Forecast page.

Brokerage Recommendations

With insights from 24 brokerage firms, Sarepta Therapeutics Inc (SRPT, Financial) has been awarded an average brokerage recommendation of 1.8, signifying an "Outperform" status. The rating system ranges from 1 (Strong Buy) to 5 (Sell), positioning Sarepta as a favorable investment according to consensus.

GuruFocus's GF Value Estimate

According to GuruFocus estimates, the GF Value for Sarepta Therapeutics Inc (SRPT, Financial) over the coming year is anticipated to be $217.10. This projection translates to an enticing upside of 327.11% from the present price of $50.83. The GF Value represents GuruFocus's calculation of the fair value at which the stock should trade, based on historical trading multiples, past business growth, and future business performance estimates. For a more comprehensive analysis, visit the Sarepta Therapeutics Inc (SRPT) Summary page.