Key Highlights:

- Taiwan Semiconductor Manufacturing Company (TSM, Financial) projects significant AI-driven revenue growth, aiming for a 40% CAGR over the next five years.

- The HPC segment reported a remarkable 58% year-over-year revenue increase, with substantial future capital investments planned.

- Analysts see a potential upside of over 46% for TSM's stock price based on current evaluations.

Taiwan Semiconductor Manufacturing Company (TSM) is poised for robust expansion in its AI accelerator sector. The company forecasts an impressive compound annual growth rate (CAGR) in the mid-40s over the next five years, commencing in 2024. This anticipated surge is fueled by a significant 58% year-over-year revenue hike in its high-performance computing (HPC) segment. To support this growth trajectory, TSM plans considerable capital expenditures ranging between $38 to $42 billion in 2025.

Wall Street Analysts Forecast

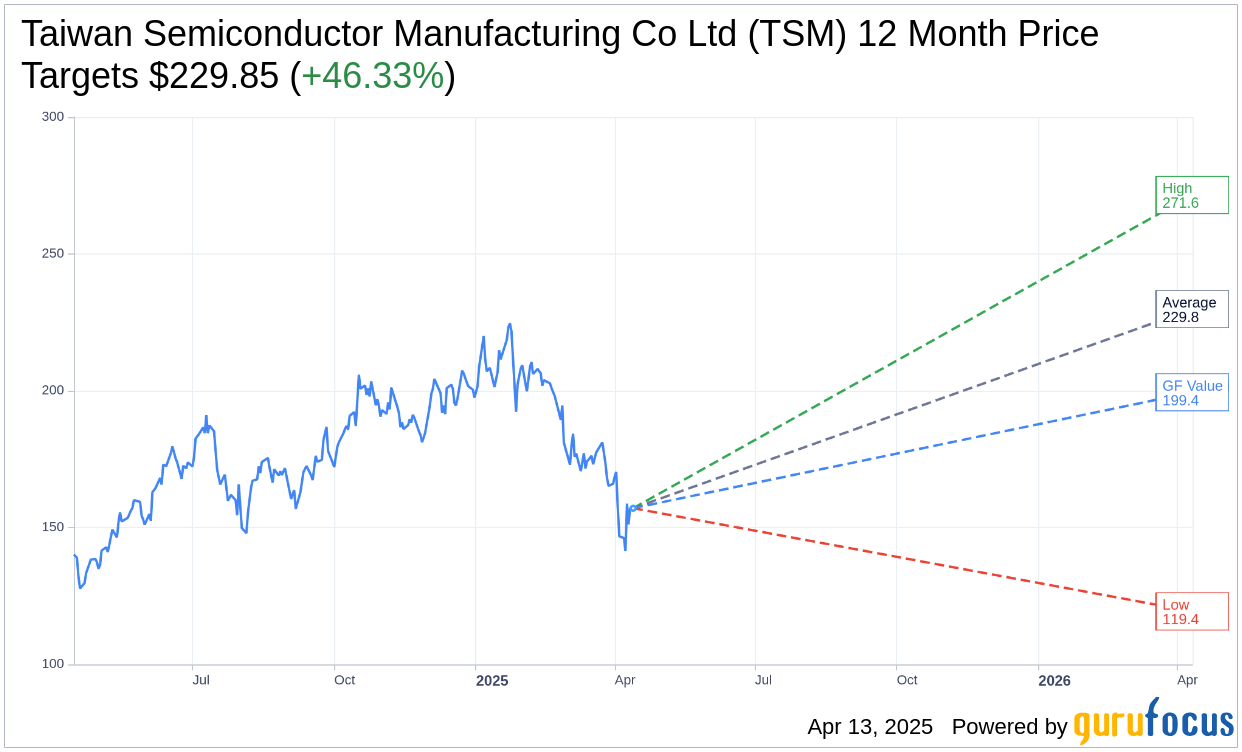

According to projections made by 16 analysts, Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) is expected to reach an average target price of $229.85 within a year. Projections vary, with a high estimate of $271.55 and a low of $119.37. This average forecast implies a potential upside of 46.33% from TSM's current trading price of $157.08. Investors can access more comprehensive estimate data on the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Forecast page.

Furthermore, the consensus from 18 brokerage firms rates TSM with an average recommendation of 1.6, denoting an "Outperform" status. This rating is based on a scale from 1 to 5, where a score of 1 represents Strong Buy, and 5 signifies Sell.

According to GuruFocus estimates, the projected GF Value for Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) over the next year stands at $199.45. This suggests a promising upside of 26.97% from the prevailing price of $157.08. The GF Value reflects GuruFocus' assessment of the stock's fair market value, derived from historical trading multiples, previous business growth, and future performance expectations. For further insights, visit the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Summary page.