In a recent development, Rallybio (RLYB, Financial) experienced a downgrade from Evercore ISI analyst Gavin Clark-Gartner. The analyst adjusted the company's rating from Outperform to In Line, in response to Rallybio's decision to halt its RLYB212 program. This program was in the process of being developed to address fetal and neonatal alloimmune thrombocytopenia, a condition affecting newborns.

Alongside the downgrade, Clark-Gartner also withdrew the previous price target of $8 set for Rallybio shares. The cessation of the RLYB212 program marks a significant shift in the company's developmental pipeline, influencing market perspectives and analyst expectations.

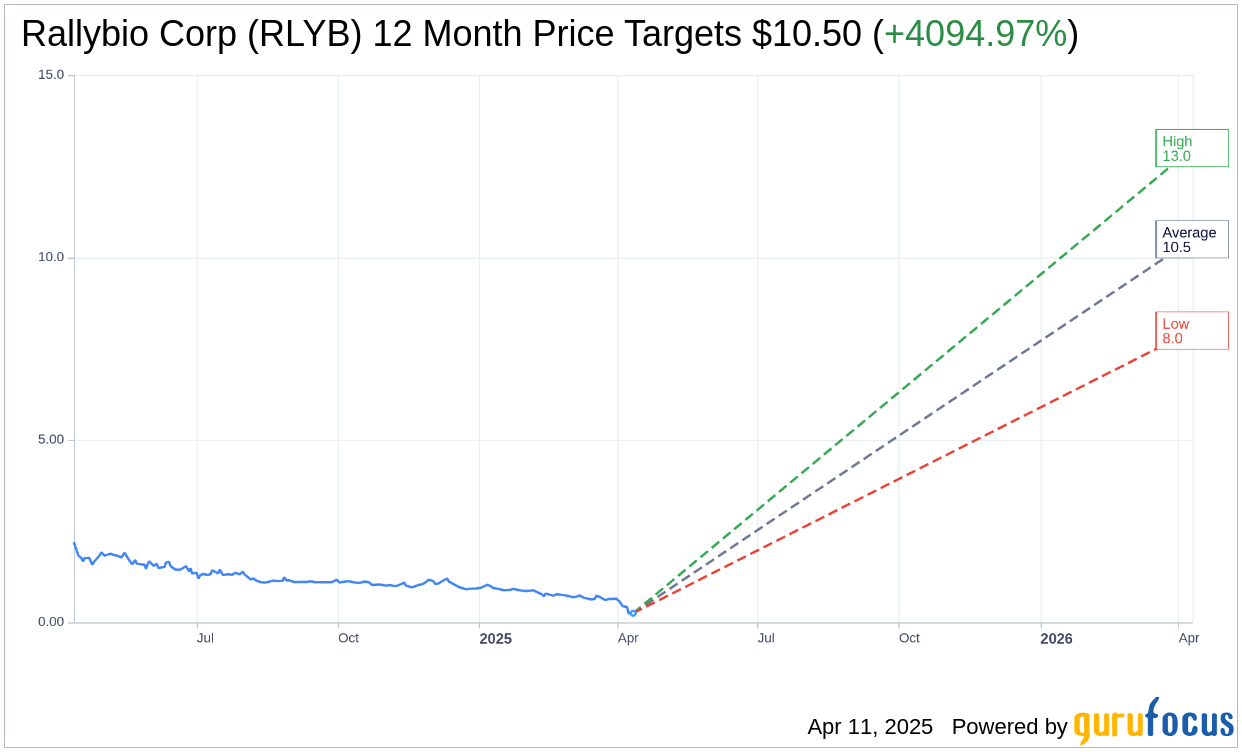

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Rallybio Corp (RLYB, Financial) is $10.50 with a high estimate of $13.00 and a low estimate of $8.00. The average target implies an upside of 4,094.97% from the current price of $0.25. More detailed estimate data can be found on the Rallybio Corp (RLYB) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Rallybio Corp's (RLYB, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.