- The Federal Trade Commission is reassessing past restrictions on Exxon Mobil and Chevron executive board appointments.

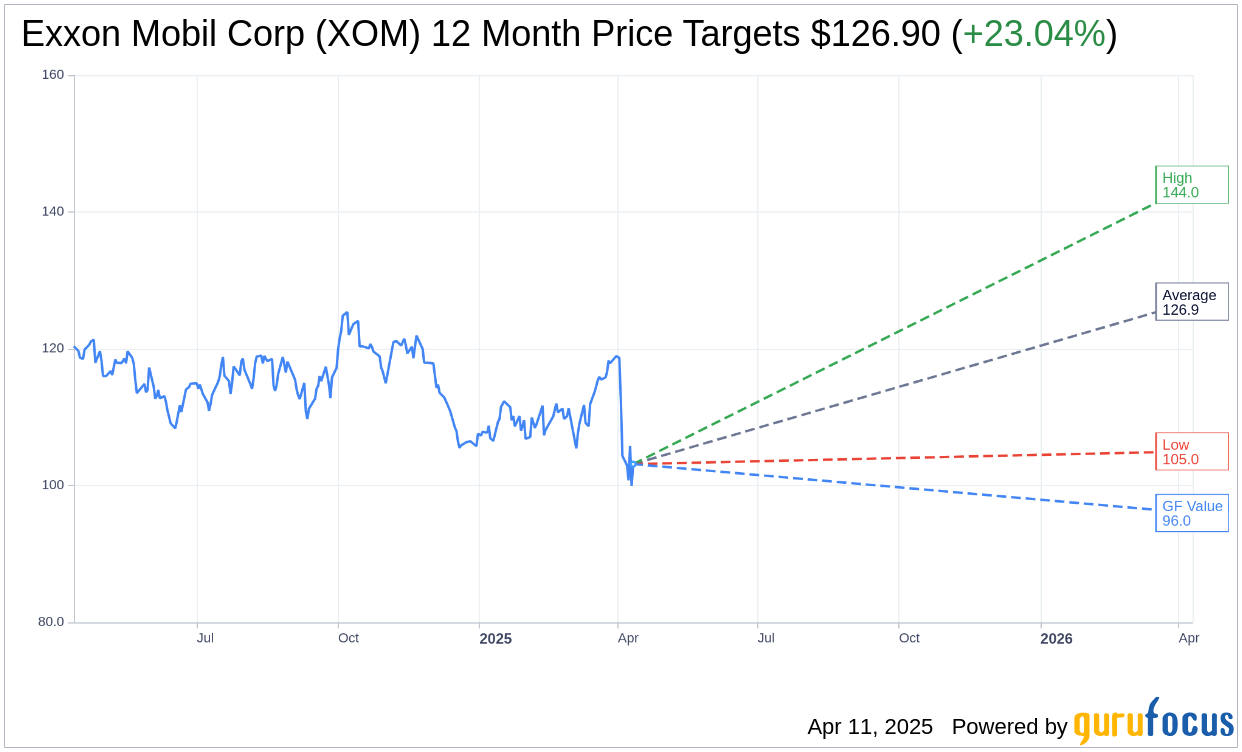

- Analysts predict a potential upside of 23.04% for Exxon Mobil stock.

- GuruFocus estimates suggest a 6.93% downside from current prices.

The Federal Trade Commission (FTC) is currently reevaluating its earlier restrictions, which barred certain executives from joining the boards of Exxon Mobil (XOM, Financial) and Chevron. These restrictions were initially imposed during the acquisitions of Pioneer Natural Resources and Hess. Following requests from the involved parties, the FTC has initiated a review process. A final decision will be made after a 30-day public comment period.

Wall Street Analysts Forecast

Exxon Mobil Corp (XOM, Financial) has captured the attention of 25 analysts, who have offered a one-year price target averaging $126.90. The high estimate reaches $144.00, while the low is set at $105.00. This average target represents a potential upside of 23.04% from the current price of $103.14. For more detailed insights, visit the Exxon Mobil Corp (XOM) Forecast page.

Brokerage Firm Recommendations

The consensus recommendation from 28 brokerage firms classifies Exxon Mobil Corp (XOM, Financial) with an average brokerage recommendation of 2.3, an indicator of its "Outperform" status. This rating uses a scale from 1 to 5, where 1 signifies a Strong Buy, and 5 denotes a Sell.

Exxon Mobil's GF Value Estimation

According to GuruFocus estimates, the projected GF Value for Exxon Mobil Corp (XOM, Financial) over the next year is $95.99. This suggests a potential downside of 6.93% from the current trading price of $103.14. The GF Value is GuruFocus' estimation of the stock's fair value, calculated based on historical trading multiples, past business growth, and future performance projections. For further detailed data, visit the Exxon Mobil Corp (XOM) Summary page.